ITC is reviving its plans to create an alternative structure for the hotel business following a recovery in the hospitality industry after Covid-19, managing director Sanjiv Puri said. Addressing shareholders in the company’s 111th annual general meeting held virtually on Wednesday, Puri said the plans to unlock value for the hotel business were put on hold earlier because the industry was badly impacted by the pandemic. “We will take it forward in line with industry recovery dynamics,” he said.

The conglomerate had first announced plans to create alternative structures for the hotels business in its 2020 annual report as a way to enhance value creation, but Puri had stopped short of disclosing the details. The market has been speculating about the demerger of the hotel business, but ITC never commented on it. ITC runs the country’s second largest hotel chain with 113 properties – both managed and owned ones. It has adopted an ‘asset-right’ strategy that provides greater thrust on management contracts through three brands: Welcomhotel, Mementos and Storii.

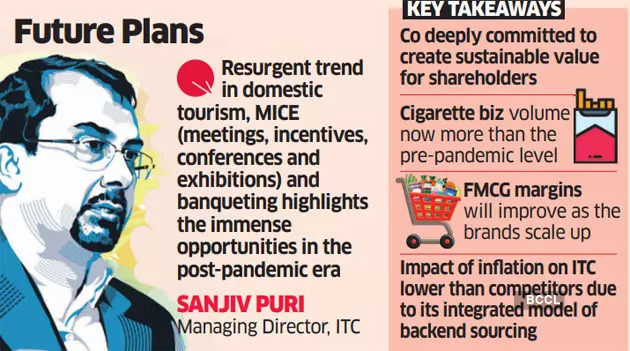

Puri said the last two years had been the most challenging for the travel and hospitality sector worldwide. “The segment revenue of ITC’s hotel business last fiscal doubled whilst segment PBIT (profit before interest and taxes) turned positive in the second half of FY22. The resurgent trend in domestic tourism, MICE (meetings, incentives, conferences and exhibitions) and banqueting highlights the immense opportunities in the post-pandemic era,” he said.

Responding to shareholder queries on value creation through bonus, demerger and buyback of shares, Puri said the company was deeply committed to create sustainable value for all shareholders.

“We evaluate all ideas and whatever is in the interest of value creation over a long period, we will do it. An enterprise strategy follows from the business strategy, context of competitive landscape and business maturity. At ITC, nothing is really cast in stones. The first we have already announced is an alternative structure for hotels,” he said.

The ITC scrip, which has been on the roll for the past few weeks, on Wednesday hit a 52-week high, touching ?299.55 on the BSE, before closing at ?298.10, a gain of 1.24%. The benchmark Sensex gained 1.15%. Puri said the shares had done well. “In the past, there were factors like ESG (environmental, social and corporate governance, which has been a concern for tobacco companies), anxiety on (cigarette) taxation, and certain businesses were impacted during the pandemic. These were the challenges. But the resilience of the enterprise is demonstrated by the way the company has bounced back. It is our goal and objective on a sustained basis,” he said.

The chairman said ITC’s cigarette business volume was now more than the pre-pandemic level and the company was going to expand exports of its FMCG products, making it a significant contributor to revenue in the years to come. It has inked distribution agreements in 60 countries for cigarettes and other FMCG products. ITC will scale up its big FMCG brands such as Aashirvaad, Sunfeast, Bingo and Yippee to enter value-added adjacencies and invest in categories of the future.

“FMCG margins will improve as the brands scale up and based on interventions on digital, delayering the supply chain, servicing proximal markets and investing in categories. Even last year, our margins improved despite inflation,” said Puri.