Route Mobile Limited (“Route” or “RML”) established in 2004 is a cloud communications platform service provider, catering to enterprises, over-the-top (OTT) players and mobile network operators (MNO). RML’s portfolio comprises solutions in messaging, voice, email, SMS filtering, analytics and monetization. RML has a diverse enterprise client base across a broad range of industries including social media companies, banks and financial institutions, e-commerce entities and travel aggregators. RML is headquartered in Mumbai, India with a global presence in Asia Pacific, Middle East, Africa, Europe and North America. The equity shares of RML are listed on nationwide bourses in India.

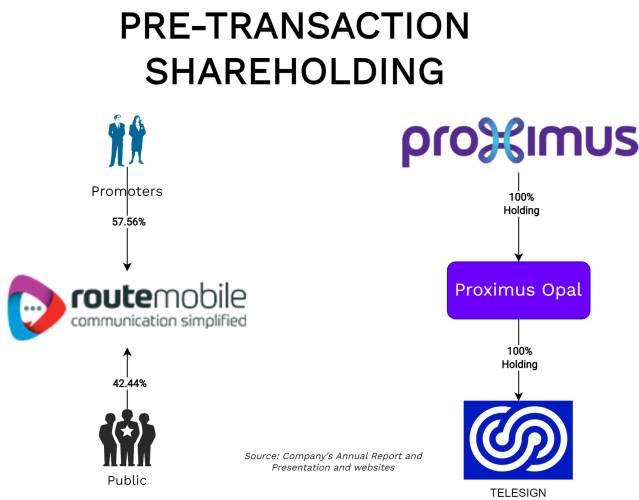

Proximus Group is a provider of digital services, communication and ICT solutions operating in the Belgian and international markets. The equity shares of Proximus are listed on Belgium Stock Exchange. Proximus Group is controlled solely by Belgium State (53.51%) and remaining by public & treasury shares.

Proximus Opal is 100% owned by Proximus Group a holding entity (100%) of Telesign which provides Continuous Trust to leading global enterprises by connecting, protecting, and defending their digital identities. Telesign verifies over five billion unique phone numbers a month, representing half of the world’s mobile users, and provides critical.

Journey So far for Route

Started in 2004, Route Mobile become India’s multinational Communication as Platform Services (CPaaS) company within a decade. With the help of a few acquisitions, Route transitioned as an Enterprise Business model. The equity shares of the Company got listed in 2019 on nationwide bourses in India. The Initial Public offering (“IPO”) was comprising of combination of fresh issue & offer for sale. RML raised INR 240 crore through IPO.

Immediately after Initial Public Offering, Route further expanded its product portfolio with acquisitions. In 2021, it raised an amount of circa INR 867 crore through qualified institutional placement from marquee investors. In 2022, the company did buyback of INR 120 crore. It further acquired Teledger’s DLT, Blockchain and AI solution business through Business Transfer Agreement. Finally, in 2023 the promoters of the company announced ownership exit.

The Transaction

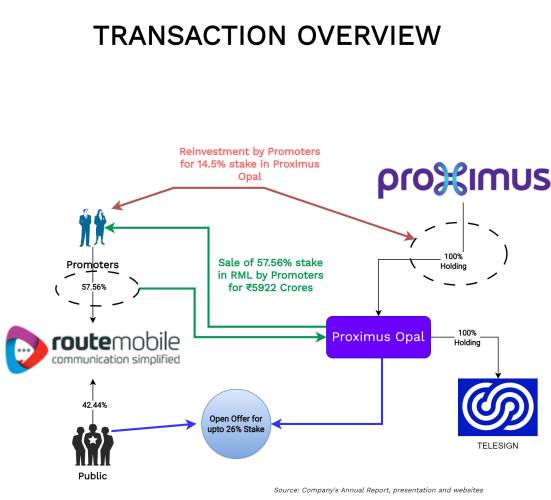

The existing promoters of Route Mobile Limited announced an execution of Share Purchase Agreement (“SPA”) with Proximus Group/Proximus Opal which inter-alia provides for the transfer of entire paid-up equity share capital held by the existing promoters i.e., 57.56% to Proximus Group for a consideration of INR 5922 crore.

