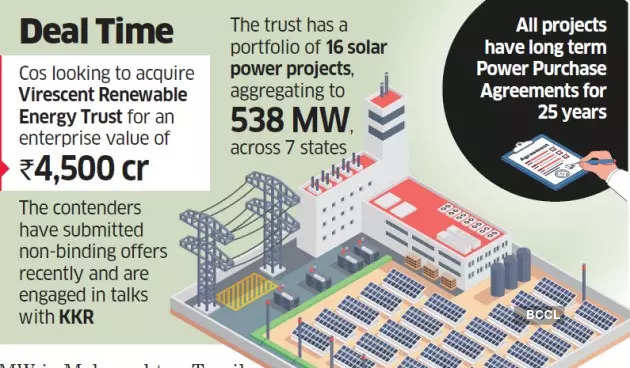

About half a dozen domestic and global energy developers, including Adani Green, Torrent Power, Shell and Actis, are looking to acquire Virescent Renewable Energy Trust, an infrastructure investment trust (InvIT) owned by KKR India, for an enterprise value of $550million (₹4,500 crore), sources said.

The trust has a portfolio of 16 operational solar power projects, aggregating to 538 MW, across 7 states. If the deal materialises, this could be the first sale of an InvIT in India. The contenders have submitted non-binding offers recently and are currently negotiating with KKR and its advisors JP Morgan who will proceed with a smaller group of shortlisted candidates for the next round of negotiations and due diligence, the sources mentioned above added.

The trust’s initial portfolio of assets comprised 9 operational solar power projects, aggregating to 394 MW, in Maharashtra, Tamil Nadu, Rajasthan, Gujarat & Uttar Pradesh. Subsequently, the Trust added another 7 operational solar power projects, aggregating 144 MW, in Rajasthan, Madhya Pradesh & Punjab. All 16 projects have long-term Power Purchase Agreements for 25 years, with Central & State Government off-takers.

Terra Asia Holdings II Pte. is the sponsor to the Trust and is an affiliate of the funds, advised by affiliates of KKR.

“The potential sale of InviT would be a complicated one,” said one of the persons cited above. As the sponsor can’t hold more than 75% stake in the InviT, the new investor needs approval from other minority shareholders to become a co-sponsor and acquire a majority stake. The potential buyer, for becoming a co-sponsor, needs to intimate Sebi and then seek approval from the other unit holders.

“In case the minority shareholders don’t agree, the potential buyer has to provide an exit to them which would create more complexities and further delay the process,” he added. Mails sent to Actis, Torrent Power, Adani Green, Shell did not elicit any responses till the press time. A KKR spokesperson declined to comment.

The pooled structure of the InvIT results in a well-diversified mix of assets and the cash flows from the pool of 14 assets, having an operational track record of three-to-nine years, are robust, said a recent India Ratings report. The projects are located across 7 states, minimising the impact of any one-time resource-related risks at isolated locations to an extent, it added.

Virescent, set up in 2020, raised Rs460 crore ($62 million) from a group of foreign and domestic investors including Canada’s Alberta Investment Management Corporation. KKR invested in VRET from its Asia Pacific Infrastructure Investors Fund.

Source: Economic Times