Global private equity funds General Atlantic, TPG Capital, Warburg Pincus and Ontario Teachers’ Pension Plan are in contention for acquiring a majority stake in Altimetrik at a valuation of about $1.5 billion (Rs 12,500 crore), said people aware of the development.

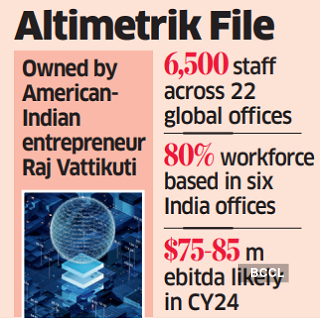

The Michigan-based pure-play digital services company, owned by American-Indian entrepreneur Raj Vattikuti, is being advised by Jefferies on the stake sale.

The promoters plan to offload about 60% in Altimetrik for $900 million (Rs 7,500 crore), the people cited said. Final bids are expected by the first week of June.

Altimetrik has offices in over 20 locations, six of them in India, with more than 80% of its workforce based in the country. The company has a team of over 6,000 digital practitioners.

It has a global client base engaged in the BFSI, fintech, automotive, manufacturing, retail, pharmaceutical and life science sectors. They include Citi, Morgan Stanley, Novartis, Sony, Schindler and Samsung. In India, the company has offices in Pune, Chennai, Bengaluru, Hyderabad, Jaipur and Gurgaon.

Altimetrik, General Atlantic, Warburg Pincus, OTPP and Jefferies did not immediately respond to queries. A TPG spokesperson declined to comment.

The company’s digital business methodology provides a blueprint to develop, scale and launch new products faster. It is likely to post an Ebitda of $75-85 million in CY24, said people cited above.

In 2007, Vattikuti sold his US-based consulting and technology services company Covansys to Computer Sciences Corp (now DXC Technology) for $1.3 billion. That company has 12 sites in seven cities in India with more than 43,000 employees.

Set up in 2012

Vattikuti set up Altimetrik in 2012 with a focus on data and digital engineering solutions. He also owns VC firm Vattikuti Ventures and financial services and micro-credit startup Davinta Technologies. He founded IT staffing company CBSI India (formerly Synova), which was acquired by HR platform First Meridian, backed by investors Goldman Sachs, Samara Capital, in 2020.

The information technology (IT) and IT enabled services (ITeS) space has seen big-ticket private equity transactions such as Carlyle’s $3 billion acquisition of IT services firm Hexaware in 2021, the $800 million buyout of IGT Solutions by EQT and a $960 million investment in CitiusTech by Bain Capital in 2022.

IT services sector a big draw

About 10 PE funds held majority investments in the IT services sector between 2008 and 2013. This has jumped to over 50 funds with majority stakes in IT services (2018-2023), Shobhit Jain, MD and co-head of enterprise technology and services for investment banking, Avendus Capital, told ET in March.

The total value held by PE firms in the sector has quadrupled, from $13 billion in 2013 to $55 billion now, he added.

In 2023, Warburg Pincus acquired a significant stake in Everise, a Delaware-registered outsourcing company, from its existing investor Brookfield, valuing the company at around $1 billion.

Last year, homegrown PE fund ChrysCapital had acquired Xoriant, a software engineering and digital IT services provider, for $250 million. California-based Xoriant provides services and solutions focused on digital product engineering and cloud infrastructure. ChrysCapital plans to sell its Los Angeles-based healthcare BPO firm GeBBS Healthcare Solutions at a valuation of $800 million-$1 billion and has hired Jefferies to run the sale process, according to people with knowledge of the matter.

Source: Economic Times