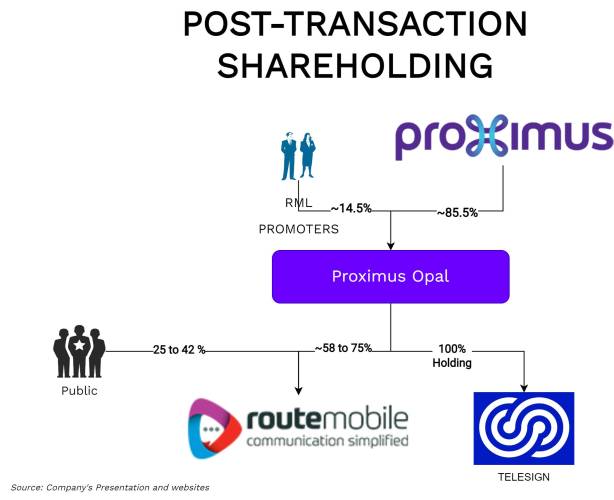

The SPA will trigger Mandatory Open Offer requirements in terms of Regulation 3(1) and Regulation 4 of the SEBI (SAST) Regulations for Proximus Group. Pursuant to the same, Proximus Group will give an open offer to public shareholders for acquiring 26% of paid-up capital.

Total Consideration:

| Particulars | Price Per Share | % | Total Consideration |

| Promoters | 1626.40 | 57.56% | 5922 |

| Public-Open Offer | 1626.40 | 26% | 2675 |

| Total | 83.56% | 8597 |

The promoters will receive the consideration in two tranches:

- an amount equal to 75% of the amounts payable under the Share Purchase Agreement on the Closing Date (“Upfront Consideration”); and

- an amount equal to 25% of the amounts payable under the Share Purchase Agreement, post receipt of Initial Consideration on counter investment (as discussed below) by Promoters in Proximus Opal.

The existing promoter & Managing Director Mr. Rajdip Gupta will continue to be the Managing Director of RML.

Counter Investment by Promoters in Proximus Group:

It is further announced that, Proximus Group has entered into another share sale agreement dated 17 July 2023 (“Affiliate Share Sale Agreement”) with Clear Bridge Ventures LLP, an affiliate of the existing promoters. Pursuant to which the Sellers’ Affiliate intends to make a minority non-controlling investment of up to 14.5% and acquire from the Proximus Group an aggregate consideration of circa INR 2800 crore.

This investment will include:

- the right to appoint one director on the board of directors of the Proximus Opal,

- certain information rights, and

- veto rights over alteration of share capital, dividends and amendments to governing documents and board composition, insolvency/deemed liquidation, material alteration to the nature of the business of the Acquirer, incurrence of indebtedness above a certain value, amendments to the terms of any option or other grant under any Share Plan and related party transactions above a certain value.

| Particulars | Amount (Rs Crores) |

| Total Receipt from selling entire shares of RML | 5922 |

| Re-investment in Proximus Opal | 2800 |

| Net Consideration | 3122 |

Please note that out of INR 5922 crore, promoters will receive total 75% amount i.e., INR 4441 crore upfront and remaining 25% i.e., 1481 crore after initial subscription by them in Proximus Opal.

From the gross consideration, Existing promoters will have to pay direct taxes. Net of direct taxes, an amount of Circa INR 2800 crore will be re-invested into Proximus Opal which will hold investment in Telesign & RML. Thus, effectively promoters will get:

- Gross Amount of INR 3122 crore; and

- 14.5% share of Proximus Opal which translate into indirect stake of 14.5% in Telesign & circa 8.34% (without considering additional stake acquired through open offer) of RML.

Further, the shares acquired by the promoters will have lock-in period of 5 years.

