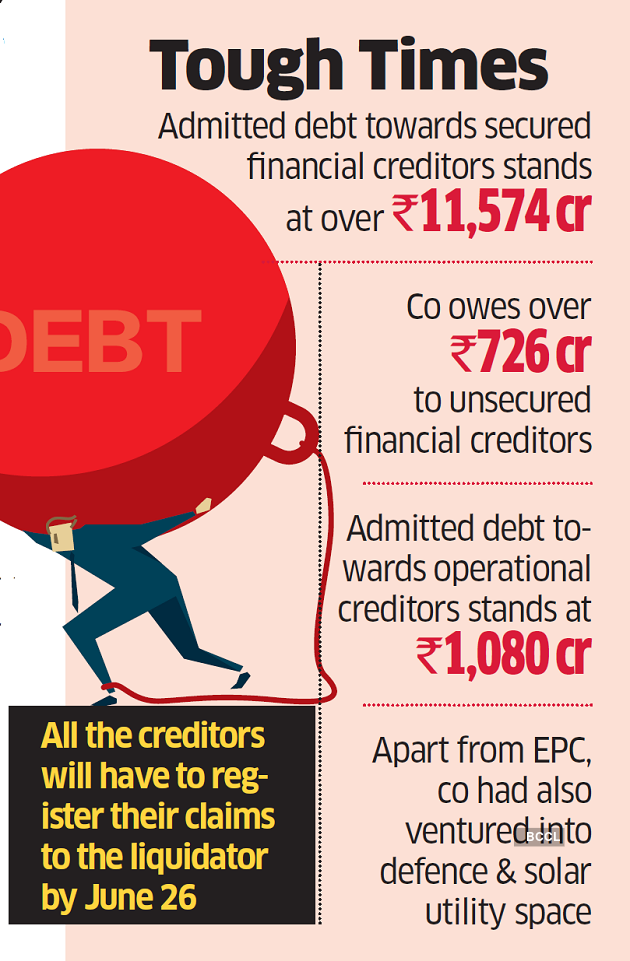

The dedicated bankruptcy court admitted Atul Punj-promoted Punj Lloyd for liquidation after its lenders rejected the revival plan submitted by a consortium of Prudent ARC and Payard Investments. The company has admitted liability of over ₹13,380 crore. The tribunal also approved the name of Ashwini Mehra, the company’s resolution professional (RP), as the liquidator for the engineering, procurement and construction (EPC) company.

The principal bench of the National Company Law Tribunal at New Delhi, while passing the order, directed the liquidator to submit the primary report within 75 days from the liquidation commencement date. “The voting percentage ‘for’ the resolution plan was 8.06% and ‘against’ the plan was 79.53% and ‘abstain’ from the voting on resolution was 12.41%. Resultantly, the plan was declared as failed,” observed the division presided over by Ramalingam Sudhakar and Avinash K Srivastava in its order, which was made available on June 2.

Originally, private sector lender ICICI Bank had approached the tribunal to admit the company under the Corporate Insolvency Resolution Process (CIRP) after the company defaulted on over ₹800 crore. On March 8, 2019, the tribunal admitted the plea.

While filing an application to admit the company for liquidation, the RP of the company also sought the tribunal’s directions for liquidating the company as a going concern in view of the fact that there were several ongoing EPC projects of the company and it has around 3,000 employees on its roll.

Originally, when the RP had first invited bids from potential buyers, about 13 potential bidders had expressed interest to acquire the company through the resolution process. However, the final resolution plan was submitted by only a consortium of Payard Investments and Prudent ARC.

“The assets, which an EPC company will have, generally would mean its ongoing projects. However, by the time the company reaches the stage when it must be sold as a going concern; most of the projects are either gone or over, employees are gone,” said Ashish Pyasi, associate partner, Dhir & Dhir Associates.

“With so many cases of EPC companies which have gone into liquidation, it is evident that to find a resolution applicant or buyer for EPC company is difficult. In liquidation, challenges are multi-fold. However, the only benefit for prospective buyers is that they don’t have to go through the process of plan approval,” said Pyasi.