The promoters of the Jubilant Bhartia Group have emerged as frontrunners for a stake in Coca-Cola’s India bottling arm, bettering an offer by the Burmans of Dabur, as they amp up their bet on the country’s evolving consumption patterns and rising disposable income, said people with knowledge of the matter. Brothers Shyam and Hari Bhartia are the promoters of the diversified pizza-to-pharmaceuticals group.

They recently signed an exclusivity agreement with Coca-Cola to negotiate the purchase of a significant minority stake of up to 40% in Hindustan Coca-Cola Beverages (HCCB) for Rs 10,800-12,000 crore ($1.3-1.4 billion), as the Atlanta-based beverage company looks to replicate the “asset-light” value unlocking initiative by rival Pepsico, said the people cited above. Coca-Cola plans to list HCCB and this is seen as a precursor to that, aiding in price discovery.

PepsiCo has outsourced its bottling operations to billionaire entrepreneur Ravi Jaipuria-owned Varun Beverages, which has nearly quadrupled in value since May 2022.

Bhartias uncapped better terms

ET was first to report September 4 that the Bhartias and the Burmans had made firm offers after months of diligence, valuing the wholly owned Coca-Cola subsidiary at ₹27,000-30,000 crore ($3.21-3.61 billion). The final bids were submitted in London earlier this month.

Coca-Cola, the Bhartias, and the Burman family office didn’t respond to queries. The Bhartias are said to have offered better terms to Coca-Cola. If the two sides fail to agree on a sale within the stipulated timeline, talks can be extended or negotiations can be started with other parties. Coca-Cola has been working for months with its advisor Rothschild on finding a buyer.

“These final negotiations will unfold the granular details of the potential deal — the deal structure, terms and other commercial details,” said one of the executives cited. “Coke has been insisting on ‘generational capital,’ which is why predominantly family offices and not PE funds were tapped. They are looking at a long-term partnership before listing the business.”

Several family offices including those of Sunil Bharti Mittal, Azim Premji, Shiv Nadar and the Parekh family of Pidilite as well as the promoters of Asian Paints were tapped. Eventually only two submitted binding offers.

The Bhartias are expected to route the investment through their family office and not through the quick service restaurant chains it operates, since that would necessitate involving their global head offices, the executive said.

