The Committee of Creditors (CoC) to Future Retail (FRL) have extended the voting period for the third time to decide the winning bidder to acquire the debt-laden company. The timeline has now been extended till September 30 as lenders are still undecided whether to approve a very low offer from SpaceMantra or allow liquidation of FRL as there isn’t enough time to seek fresh bids.

The decision was taken on Saturday after the second timeline ended on September 15, three people familiar with the developments said. The majority of the creditors have yet to decide on the takeover plan under consideration.

“Nobody is in a hurry to make a decision. Everyone is waiting for the other. Though some small bondholders have voted, the large financial creditors are still weighing options,” said one of the persons cited above.

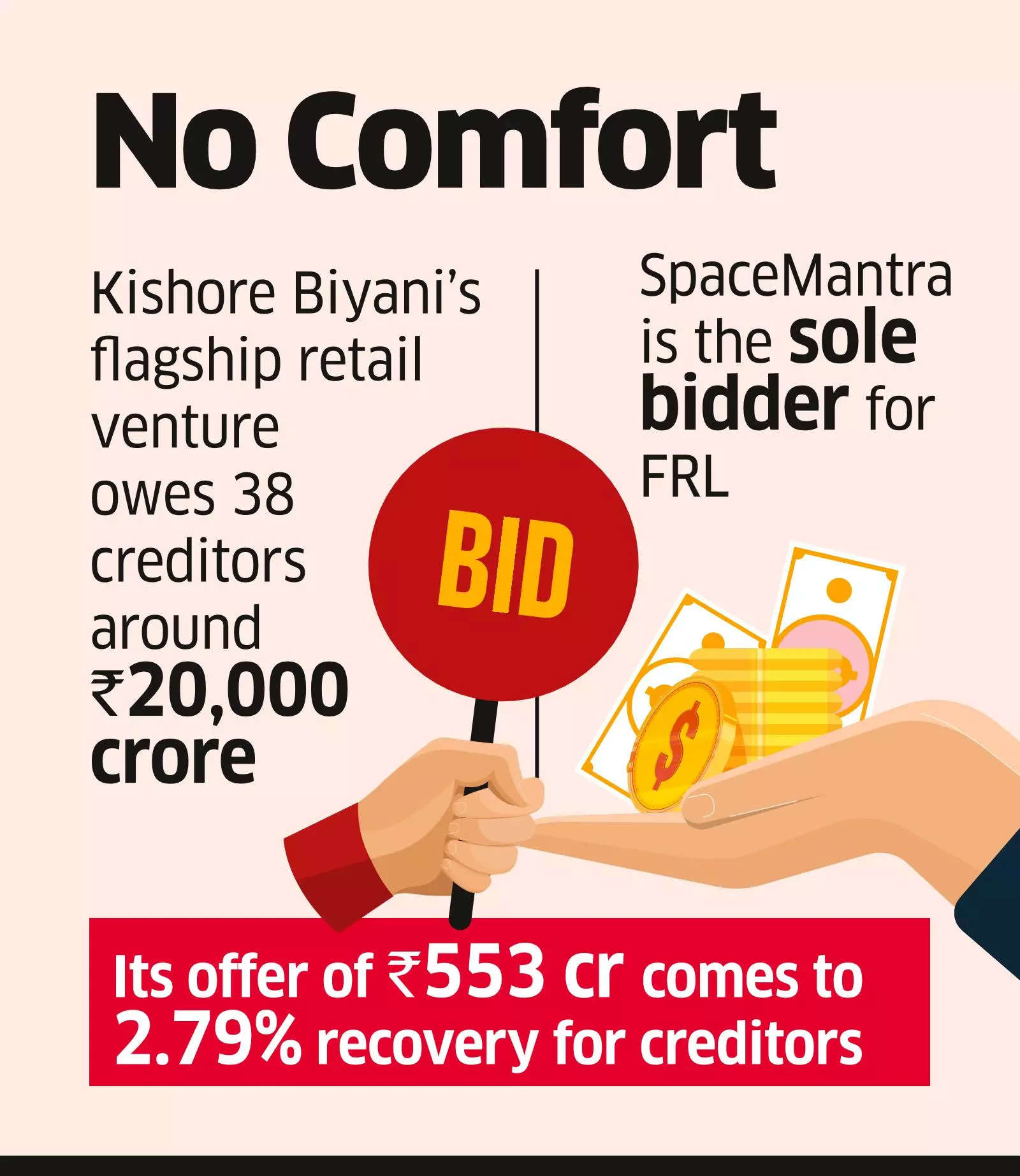

Kishore Biyani’s flagship retail venture owes 38 creditors close to ₹20,000 crore. Bondholders, represented by Bank of New York Mellon (BNYM), own 21% of the debt, or ₹4,109 crore, followed by Bank of Baroda at ₹1,826 crore or 9.24%, Union Bank of India at 9%, or ₹1,779 crore, and Central Bank of India at 8.38%, or ₹1,656 crore.

SpaceMantra, a retailer of construction, building materials and office furniture, is the sole bidder to take over FRL. Its offer of ₹553 crore comes to about 2.79% recovery for creditors.

Lenders are uncomfortable with the low offer, which is close to the liquidation value of the company. They are also sceptical of the valuations ascribed to the company since many of Future Retail’s stores are currently inaccessible or have been taken over.

“Multiple lenders have raised questions on the process, specifically the valuations ascribed to the company, the assets position and the audit report but there is no clarity from resolution professional (RP) on how to go ahead,” said the second person cited above.

Late last month, ET reported that HDFC Bank has opposed the decision of the RP Vijaykumar Iyer to put the plan to vote, alleging “gross illegalities” and “procedural lapses” in the resolution process.

HDFC has alleged that out of the 302 stores that were part of Future Retail assets when the insolvency process commenced, the RP didn’t have access to 228 stores, which means that the current ascribed value is low. Other lenders have also accused the RP of failing to maximise value. Iyer didn’t respond to an email seeking comment.

“This company was valued at more than ₹15,000 crore on various matrices – be it market cap, balance sheet or value of assets a few years ago. Banks cannot sign off on such a low offer because it will lead to questions later. There is still time and maybe banks can ask SpaceMantra to increase its offer or another bidder may emerge. Liquidation also cannot be ruled out,” the third person said.

The outer resolution timeline for the case of 330 days ends on September 30. Beyond this, any extension will have to be approved by the National Company Law Tribunal (NCLT).

Bankers are also aware that the value of FRL’s assets has been eroded as all the consumables inventory is past expiry and most of its stores have been taken over by Reliance Retail after their leases ran out. But they are also wary of any political fallout if they accept this low offer given the history of the account.

Source: Economic Times