Quadria Capital, the Asia healthcare-focused private equity fund, is in advanced talks to acquire a significant minority stake in India’s largest dialysis chain NephroPlus, valuing the latter at ₹2,000 crore ($250 million), said two sources aware of the development.

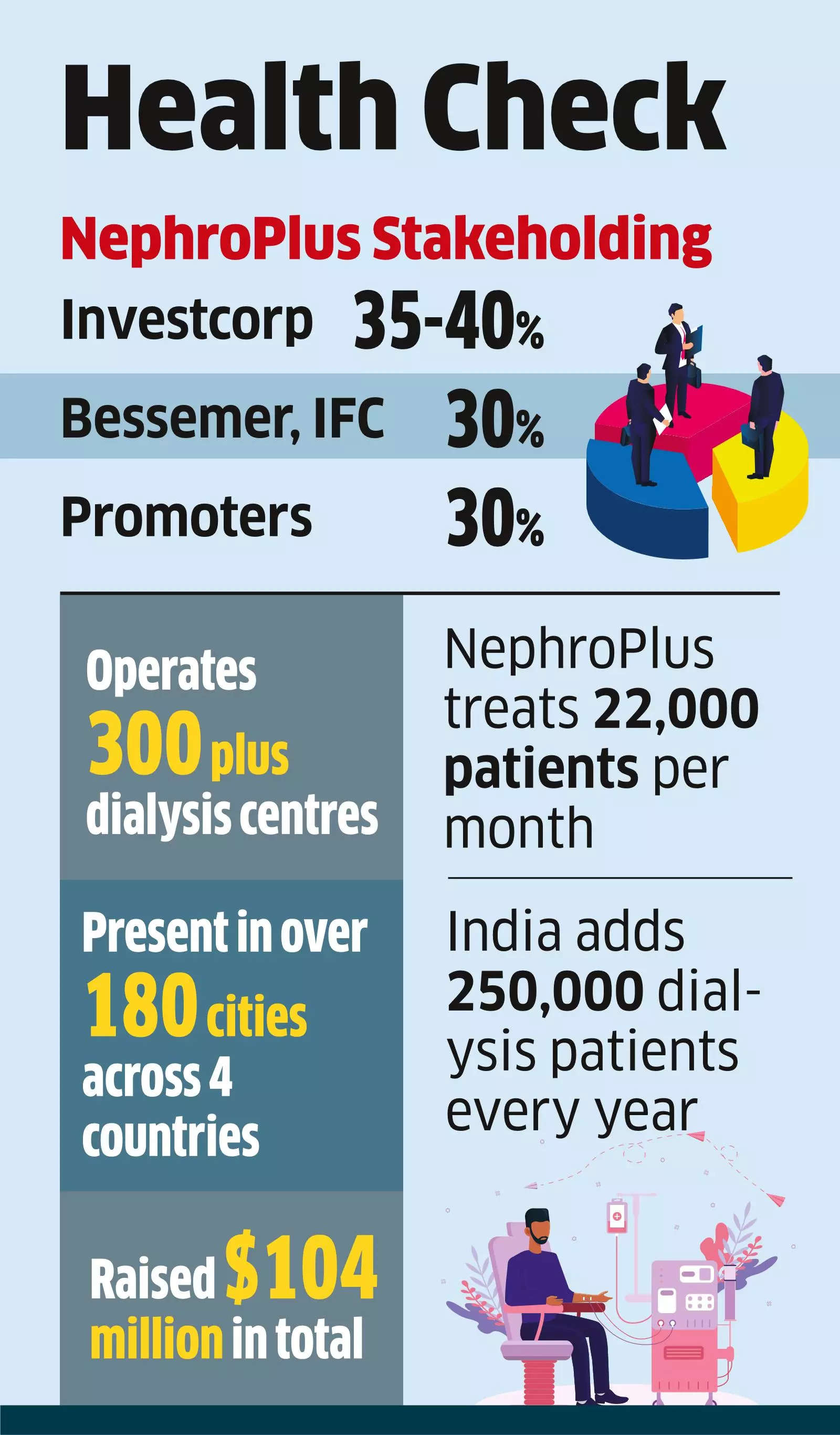

Existing investors – the US-based Bessemer Venture Partners (BVP) and International Finance Corporation (IFC) – will exit fully by selling about 30% stake together, while the largest shareholder Investcorp is likely to sell a small stake in this round, said sources. Investcorp owns about 35-40% stake in NephroPlus. IIFL is another investor with 5-6% stake while promoters hold about 30% stake in NephroPlus.

Founded in 2009 by Vikram Vuppala, Sandeep Gudibanda and Kamal Shah, NephroPlus operates 300 plus dialysis centres in more than 180 cities across four countries. NephroPlus treats 22,000 patients per month and has performed 8 million treatments to date.

Existing investors started exploring their exit from NephroPlus at a valuation of ₹2,000 crore, ET first reported in October.

Mails sent to Vuppala, CEO of NephroPlus, IFC, BVP, and Quadria spokespersons did not elicit any response, while Investcorp spokesperson declined to comment. NephroPlus is expected to have an Ebitda of ₹90-100 crore in FY24, and the company may be valued at 20X Ebitda multiple, said sources.

In 2021, NephroPlus raised $24 million (₹180 crore) as Series E funding round led by IIFL Asset Management (IIFL AMC), along with existing investors Investcorp and BVP. Till date, NephroPlus has raised about $104 million through several rounds.

In January 2023, NephroPlus received about ₹70 crore loan from Asian Development Bank to expand in Uzbekistan. NephroPlus is setting up four dialysis centres as part of a partnership with the ministry of health, the Republic of Uzbekistan, after securing a $100 million contract.

India has the highest numbers of renal failure patients in the world. An estimated 1/11 Indians are likely to be a victim of renal failure, the leading causes of which are said to be diabetes and hypertension. India adds close to 250,000 new patients every year to the pool of people requiring dialysis support due to advanced kidney failure.

There are around seven crore patients suffering from various chronic kidney diseases, but only around 12,881 haemodialysis centres can perform dialysis across the country.

Citing this opportunity, PE/VC investors keep exploring investment opportunities in the kidney-care segment in India.

Last year, TPG Growth & Singapore’s GIC-owned healthcare platform Asia Healthcare Holdings (AHH), had acquired a majority stake in India’s largest hospital network of kidney-care Asian Institute of Nephrology and Urology (AINU), for ₹600 crore.

Recently, Kolkata-based kidney care provider Nephrocare India, raised ₹8 crore in a pre-initial public offering (IPO) round led by HDFC’s Deepak Parekh. The company plans to use the funds to establish 300 comprehensive kidney care clinics across India over the next eight to ten years.

Quadria, which owns assets under management of $3.4 billion, recently invested $155 million in Maxivision Eye Hospital, a private eyecare clinic chain owned by GSK Velu.