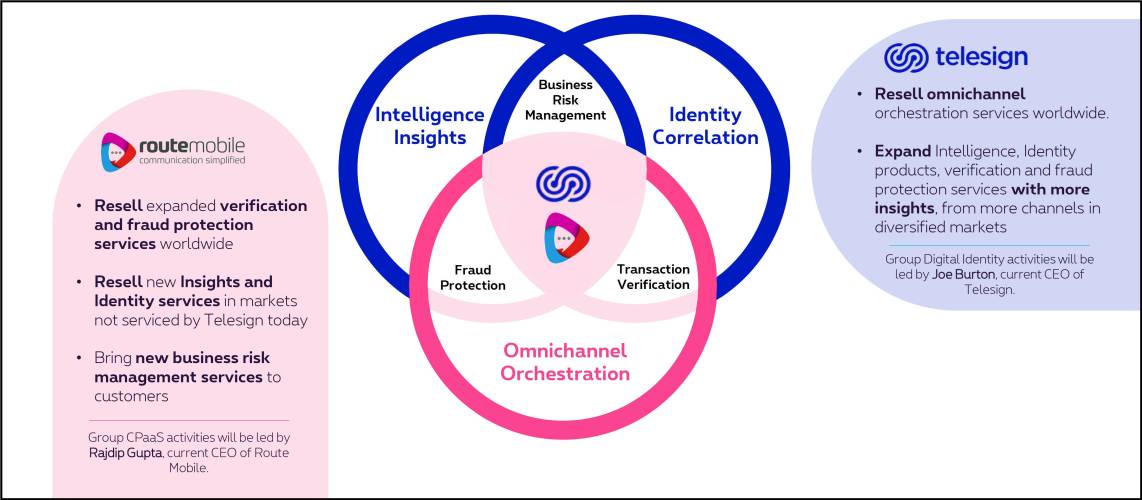

The Synergy Game:

Proximus Group is one of the leading groups engaged in digital services, communication, and ICT solutions. Over years, it grew its operations organically and inorganically. One of its acquisitions in 2017 was Telesign, a Fast-growing leader in digital identity services to internet properties, digital champions, and cloud native businesses and with a growth path in programmable communications.

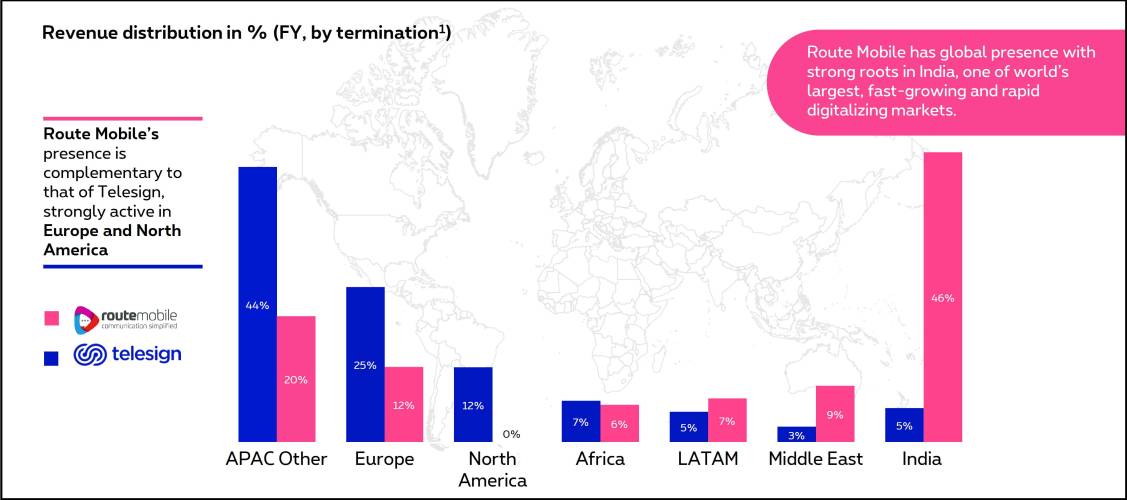

Basically, Telesign has strong presence in digital identity while good presence in Communication as Platform Services (CPaaS) and on other hand Route Mobile has strong presence in CPaaS while it started expanding into digital identity few years back. The business carried by Telesign & Route complement each other.

