Lenders to the Anil Ambani-promoted Reliance Infrastructure Telecommunications Ltd (RITL) have come to an understanding with the winning bidder for the bankrupt company on completing the takeover two years after the deal was approved by the National Company Law Tribunal (NCLT). The winner is Reliance Projects & Property Management Services, an arm of the Mukesh Ambani-owned Reliance Industries (RIL), the country’s biggest company.

Banks led by the State Bank of India (SBI) have agreed to issue a no objection certificate (NOC) to RIL following which the Mukesh Ambani-promoted company will transfer the agreed amount to an escrow account. The NOC essentially is a no dues certificate for RITL, a procedure followed before the implementation of the resolution plan.

“Both parties have agreed to move forward, which means there is progress in completing this resolution which has been hanging fire for close to two years now. Banks have already started issuing NOCs which will be collated and given to the resolution professional following which RIL will transfer the amount to the escrow account,” said a person aware of the transaction. RIL did not reply to an email seeking comment.

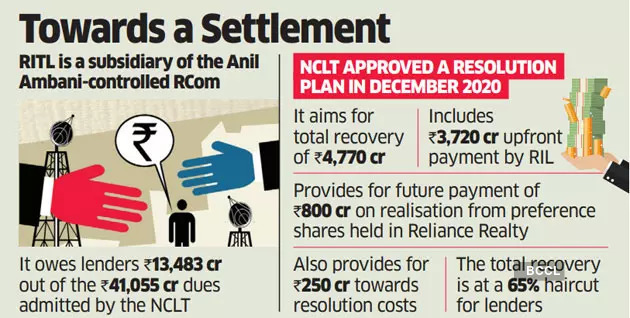

RITL, a subsidiary of the Anil Ambani-controlled Reliance Communications (RCom) owes lenders a total of ₹13,483 crore in direct exposure out of the ₹41,055 crore dues admitted by the NCLT. About 30 lenders have direct or indirect exposure to the company which includes guarantees given to RCom, the parent company.

The resolution plan approved by the NCLT back in December 2020, envisages a total recovery of ₹4,770 crore which includes an upfront amount of ₹3,720 crore paid by RIL directly. It also includes a future payment of ₹800 crore to financial creditors on realisation from preference shares held in Reliance Realty (RRL) and ₹250 crore provided towards the resolution costs. The total recovery is at a haircut of 65% for lenders.

“It is expected that banks will give their NOCs by the end of the month and the money should flow into the escrow account latest by early next month. RIL has assured lenders that it will honour its commitment to release the amount as soon as the NOCs are in,” said a second person aware of the plan.

Bankers have been worried about the delay because the 178,000 route kilometre fibre and close to 43,000 telecom towers are already being used by Reliance Jio, the telecom arm of RIL.

To be sure, banks will not receive the money immediately as Qatar’s Doha Bank, one of the banks which has direct fund-based exposure to the company, has contested the plan in the National Company Law Appellate Tribunal (NCLAT) because it treats non-fund-based creditors on par with the fund-based ones. The NCLAT has stayed the distribution of the proceeds till further orders. The next date for hearing in the NCLAT is August 26.

“The deal was stuck as RIL has asked for certain clarifications including a report of the forensic audit of the company. These clarifications have been given so the company is now ready to move ahead with the plan, though there could be some recalculations with regards to the maintenance of the assets in the last two years” said a third person aware of the deal.

SBI, Union Bank of India and Indian Overseas Bank had tagged RITL as a fraudulent account, which made RIL wary of taking over the company. Banks have maintained that the fraudulent tag will not apply after the takeover by RIL. The forensic audit report was shared with RIL in March 2022.

After taking into account the cash in the company’s balance sheet as of June 2022, the company has payment dues of ₹226 crore. Banks have so far refused to take any reduction to the amount approved by the NCLT in December 2020.