Three years after acquiring Avanse Financial Services, the education financing arm of Wadhawan Global Capital and its group company Dewan Housing Finance Ltd (DHFL), private equity fund Warburg Pincus plans to unlock value by selling 25-30% stake to potential investors and raise ₹1,950 -₹2,500 crore, sources said.

Warburg owns about 80% stake in Avanse. World Bank’s arm International Finance Corporation (IFC) owns the remaining 20% stake in the non-banking finance company. Avendus has been appointed by Warburg Pincus to find potential suitors. A formal process is expected in the coming weeks.

Set up in 2013, Avanse has funded over 250,000 students across 22,000 courses in over 3,000 institutions across India and over 50 countries.

Avanse has AUM of ₹4,836 crore as on 31 March 2022. During FY22, the organisation witnessed the highest ever growth in its disbursement of ₹2,927 crore, 3x growth over FY21. Avanse reported a PAT of ₹63 crore, which indicates a growth of 1.7x over FY21. At the end of FY22, net worth stood at ₹1,010 crore, the company said.

The NBFC provides education loans to students from school to post-graduation as well as loans to educational institutions for financing their working and growth capital needs.

Mail sent to Warburg Pincus did not elicit any responses till the press time.

Even though the financial details of the 2012 Warburg Pincus transaction was not disclosed, the company was valued at ₹1,100 crore. The deal also involved a primary infusion of ₹300 crore.

Major competitors of Avanse are HDFC Credila, Varthana, Shiksha Financial Services and Manya Group. Major education providers are already funded by India focused private equity firms.

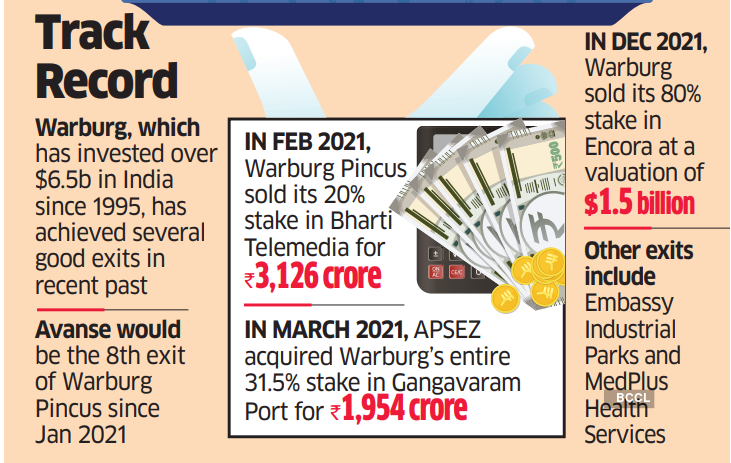

Warburg, which has invested over $6.5 billion in India since 1995, has achieved a number of good exits in the recent past.

Once materialised, Avanse would be the 8th exit of Warburg Pincus since January 2021. In February last year, Warburg Pincus sold its 20% equity stake in DTH firm Bharti Telemedia back to Bharti Airtel for a total consideration of ₹3,126 crore. Warburg had bought the minority stake for ₹2,258 crore in December 2017. In March 2021, Adani Ports and Special Economic Zone, the flagship company of Gautam Adani, had acquired Warburg’s entire 31.5% stake in Gangavaram Port for ₹1,954 crore. In March 2021, Warburg also reduced its stake in Kalyan Jewellers from 32% to 24% through the IPO of Kerala-based Kalyan. Other exits include Embassy Industrial Parks and MedPlus Health Services. In December 2021, Warburg had sold its 80% stake in Encora at a valuation of $1.5 billion.