Recently, Advent International announced the merger of its privately held pharma company into recently acquired listed pharma company. Advent being one of the largest private equity entities, is the merger move looking for 1+1=11?

COHANCE LIFESCIENCES LIMITED (the “Transferor Company” or “Cohance”) is, inter alia, engaged in the business of: (i) end-to-end contract development and manufacturing of intermediates(CDMO) and active pharmaceutical ingredients (“APIs”) for innovator customers; (ii) manufacturing of intermediates, APIs, finished dosage formulations for pharmaceutical companies; (iii) manufacturing of specialty chemicals, including electronic chemicals; and (iv) undertaking clinical research studies, catering to both domestic and international markets, thereby providing products. Cohance is a private company 100% owned by Advent International and has a registered office in the state of Maharashtra.

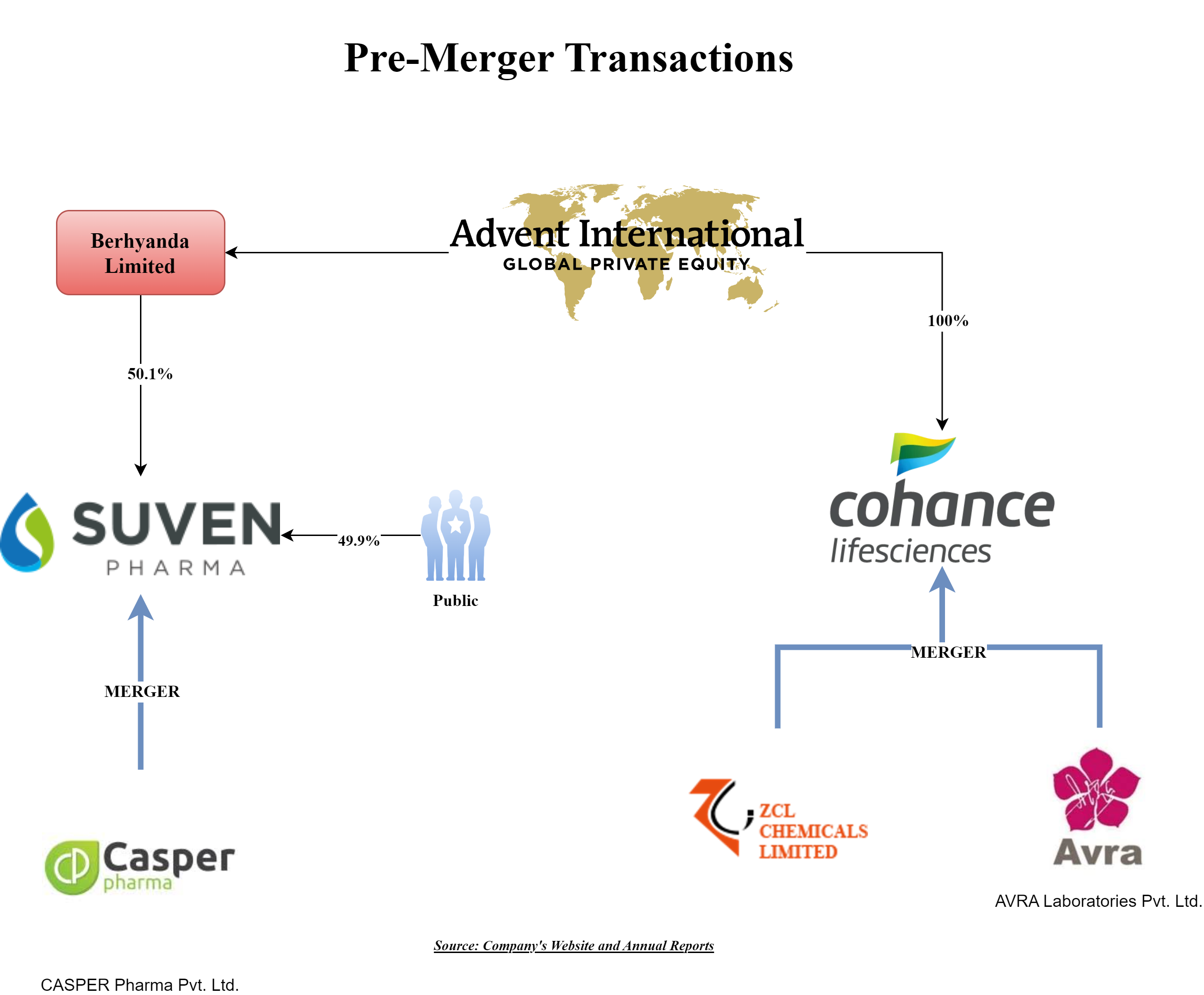

Recently, to combine its private pharma portfolio, Advent merged its other portfolio companies ZCL Chemicals Limited and Avra Laboratories Private Limited into Cohance.

