Ending years of protracted negotiations, IHH Healthcare-backed Fortis Healthcare is set to acquire the stake of private equity firms in its own diagnostics arm Agilus Diagnostics (formerly SRL), according to sources in the know.

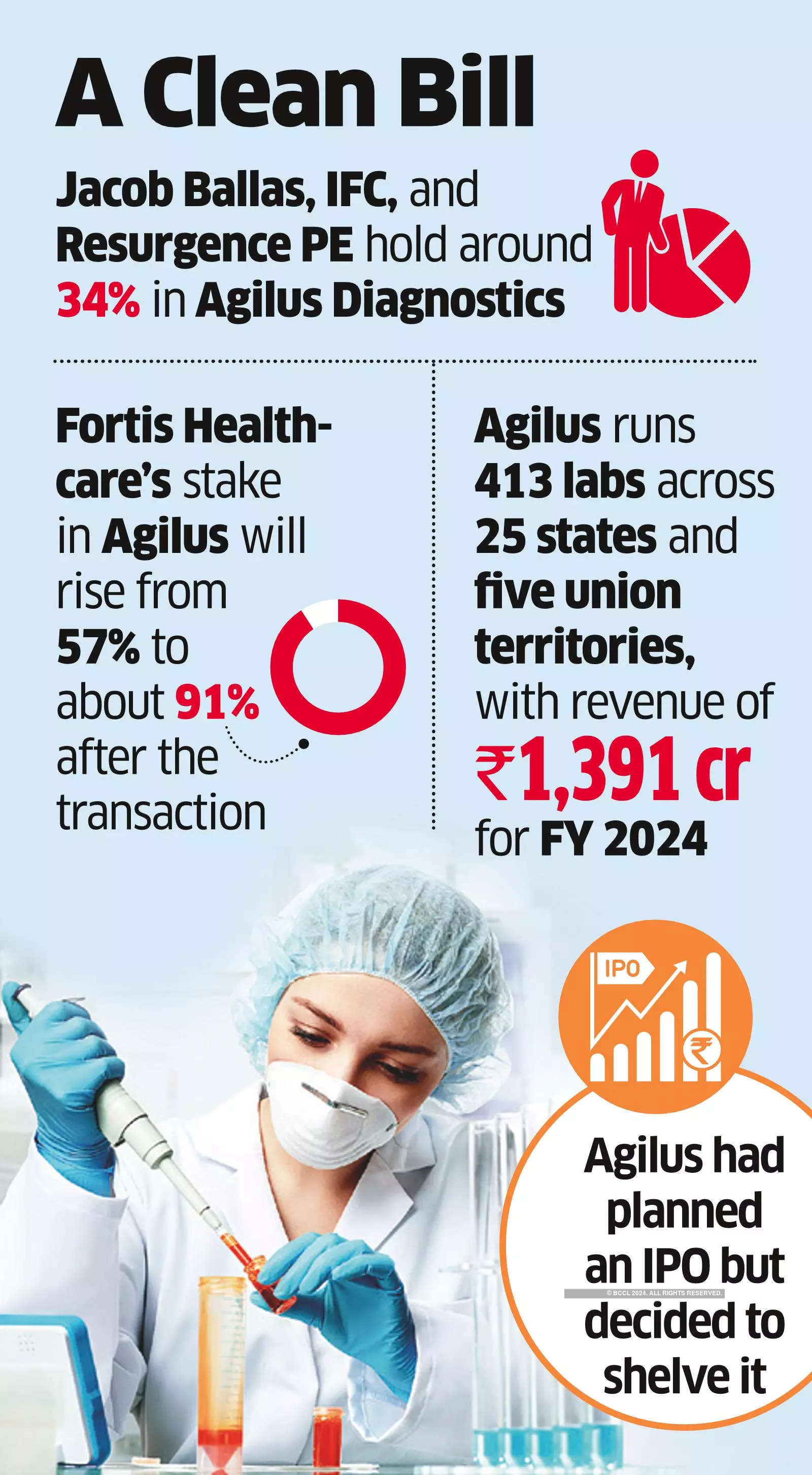

Jacob Ballas and International Finance Corporation (IFC), who along with Resurgence PE own around 34% stake in the diagnostics company, are selling their stake and exercising a put option.

The deal will peg the valuation of Agilus at around ₹5,000 crore, the people cited earlier said.

Fortis Healthcare informed in a late afternoon stock exchange filing that Jacob Ballas had expressed its intent to exercise its put option.

“The company has received a letter in respect of the exercise of put option right by NYLIM Jacob Ballas India Fund III, LLC (one of the PE investors) for 1.24 crore (12.4 million) equity shares equivalent to 15.86% equity stake held by them in Agilus for Rs 905 crore,” the Fortis statement said.

However, the other investors are expected to exercise their respective put options by early next week, according to sources. This will result in Fortis Healthcare consolidating its holding in the diagnostics company from its present stake of about 57% to about 91%. The remaining shares in Agilus are held by individual investors.

ET first reported the latest developments in its online edition on Thursday.

Fortis’ majority shareholder IHH Healthcare had earlier tried to help the private equity investors get an exit by mandating Kotak Mahindra Capital to find a buyer for their stake. However, that transaction did not proceed as planned.

Fortis Healthcare and IFC had not responded to ET’s queries as of press time. Jacob Ballas refused to comment. Resurgence PE investments could not be contacted.

Agilus now has 413 laboratories and is present in 25 states and five union territories. It has five regional reference laboratories in Gurugram, Bengaluru, Chennai, Kolkata and Cochin.

As per its latest available financials audited by KPMG’s local audit arm BSR & Co, Agilus had revenue of Rs 1,391 crore for the year ended March 31, 2024.

The company has not been able to deepen its national presence as much as it intended to as the private equity investors were not willing to put more capital to work.

Agilus also had plans for an initial public offering but shelved those.

The company expanded its national presence by acquiring Kerala-based DDRC in 2021-22.

“After the acquisition of the entire stake in DDRC (major south India diagnostics player) in fiscal 2022, geographical diversity improved with the share of south India at 28% in fiscal 2023 against 10% in fiscal 2021,” ratings agency Crisil said in a note in July last year.

Crisil cautioned in its note that the diagnostics segment was facing increased competition from new-age online players, especially in the wellness segment, which can impact margin.

“However, Agilus has a healthy B2B (business-to-business) share of 46% and greater presence in the complex test segment compared with online players. Hence, margin is expected to remain stable over the medium term,” said Crisil.