Tata Motors has begun discussions with sovereign wealth funds and private equity investors such as UAE-based Abu Dhabi Investment Authority (ADIA) and Mubadala Investment Company, Saudi Arabia-headquartered Public Investment Fund (PIF), Singapore’s Temasek Holdings as well as KKR and General Atlantic to sell a significant minority stake in its EV division, said several people aware of the ongoing negotiations.

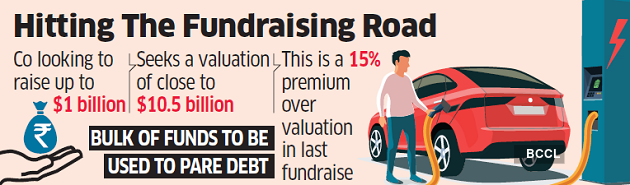

According to these people, Tata Motors plans to raise up to $1 billion through the equity sale and will use the bulk of proceeds to retire a part of its outstanding debt.

EV arm last valued at $9.1 billion

A small portion of the funds will be infused as primary equity in the EV business.

It is seeking a valuation of close to $10.5 billion, which is at a 15% premium to the last round which valued the EV arm at $9.1 billion, said a person aware of the discussions.

Tata Motors, Temasek, ADIA and KKR declined to comment. Mubadala, PIF and General Atlantic did not respond to ET’s queries as of press time Wednesday.

ET was the first to report in January that Tata Motors was again in the market to seek funding for its EV subsidiary and had appointed Morgan Stanley as the transaction advisor. This will be the second round of funding for the EV business, which is housed under Tata Passenger Electric Mobility Ltd (TPEML), after it secured $1 billion from TPG Rise Climate and ADQ in a deal signed in 2021.

The investors were given compulsory convertible instruments to secure between 11% and 15% stake in the company. The capital from the first round of funding was earmarked for investments in developing technology and manufacturing expertise for EVs.

The latest round of fundraise comes at a time when the company is likely to miss its target of becoming a zero net-debt company at a consolidated level by FY24.

In a recent earnings call, the company said that for its standalone business in India, the automaker will meet its zero net-debt target. However, in the case of foreign subsidiary Jaguar land Rover (JLR), it said, net-debt zero targets may not be immediately achievable.

Tata Motors, which is the country’s largest automaker by revenue, had a debt of about Rs 12,400 crore as of December 31 on the books of its standalone India business, which includes commercial vehicles, passenger vehicles and EVs. The company’s overall automotive debt, including its British subsidiary JLR, stood at ₹57,500 crore.

Tata Motors has managed to gain a sizeable lead in India’s electric cars business led by its Nexon EV. In 2022, four out of every five electric cars sold in the country were from the Tata Motors stable.

Over the coming four years, the automaker wants to create a portfolio of 10 EVs under TPEML. It is also looking to develop charging infrastructure in association with Tata Power.