SUVEN PHARMACEUTICALS LIMITED (the “Transferee Company” or “Suven”) is, inter alia, engaged in the business of (i) contract development, manufacturing and manufacturing process development of intermediates for innovator customers; (ii) manufacturing of specialty chemicals including agrochemicals; (iii) manufacturing of APIs and formulations, providing analytical services (including without limitation the assessment of compounds, concentration level etc.) and method development services; and (iv) process improvement services for both pharmaceutical and specialty chemicals companies.

Suven had its registered office in the state of Telangana. In early 2024 (before announcing the scheme), Suven shifted the registered office from the State of Telangana to the State of Maharashtra. The equity shares of Suven are listed on nationwide bourses.

Suven was established in 2020 pursuant to the demerger of CRAMS business from Suven Life Sciences Limited.

The Deal that Initiated Merger:

In 2023, controlling interest in Suven was bought by Advent International in 2023 from then promoters, Jasti family. Advent bought 50.10% equity interest in Suven for a consideration of circa 6313 crores. The deal was completed in September 2023.

At the time of announcement of the acquisition of Suven, Advent announced that they would actively evaluate the possibility of merging Cohance with Suven to build a leading end-to-end CDMO and merchant API player servicing the pharma and specialty chemical markets.

As a first step, in September 2023, Suven appointed Dr. V Prasada Raju as managing director who was also CEO & MD of Cohance.

As a pre-step, Advent initiated the merger of ZCL Chemicals Limited and Avra Laboratories Private Limited (other private companies engaged in the pharma business owned by Advent) into Cohance. Pursuant to the order dated 5 January 2024 passed by the National Company Law Tribunal, Mumbai, with the appointed date of 1 April 2023 ZCL Chemicals Limited and Avra Laboratories Private Limited got merged with Cohance.

After completing the portfolio companies merger & change of registered office of Suven, Advent announced the mega-merger.

Proposed Transaction

The board of directors of Suven & Cohance in their respective board meeting held on 29th February 2024, announced the merger of Cohance with Suven. On the same date, Suven also announced the merger of Casper Pharma Private Limited, a wholly owned subsidiary of Suven with itself. Both mergers will be executed through different schemes.

The rationale as envisaged in the proposed scheme for merger of Cohance:

- The proposed merger will result in creating a diversified contract development and manufacturing organization (“CDMO”) leader from India with 3 (three) engines of growth: (i) pharmaceutical CDMO; (ii) specialty chemical CDMO; and (iii) API (including formulations), providing the ability to drive a relatively steady growth profile for the business.

- The proposed merger will result in Suven having end-to-end capabilities to service the entire lifecycle of a molecule for innovators from clinical development to commercialisation to post genericization for starting materials, intermediates and APIs. There are multiple examples of global contemporaries with similar end-to-end capabilities, business mix and service lines, who have demonstrated scaling up globally.

- The proposed merger will have other benefits such as:

- Scale

- Customer relations & cross-selling

- Access to niche chemistry capabilities

- Access to the best manufacturing facilities

- Apart from the above, there will be multiple revenue & cost synergies on account of the merger.

As per the management, the merger will double the revenue base with a combination of the two platforms. The combined entity will become a leading integrated CDMO player in India and top 10 in Asia with the capacity going from 1,400 KL to combined capacity of 2,650+ KL.

It will also have access to niche chemistry capabilities like ADC or antibody drug conjugates, which can be leveraged to service innovative customers. It will pave the way for leveraging Cohance capabilities to offer to Suven customers and for Suven to offer capabilities of clinical to patent protected pharma CDMO intermediates to Cohance customers is going to play an important role.

The “Appointed Date” for the Cohance merger will be the Effective Date or such other date as may be approved by the Board of Suven & Cohance.

The Capital Structure & Swap Ratio:

As consideration for the merger, Suven will issue 11 equity shares of INR 1 each for every 295 equity shares of INR 10 each of Cohance.

