Bangur family-owned Shree Cement is in non-binding talks to acquire between 40% and 72% stake in Sanghi Cement for an enterprise value (EV) of ₹6,000 crore, according to multiple sources briefed on the matter.

Indicative commercial terms have been shared. The talks are not exclusive and other parties could also be simultaneously discussing a deal, according to the sources.

“Due diligence has not started,” an executive aware of the matter told ET.

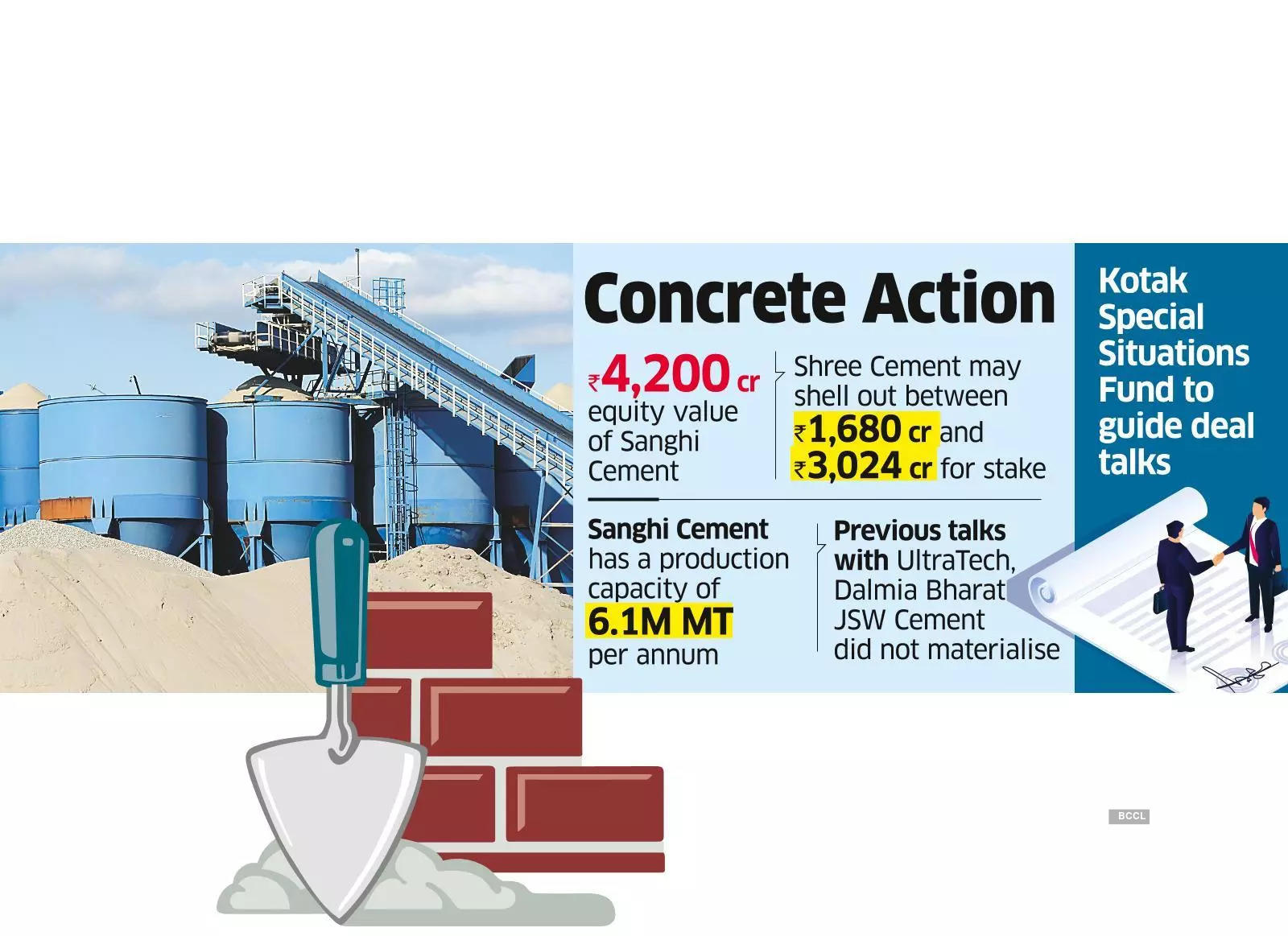

Commercial terms could vary depending on the outcome of due diligence. The talks could end up being inconclusive. The EV of ₹6,000 crore includes debt of ₹1,800 crore. This places the equity value being discussed at ₹4,200 crore. At this valuation, Shree Cement could fork out between ₹1,680 crore and ₹3,024 crore for the quantum of equity stake being discussed if a deal were to work out, not including the cost of an open offer.

In the past, rivals such as UltraTech, Dalmia Bharat and JSW Cement are also said to have engaged in informal discussions for a potential acquisition but no deal took place, well placed industry sources said.

Shree Cement declined to comment. Sanghi Cement’s director Alok Sanghi did not respond to emailed queries, phone calls and text messages.

UltraTech and Dalmia Bharat declined to comment.

“JSW Cement has no intention of making a bid for Sanghi Cement and has no interest in acquiring the asset. Any claims to the contrary are completely baseless and untrue,” a JSW spokesperson said.

Kotak Special Situations Fund, which invested ₹550 crore in Sanghi Cement in November, is said to be guiding the deal talks.

Sanghi Cement’s promoters own around 72% stake in the company as per latest available stock exchange disclosures. Around 98% of their shareholding is encumbered according to the disclosures.

“There was a need for funds in November to tide over certain debt repayments. We were approached to assess our interest to purchase a stake. Global commodity price surges had impacted the cement business. Things are more comfortable now,” said a top cement manufacturer.

As per latest available financials of Sanghi Cement, the company posted a loss of ₹221 crore on revenue of ₹720 crore for the first nine months of 2022-23. It is yet to report its fourth quarter results.

Sanghi Cement has a production capacity of 6.1 million metric tonnes per annum. It caters to the western Indian markets of Gujarat, Rajasthan, Maharashtra and Madhya Pradesh. It also owns two terminals strategically located near the coast, which facilitates transportation of raw materials. The company owns a 143 MW captive power plant.

“Promoters have been down a similar path in 2016 when the company had to undergo debt restructuring. But they were able to hold out even then,” said a banker who has been tracking the company closely.