US-based Advent could rope in new investors into its planned combination of Suven Pharma and Cohance Life Sciences, as it looks to create a top three contract development and manufacturing organisation with a diversified shareholder base by combining the portfolio companies, according to sources in the know.

“A few investors have been sounded out. They are looking to induct new investors as part of the merger plan of Suven Pharma with Cohance. The idea is to have a diversified shareholder base in the merged entity and bring in investors who could add value to the business,” a person in the know said.

The merger is still on the drawing board, the sources cautioned.

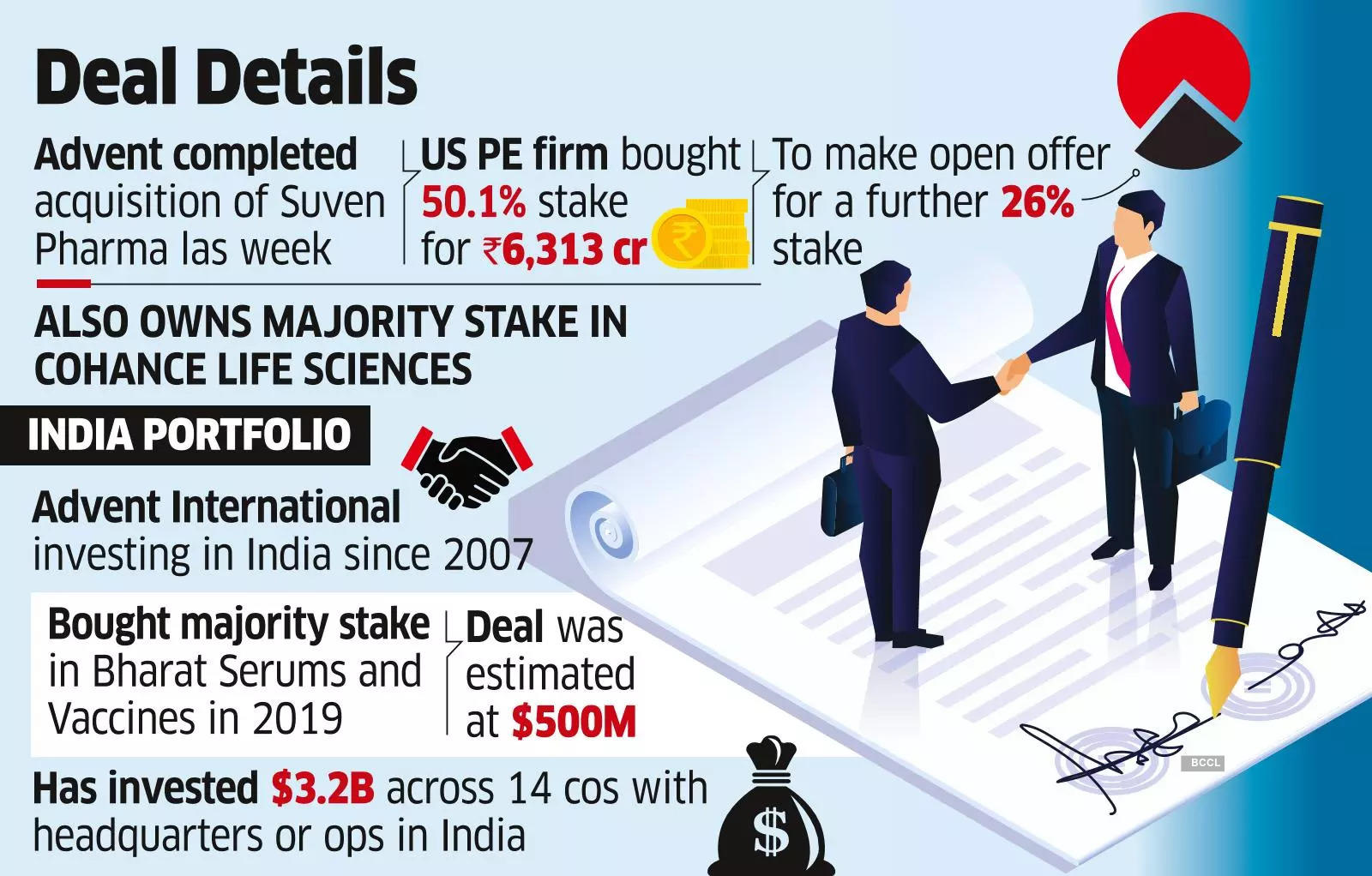

The US PE firm completed its ₹6,313-crore acquisition of Suven Pharma wherein it has acquired 50.1% stake in the company from the past promoters and will make an open offer for a further 26% stake. It also owns a majority stake in Cohance Life Sciences, an active pharmaceutical ingredient (API) manufacturer that was put together by combining three companies – RA Chem Pharma, Avra Labs and ZCL Chemicals – all of which were acquired in the past three years and are unlisted.

“They expect good investor acceptance of Suven Pharma’s open offer. That could make them a very significant shareholder of the company,” one of the people said.

Details about the quantum of stake Advent could sell in the Suven Pharma-Cohance combined entity and the value of that stake are still being determined, as per the sources.

“There is no outreach being made to financial investors,” Advent said in its response to ET’s queries.

Advent announced its acquisition of Suven Pharma in December. Including the cost of the open offer, the deal size would go up to Rs 9,589 crore. The deal was given a green light by the union cabinet on September 14.

A Suven Pharma-Cohance combination could bring together the strong client base of the former, which is a drug development partner to large global pharmaceutical companies, and the advanced active pharmaceutical ingredient (API)-lifecycle management capabilities of the latter, according to the sources.

“The merger will be evaluated by the board taking into consideration the strategic rationale and accretiveness to Suven’s public shareholders and will be subject to regulatory approvals and other customary approvals,” Advent said in a December 26 statement about its plan to merge Suven Pharma and Cohance.

As per its website, Advent International has been investing in India since 2007.

It acquired a majority stake in Daftary family-controlled Bharat Serums and Vaccines in 2019 in a deal estimated at $500 million at the time, though financial details were not disclosed at the time.

Advent has invested $3.2 billion across 14 companies with headquarters or operations in India. Globally, Advent has invested over $10.4 billion across 51 companies in healthcare, as per details availed from a press statement on the Suven Pharma acquisition that was posted on its website.

Source: Economic Times