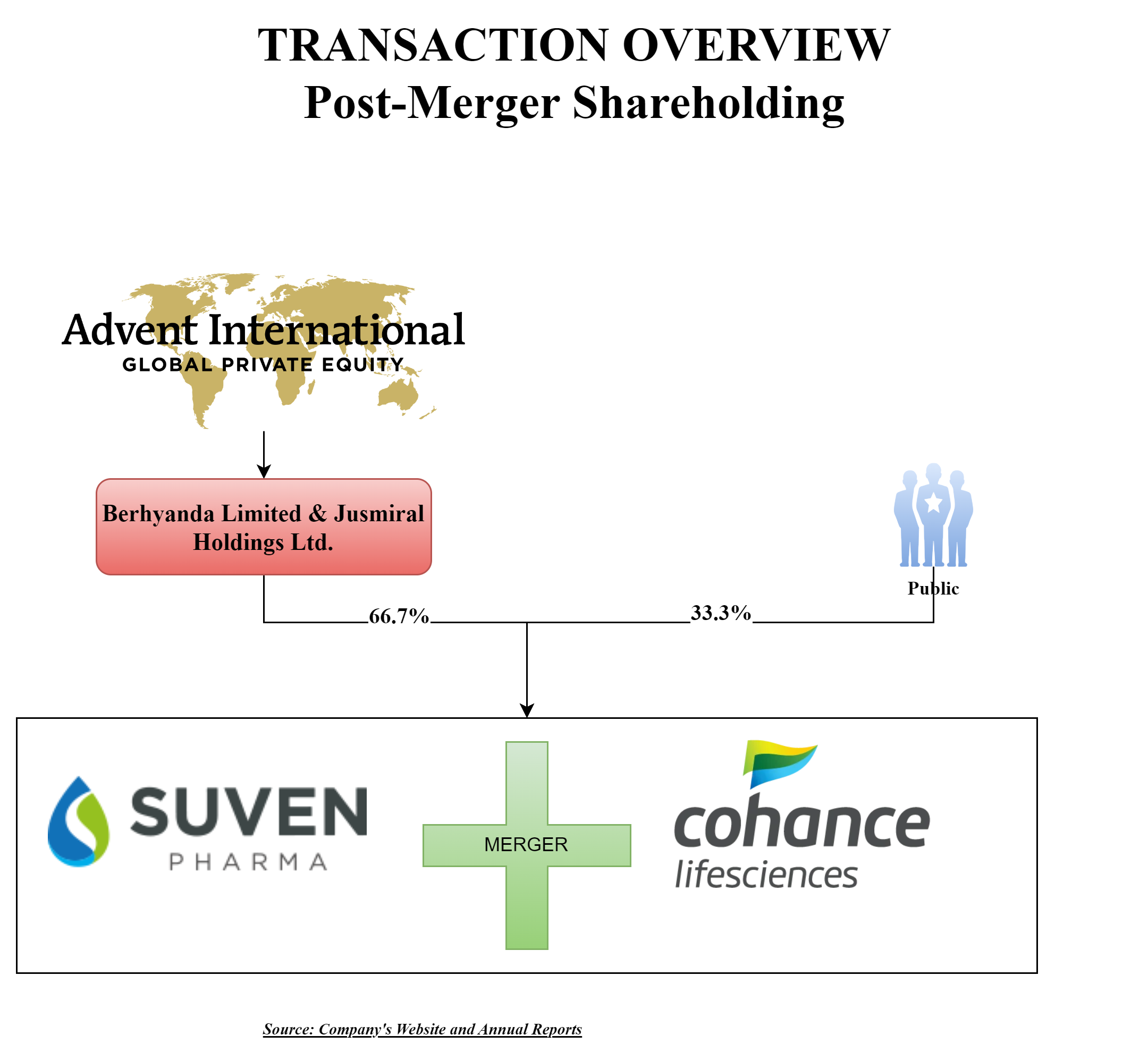

Currently, Suven is co-promoted by the Jasti family (9.90%) & Advent International (50.10%) with control with Advent. Post-merger, the Jasti family holding in the merged entity will be 6.61% and they will be classified as public shareholders.

| Particulars | Cohance | Suven-Pre | Suven-post |

| No. of Paid-up share | 339, 46,62,519 | 25,45,64,956 | 38,11,45,592 |

| Face Value | 10 | 1 | 1 |

| Advent Stake | ~100% | 50.1% | 66.66% |

Currently, Cohance has significantly higher capital than Suven. Rather, Suven’s capital is less than 1% paid-up capital of Cohance. Post-merger, the capital of merged entity will likely to commensurate with the size of the merged entity.

