The sale of IL&FS Paradip Refinery Water to IndianOil Adani Ventures, a deal worth ₹600 crore, has hit a roadblock with the state-owned refiner Indian Oil Corporation (IOC) delaying the consent, raising concerns about the timely completion of the sale. The IL&FS board is planning to approach the National Company Law Appellate Tribunal (NCLAT) to proceed with the sale without IOC’s consent.

This is the second time the sale of this distressed asset has encountered obstacles, following a Morgan Stanley-run fund’s withdrawal from a deal to purchase it a year ago.

IndianOil Adani Ventures, earlier called Indian Oiltanking, is a joint venture between IOC (49.38% stake), Adani Group (49.38%), and UTI Fund (1.24%). The company has expressed preliminary interest in acquiring IL&FS’ 100% stake in IL&FS Paradip Refinery Water (IPRWL). However, the sale is awaiting IOC’s consent.

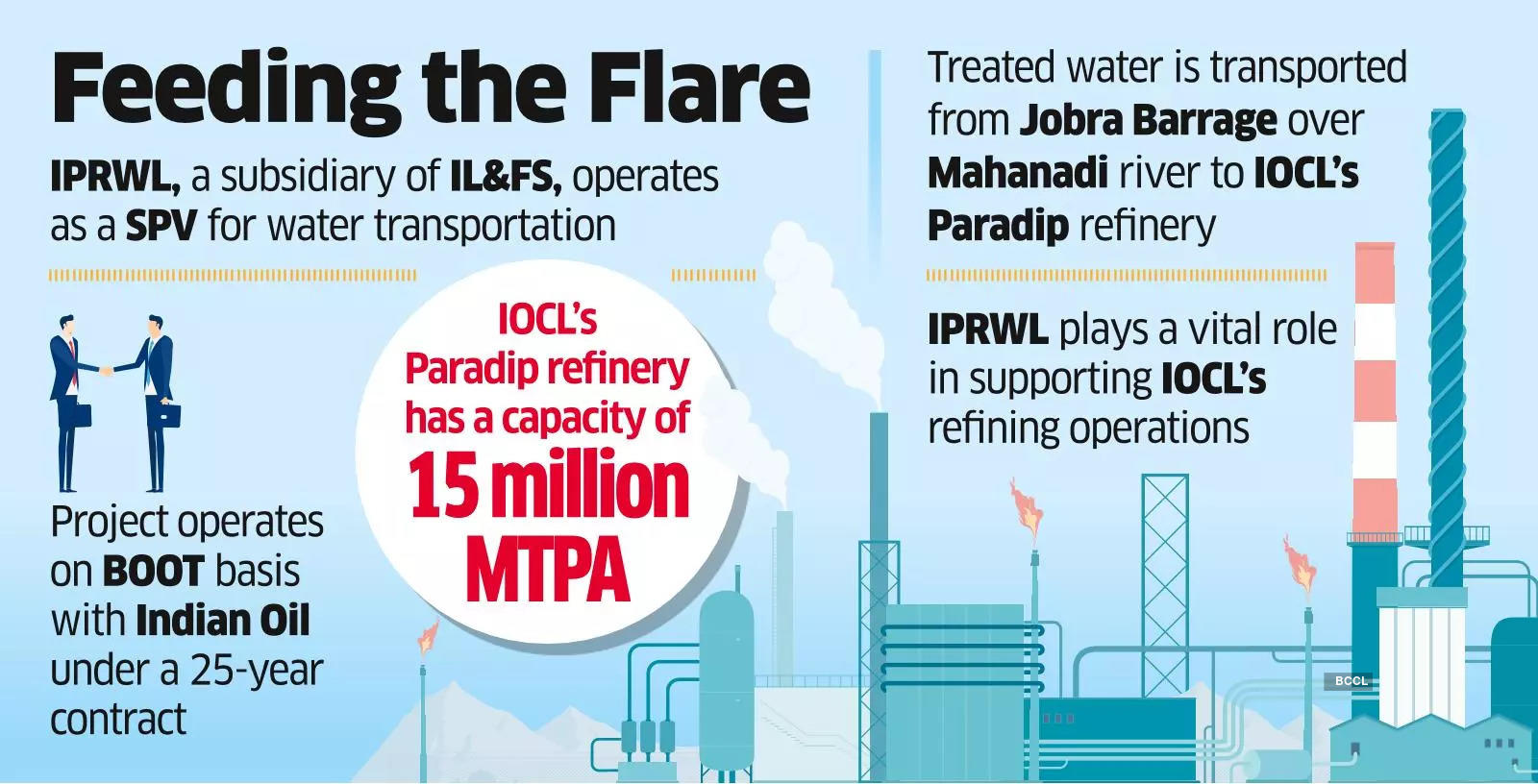

According to the terms of the contract between IOC and IL&FS established on January 29, 2010, IL&FS must retain a minimum 51% equity stake in IPRWL until the end of the build-own-operate-transfer (BOOT) concession period, which concludes in May 2039.

Additionally, IOC has the right to stake ownership of up to 49% of the shares when they are put up for sale. The consent of IOC is crucial for any equity sale related to the refinery.

IL&FS had requested upfront waivers from IOC to engage with IndianOil Adani Ventures, seeking to address prior consent requirements and pre-emptive rights outlined in the BOOT agreement, request for proposal, and other relevant bid documents. However, the company is still awaiting a response from IOC regarding the way forward and the possibility of obtaining upfront waivers for bilateral discussions with IndianOil Adani. “We have filed an application with NCLAT seeking permission to sell IPRWL – either by directing IOC to buy 100% stake or by granting/waiving consent to sell to third party bidder,” said an IL&FS spokesperson.

He added that the decision was taken by the Board after attempts to sell this asset failed pending IOC consent.

In case IOC decides against acquiring this asset, the board plans to launch an independent public sale process for this green company with concessions up to 2039, subject to NCLAT directions.

This latest interest expressed by IndianOil Adani follows the setback faced by IL&FS in resolving the sale of IPRWL, as North Haven India Infrastructure Fund’s (NHIIF) withdrawal affected the process.

Last year NHIIF, an India-focused infrastructure fund managed by Morgan Stanley Investment Management, withdraw its offer to purchase IL&FS’ equity stake in IPRWL due to delays in finalising the deal, as it failed to secure IOC’s final consent.