In a setback to banks, the Kolkata bench of the National Company Law Tribunal (NCLT) has dismissed a petition by the Central Bank of India to start insolvency proceedings against Simplex Infrastructures, noting that the engineering company still has pending dues from government agencies and other contractors stuck in arbitration.

These potential cash flows could help it pay back creditors, said the court, while ruling against the applications seeking the initiation of bankruptcy proceedings.

Simplex owes lenders led by Punjab National Bank (PNB) a total of ₹9,600 crore and is one of the largest accounts to be taken to the bankruptcy courts in recent times.

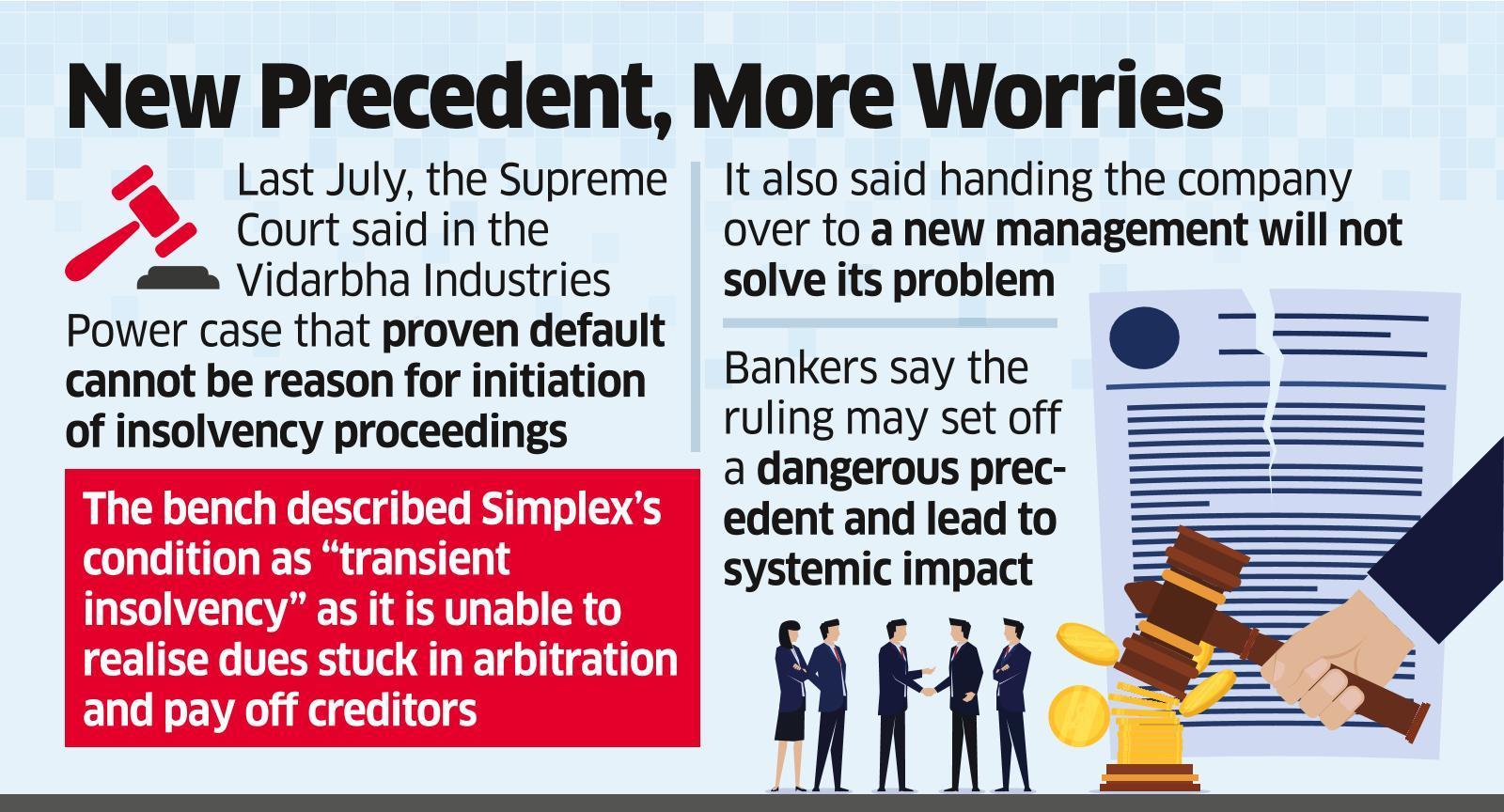

A two-judge bench of Bidisha Banerjee and Balraj Joshi relied on last July’s Supreme Court order in the Vidarbha Industries Power (VIPL) case. The apex court had ruled that proven default cannot be the reason for the initiation of insolvency proceedings.

The NCLT bench said engineering, procurement and construction (EPC) companies like Simplex do not have many tangible assets and handing over to a new management will not solve its problem.

Resolutions Pending

The court noted that resolutions of a total amount of ₹554 crore due to the company are at various stages in courts across the country.

“The balance sheets of the corporate debtor do not show a negative net worth and as such cannot be termed as insolvent…This uncertainty is undoubtedly, a situation where the company though not being able to pay its debt cannot be termed as insolvent, as it has a much large amount of claims waiting to be released in its favour,” Banerjee and Joshi wrote.

Bankers said the judgement is against the law and sets a dangerous precedent. “The IBC was envisaged to give creditors a time-bound mechanism for recovery. The court’s interpretations defeat the very purpose of the law. Central Bank may appeal this judgement but the damage this does to the timeline and resultant deterioration in the asset is irreparable,” said a senior banking executive.

Multiple Petitions

State Bank of India and Indian Bank are also creditors to Simplex.

SBI and PNB had also filed separate petitions to initiate insolvency proceedings against Simplex. All these are now dismissed following the order.

Central Bank of India did not reply to an email seeking comment.

In their order, the judges said that one of the precepts of the insolvency legislation is to promote entrepreneurship and the availability of credit.

“In the present case, it is a financial failure while the business model is sound in keeping with the general industry practice. Having said that it is not likely that any new management would be in a position to do something better which the current management is not able to do,” Banerjee and Joshi said.

The judges described Simplex’s condition as a “transient insolvency” due to a financial failure which is dependent on it being able to realise the arbitration and pay off creditors. “We are not satisfied that this application needs to be admitted for if that was done it might create a larger harm to the corporate debtor,” the order said.

Bankers said that although a review petition has been filed at the Supreme Court in the VIPL case, the damage it has done will take time to undo. In cases like Simplex where there are more than two dozen small and large creditors, it can have a systemic impact.

Source: Economic Times