State Bank of India has granted its consent to Vedanta’s proposed demerger that will separate its existing businesses into six independent pure-play companies, two bankers aware of the development said.

This crucial approval from the state-run lender is seen as the last major compliance requirement for the company, which was keenly watched by the market and paves the way for the $20 billion demerger.

“With the nod by SBI, a majority of lenders have given the go-ahead for the demerger, and a few remaining ones are likely to follow in the next few weeks,” said the first person cited above.

Last September, India’s largest diversified natural resources company announced plans to separate its six core businesses. The demerger will create independent companies housing the aluminium, oil & gas, power, steel and ferrous materials, and base metals businesses, while the existing zinc and new incubated businesses will remain under Vedanta.

The demerger is planned to be a simple vertical split with Vedanta shareholders getting one share of each of the five newly listed firms for every share they hold in Vedanta.

Both Vedanta and SBI did not respond to ET’s queries.

Last month, chairman Anil Aggarwal said in a letter to stakeholders that the demerger of five of its key businesses will be completed by December 2024.

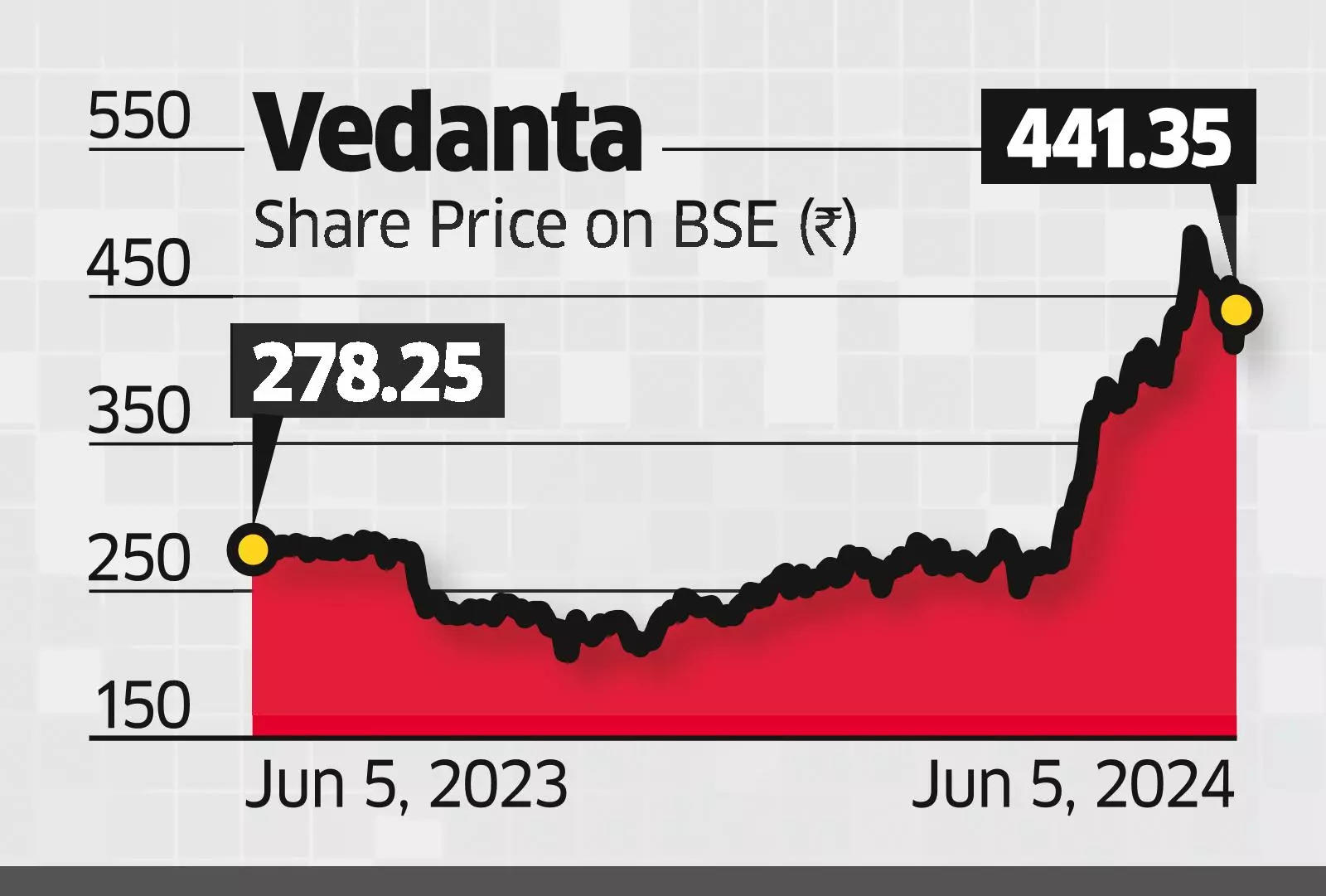

Shares of Vedanta have rallied 82% in the last six months outperforming a 7.34% gain in the benchmark Sensex.

Vedanta’s existing debt will be allocated in the same ratio of the separation of assets among the six different demerged entities. The demerger is expected to create more headroom for demerged businesses.

“Distinct businesses with their core competencies have a better ability to manoeuvre market cycles, which is crucial in the mining and commodities business,” said the person cited above. “Banks are now satisfied that the demerger will provide the demerged units greater capacity to finance growth and an ability to invest and grow independently,” he said.

Vedanta’s lenders include state-owned lenders like SBI, Bank of Baroda, Punjab National Bank, and private banks like ICICI Bank, Axis Bank, IDFC First Bank, and Kotak Mahindra Bank.

SBI’s greenlight to the demerger comes at a time when Vedanta has shown progress in deleveraging. In the March 2024 quarter, the company trimmed its net debt by ₹6,155 crore to ₹56,388 crore, primarily helped by robust cash flows from operations and improved working capital.

Taking note, credit rating agencies have assigned stronger credit ratings to the company and its debt instruments. ICRA assigned an A1+ rating to Vedanta’s ₹2,500 crore commercial paper on May 30. Similarly, CRISIL and India Ratings have assigned long-term ratings of AA- and A+ and short-term ratings of A1+ and A1 on Vedanta, respectively.

Source: Economic Times