Lenders led by Bank of India have appointed BDO India to conduct a forensic audit of Future Retail(FRL), which is facing insolvency proceedings, said two people with knowledge of the matter.

Kishore Biyani-led Future Retail had attempted to stave off bankruptcy by selling its companies to Reliance Industries retail unit. Creditors did not approve the deal and the company was admitted to the National Company Law Tribunal for insolvency proceedings after it defaulted on ₹3,495 crore debt.

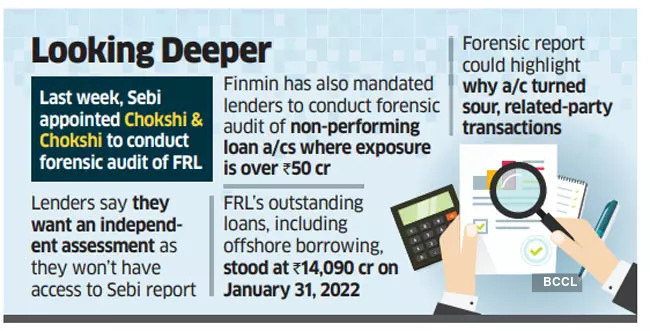

Market regulator Securities and Exchange Board of India too has last week appointed chartered accountants Chokshi & Chokshi to conduct a forensic audit of Future Retail.

Lenders say they wanted an independent assessment of the loan account since they would not have access to the Sebi report. Secondly, the finance ministry has mandated lenders to conduct a forensic audit of non-performing loan accounts where the exposure is over ₹50 crore, said a lender.

Sebi has mandated Chokshi & Chokshi to audit Future Retail and related entities for the financial year ending March 2020 to March 2022. Future Retail had entered into related-party transactions with its affiliates such as Future Enterprises, Future Supply Chain and Future Consumer. The audit report could highlight if these transactions were prejudicial to the interest of creditors.

The findings of the BDO India report will be critical for lenders to decide on whether to declare the account as fraud.

BDO did not respond to ET’s request for comment.

Future Retail’s outstanding loans, including offshore borrowing, stood at ₹14,090 crore on January 31, 2022, the people said. The forensic report could also highlight why the account turned sour.

It would also look at the related-party transactions. For instance, the fixtures and furniture in the hypermarket stores run by Future Retail were owned by Future Enterprises, and Future Retail paid it an annual rent of ₹650 crore. In January 2020, Future Retail paid ₹4,000 crore to Future Enterprises to acquire fixtures and furniture, which it pledged as security to raise ₹3,500 crore from overseas bondholders to fund the transaction. The forensic report may indicate whether Future Retail overpaid Future Enterprises.

Domestic creditors had agreed to waive their lien on furniture and fixtures on the condition that their loans would be repaid. Furniture sale to the retail chain happened without any repayment of loans to domestic lenders.

In March, Reliance Industries took possession of the premises housing some 900 Future Retail stores due to non-payment of rentals. After taking possession, Reliance separated the inventory and furniture from the stores. Overseas bondholders and domestic creditors say that the shelves and other fixtures do not hold any value. The inventory that was pledged with domestic lenders, too, lost its value.

Future Retail, already over-leveraged, also suffered a setback due to the nationwide lockdown announced in 2020 to curb the spread of Covid-19.

In August 2020, it signed an agreement to sell its entire business to Reliance Industries-linked subsidiaries in a multi-stage transaction, but a series of litigation by ecommerce giant Amazon.com claiming violation of shareholder agreement it had with the company delayed the deal. In April this year, a majority of secured lenders rejected the deal with Reliance Industries.