Norwest Venture Partners, a US venture capital firm backed by Wells Fargo, on Monday agreed to buy a 40% stake in Kanpur-based Regency Healthcare for ₹600 crore, said people in the know. Regency Healthcare runs a hospital and a chain of dialysis clinics in the city.

“An agreement has been reached today. Norwest Venture will acquire around 40% stake in the company,” said one of the persons cited above.

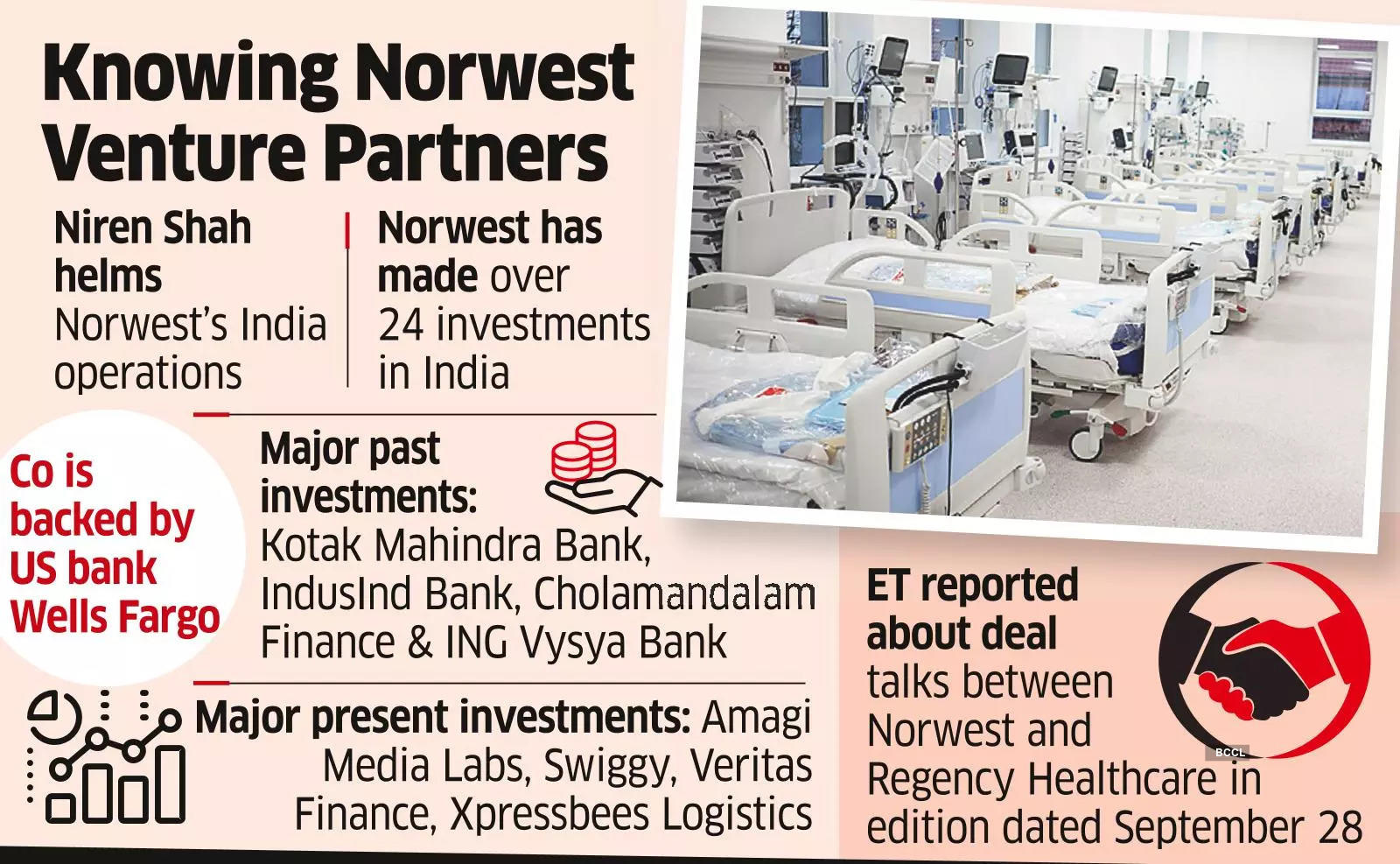

ET had first reported about the discussions between Norwest Venture and Regency Healthcare on September 28.

Regency Healthcare is promoted by Atul Kapoor, a medical doctor based in Kanpur. The company operates a 1,000-bed hospital in the city besides having a joint venture with Germany’s Fresenius Medical Care to run a network of dialysis clinics. Fresenius is a global market leader in management of end-stage kidney disease.

International Finance Corporation (IFC) and HealthQuad invested a total of about $14 million in Regency Healthcare in 2016. Both will exit the company as part of the deal with Nortwest Venture. IFC is the private investment arm of the World Bank. HealthQuad is a fund comprising a four-way partnership between Sunil Thakur, Abrar Mir, Amit Varma and impact finance investor Kois.

Atul Kapoor and Norwest Venture did not respond to ET’s requests for comment.

O3 Capital is said to be among the advisors on the transaction.

Norwest Venture, headquartered in Palo Alto, California, is a venture and growth equity investment firm with more than $12.5 billion in capital under management. The firm has funded more than 600 companies since inception. Its investment portfolio is spread across North America, Israel and India.

Wells Fargo is a main institutional limited partner of Norwest Venture.

Source: Economic Times