Rejecting a plea filed by the promoter of realty developer Satra Properties (India), the National Company Law Appellate Tribunal (NCLAT) has upheld the ruling of the National Company Law Tribunal’s Mumbai bench to admit the company under corporate insolvency resolution process (CIRP).

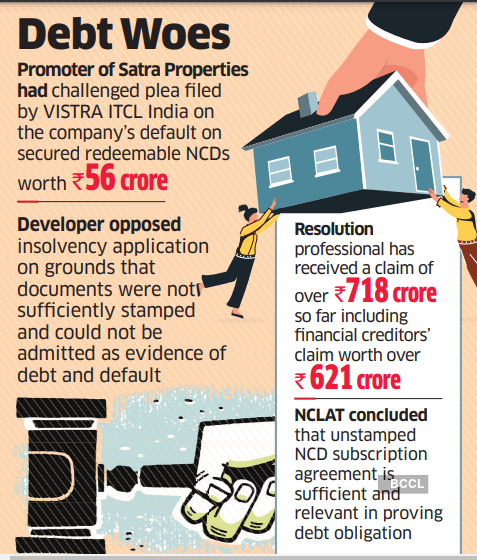

Praful Nanji Satra, promoter of the listed company, had challenged a plea filed by VISTRA ITCL India with regards to the company’s default on secured redeemable non-convertible debentures (NCDs) worth ₹56 crore.

The debenture holders were to be secured with first equitable mortgage charge of corporate debtor’s leasehold rights in a commercial plot in Jodhpur and a personal guarantee of Praful Nanji Satra. As per the funding agreement entered into in March 2014, all the monies to be received through the development of the Jodhpur land parcel were to be deposited in an escrow account.

These NCDs were to be redeemed after a year of issuance, but the company could not repay the funds and hence the date of redemption of debentures was revised in February 2015. Meanwhile, in November 2017, the escrow account was frozen by Maharashtra VAT authorities and the developer started depositing the monies due to be deposited in the escrow account, in the current bank account of Satra Properties (India).

In October 2017, the Satra Group including Satra Properties (India) entered into negotiations with MJS Group and IIFL Group for settlement of liabilities and the same was arrived at in January 2018.

The developer had opposed the insolvency application on grounds that both the documents were not sufficiently stamped, and as per the Maharashtra Stamps Act could not be admitted as evidence of debt and default.

The company’s resolution professional has received a claim of over ₹718 crore so far including financial creditors’ claim worth over ₹621 crore.

Nishit Dhruva, managing partner of law firm MDP & Partners, who appeared for Vistra ITCL (India), confirmed the development.

While dismissing this argument, the tribunal had admitted the application stating the insufficiency of stamp duty is irrelevant in determining the admissibility of an insolvency application. The judicial and technical members, however, had different views as to the necessity of stamp duty payment.

According to the respondent, the insufficiency in the payment of stamp duty is attributable only to the corporate debtor and the company cannot take advantage of its own wrong by setting up the defence of insufficient stamping of the documents, which is basically its own failing.

“We note that the issue of debt being due and payable in the present case is not interdicted by any law but only a technical deficiency of insufficiency of their stamping has been raised which can be cured,” the appellate tribunal said.

The appellate tribunal, while dismissing the developer’s application, concluded that an unstamped NCD subscription agreement is sufficient and relevant in proving debt obligation.