Private equity fund TPG-backed CARE Hospitals has acquired Indore-based CHL Hospitals, the first corporate hospital established in Madhya Pradesh which has strong clinical expertise in cardiology and neurosciences. While the financial terms were not disclosed, people in the know said the deal has valued CHL at ₹350-400 crore.

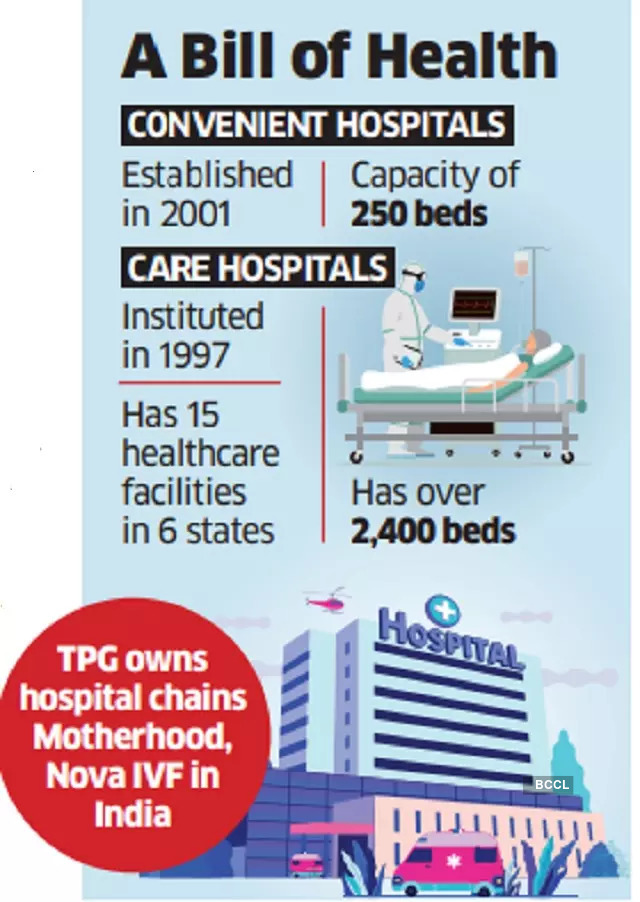

Established in 2001, Convenient Hospitals (CHL) has a capacity of 250 beds and is adding another 150 beds, CARE Hospitals said in a statement.

CARE Hospitals was instituted in 1997 as a single-specialty cardiac hospital in Hyderabad with 100 beds. Today, it has a network of 15 healthcare facilities in six states with more than 2,400 beds offering 30 clinical specialties. The network has its presence in Hyderabad, Raipur, Bhubaneswar, Pune, Visakhapatnam, Nagpur and Indore.

This partnership with CHL will consolidate CARE Hospital’s presence further with a leadership position in a key geography of the country, chief executive Jasdeep Singh said.

In 2018, TPG Growth-backed Evercare acquired the healthcare portfolio of UAE’s Abraaj Growth Markets Health Fund, which owned a majority stake in CARE Hospitals. Dubai-based Abraaj collapsed following allegations of mismanagement of its $1 billion healthcare fund. Abraaj had purchased 72% in CARE Hospitals from Advent Capital for ₹2,000 crore in January 2016.

TPG Capital owns 20% in Manipal Hospitals, while TPG Growth has a majority stake in Asia Healthcare Holdings which runs the largest mother & child care hospital chain, Motherhood Hospitals, and infertility chain Nova IVF.

“India’s future growth trajectory and aspiration of a $5-trillion economy will be routed through the rise of tier-2 cities. These cities will also contribute significantly to the rise in healthcare consumption and power the next phase of growth for the healthcare sector,” said Vishal Bali, chairman, CARE Hospitals.

India’s healthcare industry has been growing at a CAGR of around 22% since 2016. At this rate, it is expected to reach $372 billion in 2022, said a 2021 NITI Aayog report. In the hospital segment, the expansion of private players to tier-2 and tier-3 locations offers an attractive investment opportunity.