- First one is a combined annual revenue of Telesign and Route Mobile this year, which will be reaching circa EUR 900 million will place Proximus group among the top 3 Communication as Platform (CPaaS) players globally in terms of volumes and in top 5 in terms of value.

- In terms of product offering, these two Telesign & Route show a strong complementarity, which creates significant revenue growth opportunities through cross selling each other’s services. Route Mobile’s advanced omnichannel capabilities will benefit from the strong expertise and commercial presence of Telesign, especially in the U.S., but also in regions where Route Mobile is less prominent.

- Expanding Geography: the product offering of Route Mobile as well as its geographical footprint, are highly complementary to those of Telesign, hence, creating very interesting avenues for further revenue growth.

- Client Diversification: Being on the enterprise side, Telesign have few but large clients while Route have diversified client base.

As mentioned by Mr. Rajdip Gupta during the concall, single most factor to go for this transaction was Telesign strong presence in North America. For last couple of years, Route is trying relentlessly to enter North America but due to customer Stickiness and presence of global companies like Twilio & Snitch, they failed totally. This acquisition will provide new array of hope for Route to enter North America which will place them in different league. Approx. 65% of the total revenues of Telesign comes from USA.

For Telesign/Proximus Group, this strengthens their CPaaS business plus fast-growing Asia Pacific market. Further, it also gives an opportunity for Proximus Opal/ Telesign to position stronger and re-start IPO planning for Telesign. In 2021, Proximus Group, announced listing of Telesign on New York Stock Exchange through reverse merger with Special Purpose Acquisition Company (SPAC). However, later in 2022 it announced termination of the reverse merger. After successful integration of Route, Proximus group will again likely to go for listing of Telesign. This will entail group to realise the gain from the acquisition plus provide exit opportunity for Route promoters who will purchase 14.5% stake in Proximus Opal.

Acquisition Funding

Considering the re-investment by Route’s existing promoters, Proximus group depending upon success of the open offer, will require INR 5797 crore (INR 3122 crore to buy promoters stake plus INR 2675 for Open offer). However, as Route’s promoters will invest the amount in Proximus after receipt of consideration to them for Route, initially, Proximus will require more than INR 5797 crore.

As informed by Proximus, the financing of this transaction has been fully secured through a bridge facility, which shall be followed by the issuance of a new Bonds on closing of the transaction.

Financials & Valuations

| Particulars | Route | Telesign |

| Annualised Revenue (Rs. Crores) | 3608 | 4300 |

| Annualised Profit After Taxes | 333 (9.22%) | Negative |

| Valuation (Enterprise Value Rs. Crores) | 9500 | 13,000 |

As per Proximus Group concall, Telesign has operational losses. The 14.5% stake by Route Promoter in Proximus Opal, Telesign assigned enterprise valuation is circa INR 13,000 crore. Comparative to Route which generate healthy profits, the valuation seems to be at premium. Size of Route is almost equivalent to that of Telesign. Proximus group has guided the transaction is going to be highly value accretive, with EBITDA synergies estimated at a minimum of EUR 90 million per year at run rate. It is not clear how much synergies will be derived by the Route on individual level.

Conclusion

Over the last couple of years, Route Mobile is trying its best to become a large CPaaS company which passes through the North America market. The proposed acquisition by Proximus gives Route an opportunity to penetrate in USA through using Telesign customer relationship. Apart from this, there could be significant cross-selling opportunities which may come to both Telesign & Route. Having said that, the integration is going to be a roller-coaster ride.

The structuring of the transaction has been done in such a way that at the end, Proximus will acquire stake in Route in combination of cash & equity. Going ahead, Proximus group will try to list Telesign which will provide exit opportunity to Route promoters. In the process, we may see some internal restructuring between Proximus Opal, Telesign and Route.