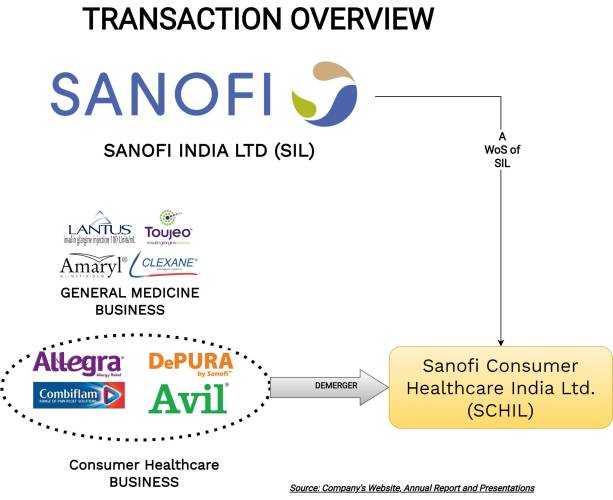

In 2019, Sanofi S.A. announced to place its Global Consumer Healthcare Business as a standalone business unit with Integrated Research & Development and Manufacturing functions. The move was intended to create a separate identity for its Consumer Healthcare Business. From the announcement date till now, Sanofi is working on simplifying its standalone Consumer Healthcare Business. Following its parents’ decision, recently Indian entity announced demerger of its consumer healthcare business.

Sanofi S.A. is a Paris based global biopharmaceutical company focused on human health. With presence in more than 100 countries, Sanofi is transforming scientific innovation into healthcare solutions around the globe. The equity shares of Sanofi S.A. are listed on Paris Stock Exchange & NASDAQ.

Sanofi India Limited (“SIL”/ “Demerged Company”) is an Indian arm of Sanofi S.A. The equity shares of SIL are listed on nationwide bourses.

Sanofi Consumer Healthcare India Limited (“SCHIL /Resulting Company”) is being recently incorporated as wholly owned subsidiary of SIL to facilitate the demerger transaction.

Current business verticals of SIL:

SIL is engaged in two business verticals:

- General Medicine Business

- Consumer Healthcare Business

The Proposed Transaction:

The Board of Directors of Sanofi India Limited, at its meeting, has approved a scheme of arrangement under Sections 230 to 232 of the Companies Act, 2013 (“Scheme”), to demerge its Consumer Healthcare Business (“CHB”) from the Demerged Company into its wholly owned subsidiary Sanofi Consumer Healthcare India Limited.

The consumer healthcare business of SIL includes assets, liabilities and all other aspects pertaining to the consumer healthcare business of the Company including brands like Allegra®, Combiflam®, DePURA ®, Avil®, etc. Pursuant to clause 3.1.2 (xi) of the Scheme, all intangibles related to CHB division will get transferred to SCHIL.

SIL’s has one manufacturing facility located at Goa which shall continue to remain as part of General medicines business/remaining business. SIL will continue to manufacture certain products for the consumer healthcare business under the contract manufacturing arrangement.

As envisaged under the scheme, the Appointed Date for the demerger is the Effective Date. thus, all profits generated by CHB division including cash will be part of the remaining SIL till Effective Date.

Some of the Rationale:

- Separation of the pharmaceutical and consumer healthcare businesses of the Company will allow the Company and the Resulting Company to have independent and focused management as well as independently pursue different opportunities and strategies for the growth of each respective business aligned to specific market dynamics.

- Enable a different operating model for the consumer healthcare business under the Resulting Company, specific to and fit for the purpose for a fast-moving consumer healthcare company, which will lead to a greater ability to operate independently and positively shape the consumer healthcare environment.

- Demerger will facilitate pursuit of scale and independent growth plans and enable more focused management and stronger leverage of specific global resources within the Sanofi group.

Share Exchange Ratio:

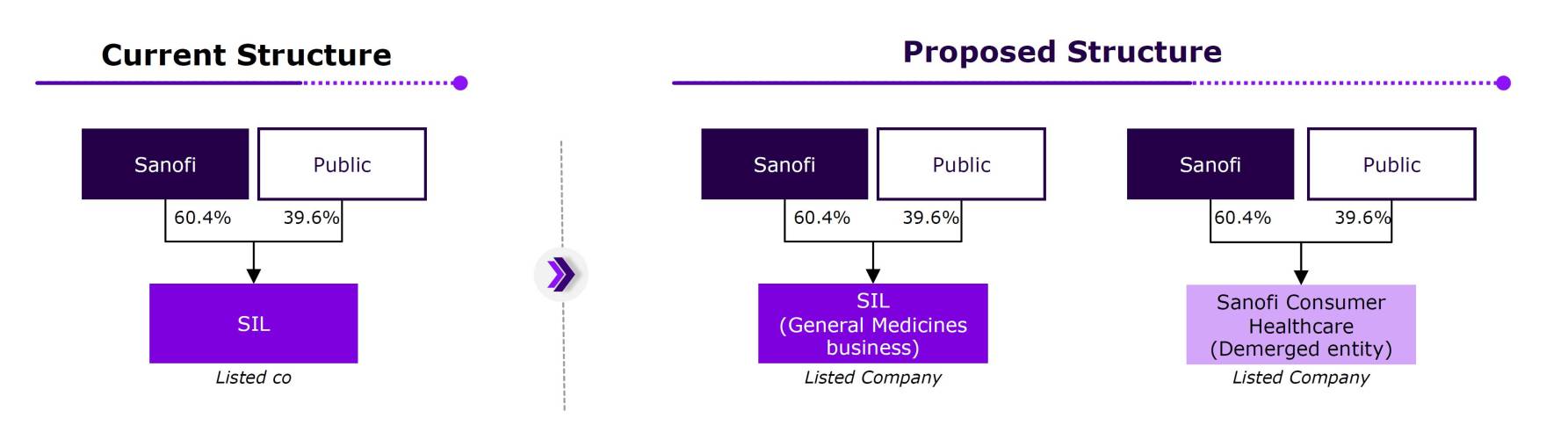

Shareholders of SIL will get 1 equity share of INR (Indian Rupees) 10 each SCHIL for every 1 equity share of INR 10 each in SIL. The shareholding pattern of SCHIL will be mirror-imaged to the shareholding pattern of SIL as on record date.

| Particulars | SIL-Pre & Post | SCHIL-Post |

| No. of Equity Shares | 2,30,30,622 | 2,30,30,622 |

| Face Value | 10 | 10 |

Sanofi S.A. through directly & its subsidiaries will hold 60.40% stake in both SIL & SCHIL post-transaction.

Financials

On the revenue side, SIL is among the top 4 multinational pharma companies in India. The turnover of the consumer healthcare undertaking of the Company for the financial year ended 31st December 2022 was INR 728 crore, representing 28% of the total turnover of the Company for the said year. On a global level, Consumer Healthcare Business contribution to overall revenues is slightly higher than 10%.

Brief Financials of SIL for CY 2022:

INR in Crore

| Particulars | Amount |

| Revenue | 2841 |

| EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) | 774 |

| PAT (Profit After Tax) | 620* |

| Networth | 1275 |

*: Includes an exceptional gain of INR 132 crore (before tax).Bifurcation of key Assets & Liabilities between divisions as envisaged by the SIL as on 31st December 2022:

Clearly, CHC will be asset-light business driven by internally generated brands. Remaining business will continue to house manufacturing facilities including for the demerged business on contract basis. Entire surplus cash will continue to remain with the remaining business undertaking and even surplus generated by CHC till Effective Date also will remain with the Demerged Company. s communicated by the management margins for consumer healthcare business are higher than the remaining business.

The proposed demerger will be accounted as per accounting principles prescribed in Appendix C of Indian Accounting Standard (Ind-AS)-103: Business Combination. SCHIL shall recognise the assets and liabilities of the Demerged Undertaking vested in it pursuant to this Scheme, at their respective carrying amounts as appearing in the books of SIL and the difference, between the carrying amount of the net assets of the Demerged Undertaking acquired and the consideration issued to the shareholders of the Demerged Company shall be adjusted to capital reserve. Pursuant to the demerger, SCHIL may have a negative capital reserve of Circa INR 32 crore. Unlike slump sale, brands will not be recorded in the books of SCHIL.

Valuation

Due to some of the inherent features like asset-light, limited trade restrictions etc, consumer healthcare businesses generate high margins. Such Standalone businesses commands better valuation and high dividend.

| Particulars | Procter & Gamble Health Limited (9M Ended on 31st March 2023) |

| Revenue | 941 |

| Profit After Tax | 200 |

| Market Capitalisation | 8600 |

| Revenue Multiple | Circa 6X |

| PE Multiple | Circa 30X |

Margins related to CHB of Sanofi will be similar to that of Procter & Gamble Health Limited. For the year ended on 31st December 2022, CHB revenue was circa INR 728 crore. The significant part of the valuation will be attributable to the brands owned by the company. As far as cost allocation between two companies post demerger, it will be practically zero for the shares of The Resultant Company.

Conclusion

Aligning with global pharma companies, Sanofi S.A. announced separation of Consumer Healthcare Business into a separate company. Being having operations across several countries, it is executing separation in each country/region separately as per available optimum way in that country/region. Due to some of the inherent features like asset-light, limited trade restrictions etc, consumer healthcare business may generate greater margins and separation proved to be value accretive.

For Indian business. SCHIL post-transaction will be asset light, margin accretive branded business which might get higher multiple and trade at premium.