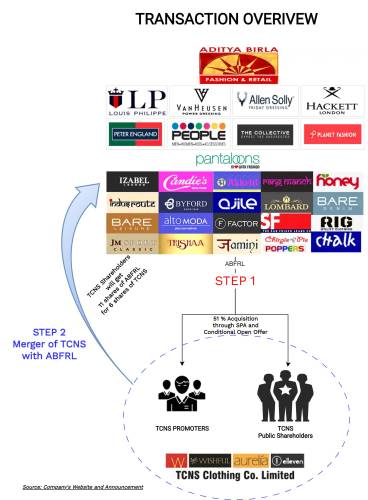

India is poised for multi-decadal change in apparel industry. With rising disposable income & desire to wear branded garments, large organised players are gearing themselves to make most of this opportunity. In recent past, we have witnessed the core strategy for large brands like Aditya Birla or Reliance Retail is to acquire controlling interest in small brands which paves the way to offer complete portfolio to their customers. Recently, Aditya Birla Fashions announced similar deal in which they will take over TCNS Clothing which houses some of the established women’s apparel brands like W, Aurelia etc. This acquisition transaction will be carried out through two steps, acquisition followed by merger.

Aditya Birla Fashion Retail Limited (“ABFRL” or “Transferee Company”) is part of a leading Indian conglomerate, the Aditya Birla Group. ABFRL is a fashion powerhouse with an elegant bouquet of leading fashion brands and retail formats. The equity shares of ABFRL are listed on nationwide bourses. The registered office of the Company is located in the state of Maharashtra.

TCNS Clothing Co. Limited (“TCNS” or “Transferor Company”) is India’s leading women’s branded Apparel Company. The company designs, manufactures, markets and retails a wide portfolio of women’s branded apparel across multiple brands. The equity shares of TCNS are listed on nationwide bourses. The registered office of the Company is located in Delhi.

Proposed Transaction

The Board of Directors of ABFRL & TCNS has approved two-step transaction which will include acquisition of 51% of the paid-up share capital of TCNS by ABFRL from the promoter through a Share Purchase Agreement (SPA) and conditional public open offer followed by merger of TCNS with ABFRL. Essentially, ABFRL will seek to control controlling interest in TCNS before merging it with itself.

Open Offer:

ABFRL & promoters of TCNS have executed a SPA to acquire equity shares of TCNS held by promoters representing between 1,41,92,448 equity shares to 1,98,76,757 equity shares (representing between 22.00% to 30.81% of the Expanded Share Capital of TCNS respectively), depending on the tendering in the Offer, at a price of INR 503 per equity share for a total cash consideration aggregating between Circa INR 714 crore to INR 1000 crore.

As part of the transaction, ABFRL will make a conditional open offer to acquire up to 29% stake at Rs. 503 per share from public shareholders. Depending upon the outcome of the open offer, ABFRL will decide the number of shares to be acquired from the promoters of TCNS which shall entails ABFRL to reach an overall shareholding of 51% in TCNS.

Effectively, ABFRL will pay INR1,650 crores for acquisition of 51% stake under the SPA and public open offer. The open offer will be with condition of minimum level of acceptance of at least 1,30,23,918 equity shares as held by the public shareholders representing 20.19% of the expanded share capital so that ABFRL can reach to 51% shareholding in TCNS by purchasing entire 30.8% stake held by promoters of TCNS.

Merger:

Both ABFRL & TCNS announced Scheme of Amalgamation (“Scheme”) which inter-alia provides for the merger of TCNS into ABFRL post completion of the open offer. The Appointed Date for the merger shall mean the Effective Date, or such other date as may be approved by the Tribunals.

TCNS will be amalgamated with ABFRL under the merger scheme wherein public shareholders of TCNS will receive 11 shares of ABFRL for every 6 shares that they hold in TCNS. Please note that one of the condition precedents for the merger is ABFRL acquiring the 51% stake in TCNS.

Shareholding Pattern:

| Particulars | ABFRL | TCNS | Merged Entity |

| Paid up no. of equity shares | 94,88,13,663 | 6,45,11,127* | 100,67,66,159 |

| Face Value | 10 | 2 | 10 |

| Promoters Holding | 55.47% | 30.81% | 52.28% |

*: Please note that this is basis the present voting share capital of TCNS is 6,17,23,668. Basis the Expanded Share Capital, the number of shares (inclusive of vested ESOPs) would be 6,45,11,127.If the existing promoters of TCNS sells maximum shares i.e., 1,98,76,757 equity shares of TCNS, they will end up having “nil” equity shares of TCNS post-open offer. If they continue to hold any shares on account of achieving desired shares in open offer by ABFRL, they will get shares of ABFRL in merger and be classified as public shareholder in the ABFRL post-merger. On account of the merger, ABFRL will issue circa 5.8 crore shares representing 5.76% of the total equity shares post issue.

