An Ares SSG Capital-backed asset reconstruction company (ARC) has given a binding offer to Life Insurance Corporation (LIC) to acquire its ₹3,400-crore Reliance Capital bonds, said two people aware of the development. The offer by Assets Care and Reconstruction Enterprise (ACRE) has triggered a Swiss challenge auction, the people said.

The ARC has offered 20-22 paise on a rupee recovery to the country’s largest life insurer, one of the persons said. The binding bid by ACRE is aligned with the offers the administrator has received from bidders of Reliance Capital, an Anil Ambani Group company undergoing corporate insolvency.

ACRE and LIC did not respond to ET’s request for comment.

The offer to LIC is much lower than the 27-28% recovery ACRE paid to acquire debt from Axis Bank and HDFC Ltd a year ago.

In the last 18 months, LIC has thrice attempted to sell the debt of Reliance Capital, but this time is likely to conclude the deal since the financial institution has announced a Swiss auction. IDBI Capital Markets, the process advisor appointed by LIC for selling Reliance Capital bonds, invited expressions of interest by November 25.

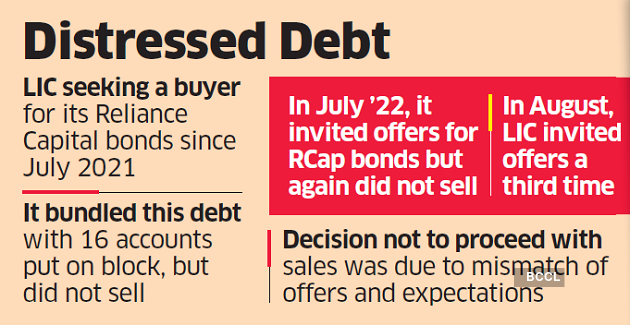

LIC has been seeking a buyer for its Reliance Capital bonds since July 2021, when it bundled this debt among the 16 accounts put on the block. However, it did not proceed with the loan sale due to a mismatch in offers received and expectations.

In July 2022, it again invited offers – specifically for Reliance Capital’s ₹3,400-crore bonds – from ARCs. Although it received three binding bids, it did not proceed with the sale. In August, LIC again invited offers for Reliance Capital by September 5.

LIC was hoping for a 45% recovery earlier, but it seems to have become more practical now, said one of Reliance Capital’s lenders.

This is the second distressed debt account that LIC is likely to sell. In the first week of this month, LIC invited counter bids for its Rs 613 crore debt held in KSK Mahanadi Power under Swiss Challenge auction. It has received an anchor offer of Rs 188 crore from Rare ARC, equating to a recovery of 30 paise on a rupee.

Nageshwara Rao Y, the administrator of Reliance Capital, the holding company having about 20 various finance companies, has invited binding bids from interested parties by November 28.

The administrator had received 14 non-binding bids, of which about six were under option, which is Reliance Capital and all its units, such as life, non-life insurance, asset reconstruction company, securities and real estate, among others.

Aditya Birla Mutual Fund did not submit a non-binding bid and was a late entrant, showing interest in bidding for the life insurance business- Reliance Nippon Life Insurance. Japan’s Nippon Group owns a 49% stake in the life insurance business.

Hinduja Group, Oaktress Capital, Torrent Investment, Sam Ghosh promoted Cosmea Financial Holdings, and a Naveen Jindal group company had given offers for option one. Advent International, Piramal-led consortium and Zurich Insurance had given an offer for Reliance General – which a 100% owned by Reliance Capital.