Private equity (PE) fund ChrysCapital is in final discussions to acquire a significant minority stake in New Delhi’s Centre For Sight, valuing the eye hospitals chain at Rs 1,600 crore, said people aware of the development.

Delhi-based ChrysCapital’s proposed investment of Rs 800-1,000 crore (about $100 million) will give an exit to Mahindra Partners, the PE arm of Mahindra & Mahindra, which owns about 32% stake in the chain, they said.

Besides Mahindra Partners’ stake, ChrysCapital plans to acquire 10-15% stake through the primary route, said the people, who did not wish to be identified.

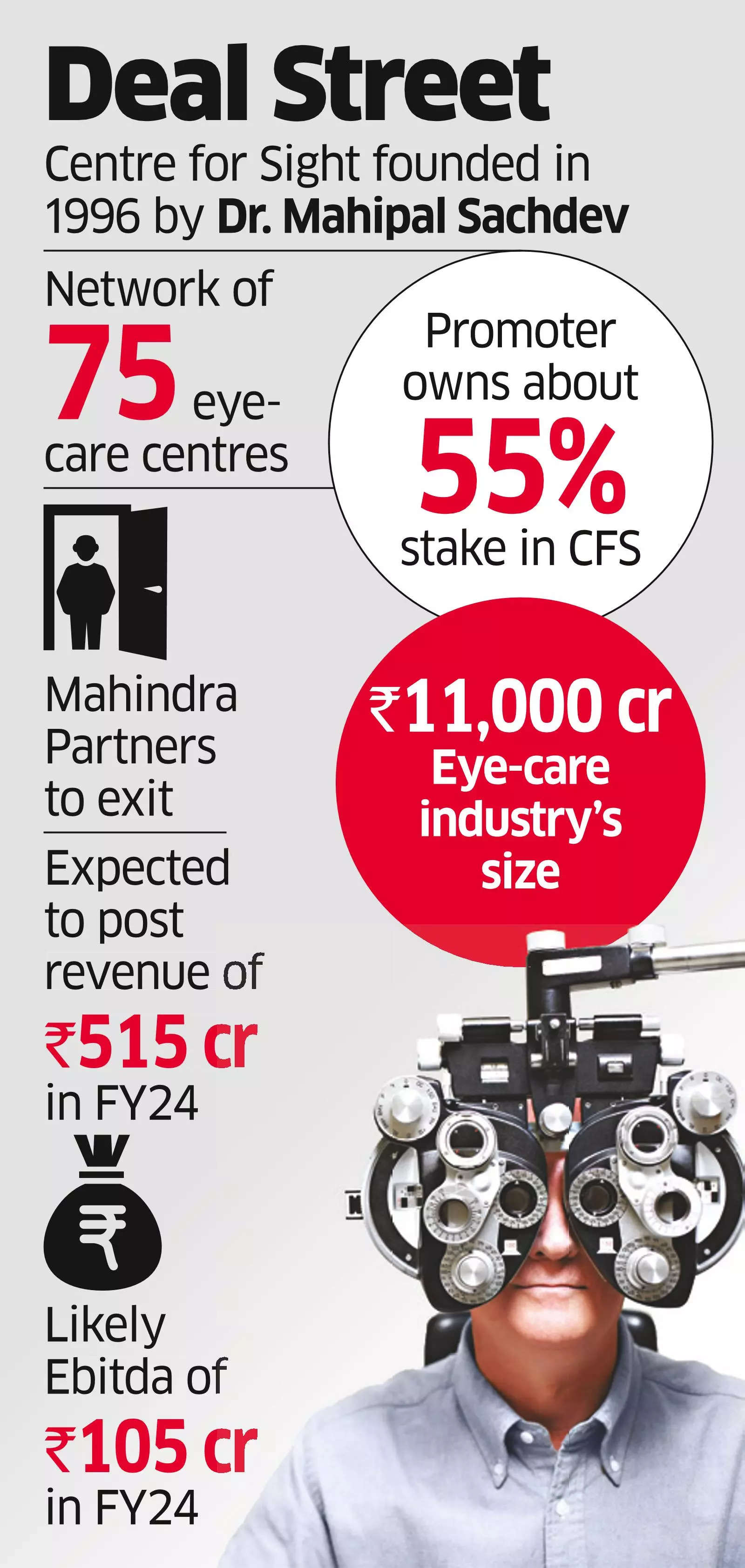

At present, Centre For Sight founder Dr Mahipal S Sachdev is the majority stakeholder with about 55% stake in the chain. Another 10% stake has been given under employee stock ownership plan.

Responding to a query from ET, Dr Sachdev said, “There is no majority deal on the table and the promoters are not divesting any of their shares.”

A ChrysCapital spokesperson declined to comment on the matter, while ET’s queries emailed to Mahindra Partners did not elicit any response.

Centre For Sight is expected to report revenue of Rs 515 crore, with an Ebitda of Rs 105 crore, for 2023-24, said people privy to the information, The company, which had got the stock market regulator’s go-ahead for an initial public offering (IPO) in 2016, dropped its Rs 115-crore IPO plans the next year.

The proposed investment in Centre For Sight will be made from ChrysCapital’s ninth fund worth $1.4 billion, which it raised in 2022, said the people cited earlier.

ChrysCapital has raised more than $5 billion across nine funds since it was founded in 1999 and made about 100 investments across sectors. Its major investments in the pharmaceuticals and healthcare sector include Curatio Healthcare, Aragen Life Sciences (GVK Bio), Torrent Pharmaceuticals, Intas Pharmaceuticals, Mankind Pharma and Eris Lifesciences.

Centre For Sight, founded by Dr Sachdev in 1996, has a network of 75 eye-care centres across regions including Delhi-National Capital Region, Rajasthan, Uttar Pradesh, Madhya Pradesh and Gujarat.

In 2019, Mahindra Partners had invested ‘206 crore (about $30 million) in the company to acquire the minority stake, giving an exit to early investor Matrix Partners, which had invested in 2010.

India’s eye care industry, which treats major diseases such as cataract and glaucoma, is valued at about ‘11,000 crore. However, organised players have less than 10% market share while the rest is held by regional or smaller specialised eye-care hospitals.

About 62 million people in India are estimated to be visually impaired, with 8 million being afflicted with blindness, according to the Lancet Global Health Commission’s report. There is a shortage of ophthalmologists and optometrists in tier-2 and -3 cities, as the country has only an estimated 25,000 ophthalmologists and 45,000 optometrists, as against the required strength of 125,000.

Eye-care chains have been expanding their presence over the past few years, with the backing of PE funds.

Dr Agarwal’s Health Care raised ₹1,700 crore (about $200 million) from US-based fund TPG Growth and Singapore’s Temasek for doubling its network to 300 hospitals in two tranches in 2022 and 2023. ChrysCapital was among the contenders for the stake.

Source: Economic Times