TCNS & ABFRL have also executed an agreement between the Transferor Company and the Transferee Company setting out the manner of effecting the transactions envisaged in the Scheme and the rights and obligations of the parties in relation thereto.

Transaction Funding

The two steps acquisition of TCNS essentially means acquisition partly through cash & shares. ABFRL will acquire 51% stake in TCNS using cash consideration to the tune of INR 1650 crore. ABFRL during the con-call mentioned of borrowing not more than INR700 crores to INR800 crores of acquiring 51% stake. Thus, remaining money will come from partly internal accruals and partly (may be major) through equity dilution in near future. Because of this, net debt to EBITDA will increase to approximately 3x in FY ’24.

Remaining 49% of TCNS will be acquired through issue of equity shares which will represent circa 5.76% ownership in merged ABFRL post-issue.

Rationale:

The merger with ABFRL gets TCNS a brand playbook and portfolio complementation, synergies in terms of leveraging front-end and back-end ecosystems and opportunity to leverage trade partnerships while for ABFRL, stronger ethnic portfolio with established brands. Some of the rationale as envisaged by the management under scheme:

- Strengthening of capabilities

- Enabling coverage of commentary market

- Creating synergies

- Channel efficiencies by cross-selling products

- Other administrative benefits

Brands

Way back in 2018, ABFRL had explicitly stated growth strategy for the coming years to be

built around ethnic wear, the largest segment in the Indian fashion space. Over these years, ABFRL has made several organic and inorganic moves with an objective to build comprehensive portfolio of brands in this key segment. It has a repertoire of India’s largest brands in Louis Philippe, Van Heusen, Allen Solly and Peter England, established over 25 years. Pantaloons is one of India’s leading fashion retailers which ABFRL acquired from Future Retail. The company’s international Brands portfolio includes – The Collective, India’s largest multi-brand retailer of international brands and has long term exclusive partnerships with select brands such as Ralph Lauren, Hackett London, Ted Baker, Fred Perry, Forever 21, American Eagle and Reebok. The Company’s foray into branded ethnic wear business includes brands such as Jaypore, Tasva & Marigold Lane. The company has strategic partnerships with Designers ‘Shantanu & Nikhil’, ‘Tarun Tahiliani’, ‘Sabyasachi’ and ‘House of Masaba’.

TCNS Clothing is the owner of leading ethnic brands W, Aurelia, Wishful, Folksong and Elleven. They are catering to Indian women’s fashion needs across markets and price points. Its product portfolio includes top-wear, bottom-wear, drapes, combination sets and accessories that cater to a wide variety of the wardrobe requirements of the Indian woman, including everyday wear, casual wear, work wear and occasion wear.

Financials

In terms of revenue, TCNS is 1/10th of ABFRL while have similar operating margins as that ABFRL. Before Covid, TCNS used to have a strong mid-teens operating margin which were dragged due to Covid. Due to Covid & inherent business model, both ABFRL & TCNS are leveraged. Working capital of TCNS is extremely high as compared to ABFRL. Going ahead, ABFRL will try to bring it down.

Valuation

| Particulars | ABFRL | TCNS |

| Market Cap as on 5.6.23 (₹ Crores) | 19,600 | 2600 |

| Assigned Valuation to the Entity as per valuation Report (₹ Crores) | 25,950 | 3222 |

| Revenue Multiple | 2.07 | 2.64 |

| EV/EBITDA | 15.8 | 22.4 |

Source: ScreenerConclusion

The transaction has been structured in such a way that existing promoters of the TCNS will be able to cash out most of their holdings (entire holding if public shareholders don’t tender their shares in open offer fully) in TCNS immediately by way of selling shares to ABFRL while most of the public shareholders will receive consideration in the form of shares of ABFRL which will take at least 10-12 months’ time for completion.

Two step acquisition (share purchase followed by merger) aims to discharge consideration partly through cash & equity shares. If ABFRL would have announced direct merger without acquisition, the share dilution would have been circa 11% instead of 5.26%. ABFRL promoters holding would have fall below 50%. As business purchase Agreement is not available in the public domain, so what will happen if ABFRL fails to acquire 51% either way. It is also not known why ABFRL is interested in 51% Acquisition in cash and balance through share swap, not more nor less.

For ABFRL, this acquisition crystallises their chalk-out plan in 2018 to expand its ethnic women segment. For player like TCNS, it provides an opportunity to leverage various expertise of ABFRL. Shareholders of TCNS are waiting for value creation since its listing in 2016. The open offer price is 50% down from its listing price. Small public shareholders of TCNS shall be praying more for consummation of this transaction and hoping for value creation post-merger.