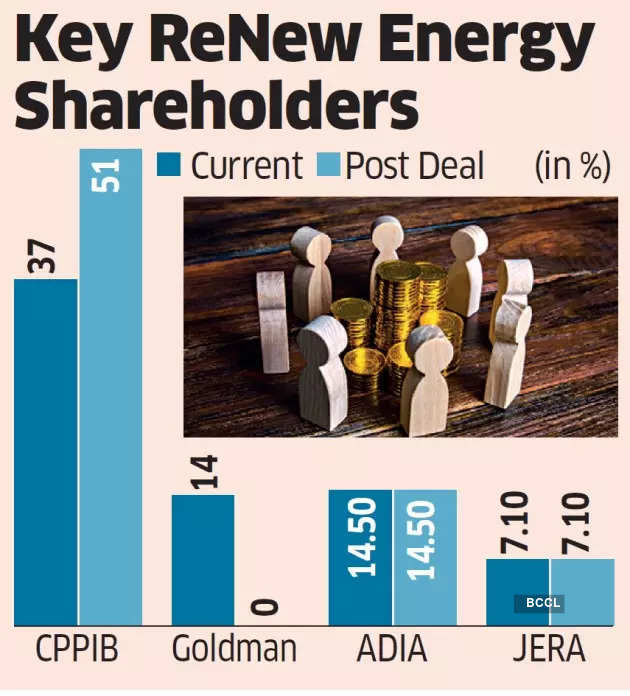

Goldman Sachs is set to sell its remaining 14% stake in ReNew Energy Global — the Nasdaq-listed parent of ReNew Power — to Canada Pension Plan Investment Board (CPPIB) for about $268 million, said two people familiar with the matter.

After the deal, the pension fund, one of the largest in the world, will become a majority shareholder in ReNew with a stake of over 51%. The deal will pave the way for Goldman’s exit from ReNew, one of India’s largest renewable energy companies. The Wall Street firm, which was one of the early investors in Sumant Sinha-founded ReNew, has been trimming its stake in the company over the years. Canada Pension Plan, with assets under management of over $536 billion, has been gradually raising its holding in the company.

In response to an emailed query, a CPPIB spokesperson said, “We don’t have any further comment other than information contained in the SEC filings.” Goldman and ReNew spokespersons did not respond to queries.

The other key shareholders in ReNew are Abu Dhabi Investment Authority with 14.5% and Japan’s JERA with 7.1%. Public shareholders hold close to 22%.

Canada Pension Plan’s move to increase its stake in ReNew is part of a plan to boost investments in the renewables space. ReNew has a capacity of over 13.4 GW. Pension funds and global investment firms with a focus on environmental, social and governance (ESG) investing have been scouting for opportunities in clean energy initiatives.

ReNew has been producing renewable energy through solar and wind-driven projects. The company is now looking to branch out to green hydrogen. It has formed a joint venture with Larsen & Toubro and Indian Oil Corp for the production of green hydrogen in the country.

Source: Economic Times