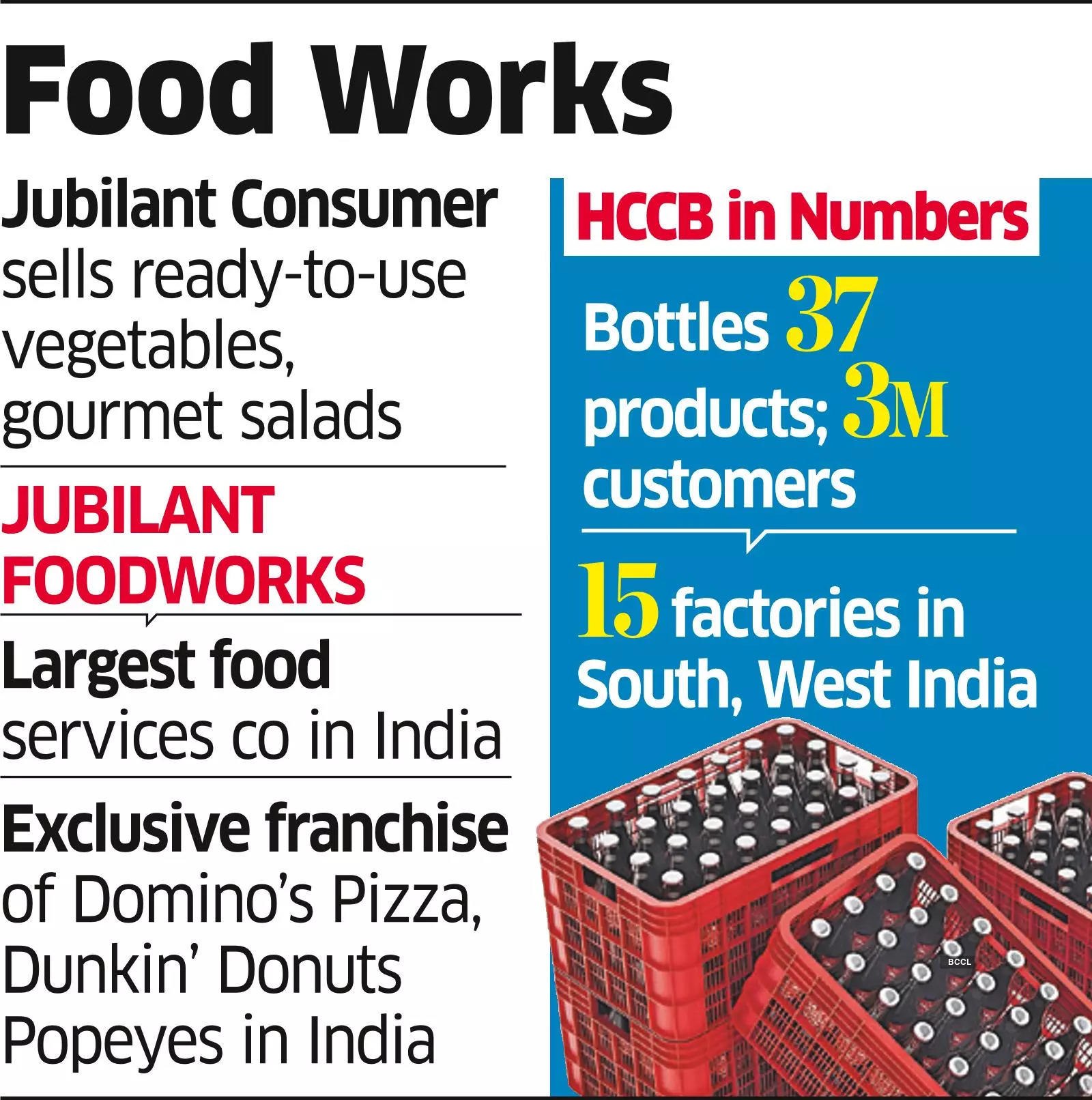

Jubilant Foodworks Ltd (JFL), India’s largest food services company, owns the exclusive franchise for Domino’s Pizza, Dunkin’ Donuts and Popeyes in India. Additionally, the company is Domino’s franchisee in five other markets in Asia and has acquired Coffy, a leading coffee retailer in Türkiye. In 2019, JFL ventured into the Chinese fast casual segment with its own brand Hong’s Kitchen.

Apart from food, the group has interests in pharmaceuticals, contract research and development, agri products, performance polymers and oilfield services. The Bhartias also invest in their personal capacity.

According to information on its website, the Jubilant Bhartia Group has four key companies — Jubilant Pharmova, Jubilant Ingrevia, Jubilant FoodWorks and Jubilant Industries.

HCCB runs bottling operations in the south and west of India, and has 16 factories that cater to 2.5 million retailers in 12 states via 3,500 distributors in 236 districts. Through these units, it manufactures and sells 37 different products in eight categories.

In January, Coca-Cola announced it was making “strategic business transfers in India” by selling off company-owned bottling operations in some regions—Rajasthan, Bihar, the Northeast and select areas of West Bengal—to local partners for a net gain of ₹2,420 crore ($290 million). After the divestment, Coca-Cola’s bottling operations have been split evenly between HCCB and half a dozen franchisees that manufacture and distribute fizzy drinks Coke, Thums Up and Sprite, juices Minute Maid and Maaza, as well as Kinley water. India is among the top five volume growth markets for the beverage giant.

But unlike FMCG categories such as tea, soap, toothpaste or biscuits—that are much larger in sales volume—packaged beverages are among the lowest penetrated categories in India, according to industry executives and, therefore, have a substantial growth runway as discretionary income rises. That’s the reason Coca-Cola has been expecting a significant premium for HCCB, pegging the value at $4-5 billion, said people with knowledge of the matter.

In its last published annual report of FY23, HCCB highlighted the changing dynamics and said it’s looking to emerge as a “total beverage company”. The structural drivers of long-term growth like rising disposable incomes and consumer awareness, low levels of penetration of consumer goods, favourable demographics, increasing urbanisation and growing preference for trusted brands are firmly in place.

HCCB said it “will continue to focus on the new opportunities like E-Commerce, Grocery, Pharmacy etc. to grow organically and inorganically.”

To expand its footprint and cater to consumers into entry pack segments like 150 ml Tetra, 200 ml returnable glass bottles (RGB) as well as 250 ml PET, HCCB expanded footprints by strategic investments in this segment through new lines, glass bottles as well as market execution.

Even when mainline FMCG categories have seen demand cooling off due to sluggish income growth in the mass segments, inflation and reduced pricing-led growth combined with heightened competition from regional and D2C brands, soft drinks have bucked the slowdown trend, say multiple reports. Global research firm Kantar said in its FMCG pulse report released this June, that the average Indian household’s consumption of bottled soft drinks has breached an annual penetration of 50% in financial year 2023-24.