As the face value of Cohance & Suven is different, the scheme also provides that post-merger authorised share capital of Cohance shall be reclassified and re-organized such that each equity share of Cohance of INR 10 each shall be reclassified and reorganized as 10 (Ten) equity shares of INR 1 (Indian Rupees One) for revised authorised capital of the merged entity.

Accounting Treatment

As both Cohance & Suven is being controlled by Advent, the merger will be recorded in its books of accounts of Suven as per the ‘Pooling of Interest Method’ in accordance with accounting principles as laid down in Appendix C the Indian Accounting Standard 103 (Business Combinations), notified under Section 133 of the Act read with Companies (Indian Accounting Standards) Rules, 2015, as may be amended from time to time.

Other clauses

The scheme provides for name change of the merged entity to “Cohance Lifesciences Limited”. Though the merger seems to be the merger of equals, the key reasons for opting of Suven being a Transferee company (other than commercials) could be:

- Suven is already listed.

- Right sizing the capital of merged entity (Cohance has significantly high capital).

- Suven has a higher assigned valuation (which may also result is saving transaction cost such as stamp duty).

Financials

Although, the merger is of equals, Suven has better margins & return on capital employed. The merged entity will have reduced margins than the existing margins of Suven, however, one may expect synergies to kick in which improves the overall performance.

As informed by the management, the transaction is likely to be double-digit EPS accretive to Suven shareholders within the very first year of the implementation of the scheme.

Valuation

Advent International bought controlling stake in RA Chem Pharma Limited through AI Pharmed Consultancy India Private Limited from Micro Labs Limited. In 2022, Cohance was formed on account of merger of RA Chem Pharma Limited with AI Pharmed Consultancy India Private Limited.

Meanwhile, Advent International also bought ZCL Chemicals Limited and Avra Laboratories Private Limited in 2021 & 2022 respectively. ZCL was 100% Export Oriented Unit engaged in the manufacturing and export of advanced drug intermediates and API’s focusing on the niche therapeutic areas of Central Nervous Systems while Avra was a manufacturer of intermediates and API’s focusing on various therapeutic like cancer, anti-ulcer, anti-thrombotic, etc.

In early 2024, the order of merger of ZCL & Avra with Cohance came and got merged.

Valuation at which Advent Acquired various entities as per media reports:

| Particulars | Tentative Valuation (INR in Crore) |

| RA Chem Pharma Limited | 1090 |

| ZCL Chemicals Limited | 2000 |

| Avra Laboratories Private Limited | 800 |

| Total | 3890 |

The merger deal assigns Cohance a cumulative valuation of circa INR 8500 crore which already provides more than 2X gain for Advent International. Let us check the financial improvement for RA Chem, ZCL and Avra.

Financials for the year immediately prior to acquisition:

INR in Crore

| Particulars | RA Chem for FY 2020 | ZCL for FY 2021 | Avra for FY 2022 | Total |

| Revenue | 541 | 329 | 168 | 1038 |

| EBITDA | 145 | 127 | 44 | 316 |

| EBITDA % | 26.8% | 38.60% | 26.3% | 30.4% |

| PAT | 82 | 105 | 25 | 212 |

| Capital Employed | 423 | 572 | 234 | 1229 |

| RoCE | 30% | 19.8% | 14.5% | 22.28% |

Cohance (being merged entity of RA Chem, ZCL & Avra) has achieved revenue of INR 1337 crore for FY 2023 with combined EBITDA margin of 31.5%. However, the RoCE has improved to 34%. On account of the above improvements, the valuation has increased by more than 2X.

Conclusion

Advent International’s move to merge Cohance with Suven is aiming to make 1+1>2. Advent had mentioned its intention to merger Cohance with Suven at the time of the acquisition of Suven only. Bain a private equity player, Advent will be looking to create a bigger entity with improved efficiencies which will pave the way for them to get handsome return when they will exit in future.

It is interesting to note the chronology of various acquisitions made by Advent International and creating a larger basket by merging with Cohance just to make ready for merging with Suven. The move has already marked for potential 2x on its initial investment in various companies’ part of the transaction.