Sunil Mittal-led Bharti Airtel is in advanced negotiations with the Tata Group to buy loss-making Tata Play, India’s largest direct-to-home (DTH) business, said people aware of the matter. The aim is to consolidate its presence in the digital TV segment that’s facing growth challenges while improving Airtel’s bundled offerings to shore up its non-mobile revenues through convergence.

If a sale happens, it will mark Tata’s departure from its sub-scale content and entertainment operations. It will also be the second time that the two business groups strike a deal, after Bharti bought out Tata’s bleeding and leveraged consumer mobility business in 2017 and absorbed it two years later. That was Tata Sons’ chairman N Chandrasekaran’s first divestment after taking charge of the group holding company.

Tier 1 and tier 2 users are upgrading to over-the-top (OTT) packs on home broadband instead of DTH and cutting the cord to migrate to cheaper online alternatives while rural subscribers are increasingly opting for Doordarshan’s Free Dish.

The talks, ongoing for weeks, have gathered momentum and a formal announcement is expected soon, said the people cited above. Tata Sons did not comment.

“The group had bet on the growth of Tata Play and seen strategic value in it until the dynamics of the market changed,” said an executive close to the development. “The group has been clear that in any market, it has to be in a position of strength and scale. That did not seem to happen as hoped with Tata Play. On the other hand, Tata Play fits well in the strategic plans of Airtel and its portfolio of offerings to consumers.”

Mails to Airtel remained unanswered till press time Monday.

Tata Sons, the holding company of the diversified conglomerate, currently owns 70% of the company, after having bought out Singapore investment firm Temasek Holding Pte’s 10% stake in April for ₹835 crore ($100 million), valuing the company at $1 billion, down a third from its $3 billion pre-pandemic valuation.

Walt Disney owns 30% of Tata Play but has been looking to exit the TV distribution business after pruning its portfolio and merging its media operations with Reliance Jio in India. Disney inherited Sky’s legacy stake in Tata Play, after its 2019 mega-merger with Rupert Murdoch’s 21st Century Fox. Prior to buying out Temasek, Tata had also acquired Tata Opportunities Fund’s minority stake in the venture.

Airtel is expected to buy Tata Play at a valuation similar to that of the Temasek deal, said the people cited above. The plan had been to consolidate the Tata stakes and list the company, with IPO documents being filed in 2022. However, Tata put the listing plan exercise on hold in August.

TUNING IN

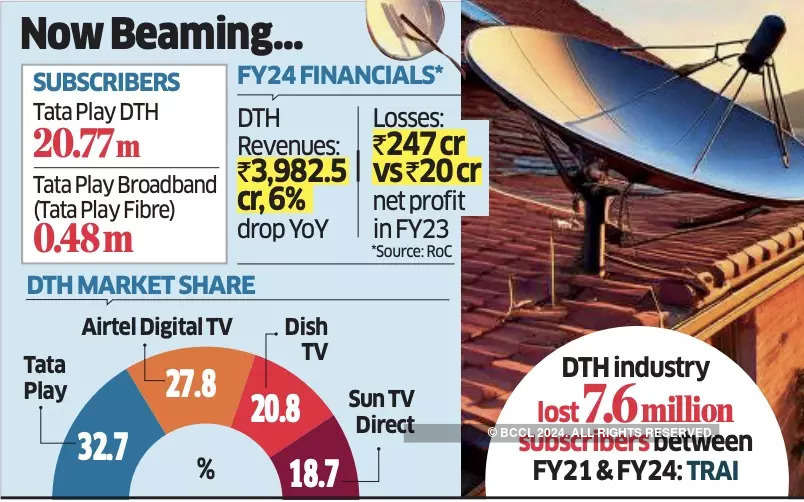

Tata Sky, which began content distribution in 2006, five years after getting incorporated, has 20.77 million subscribers, according to March Telecom Regulatory Authority of India (Trai) data, translating to a 32.7% market share. Bharti Telemedia, which offers Airtel Digital TV, is second with a market share of 27.8%. The business has been adding subscribers for the last three consecutive quarters, the management disclosed when announcing Airtel’s June quarter results. Net additions in the quarter amounted to 190,000, bucking the trend.

Cash-strapped Dish TV, with 20.8% market share, and Sun TV Direct with 18.7% share are the other two players. Tata Play Broadband, which provides service under the Tata Play Fibre brand, has 480,000 subscribers.

Airtel DTH is predominantly focused in three key pockets—the south, Maharashtra and West Bengal.

Analysts said the move, if successful, will help Airtel take on Jio’s aggressive offerings, while offsetting the vulnerability associated with a standalone player like Tata Play. “The whole strategy for telcos has been to enter one’s home and start offering bundled services, wireless or fibre broadband, DTH, internet of things. Once you have locked in a family, you can even offer content for free,” said an analyst. “Jio has strengthened its content play after the Disney (Star) deal and already has distribution. Now Airtel too gets a customer base and access to a premium set of subscribers.”

The key will be valuation, he said. With DTH in the doldrums globally, Airtel should get a discount. “Tata Play’s efforts to ramp up its broadband offerings have also been muted,” he said. “It needs huge capital commitments.”

The company’s consolidated net loss widened to ₹353.8 crore in FY24 from ₹105.25 crore the previous year, according to Registrar of Companies filings. The standalone DTH business also slipped into the red, with a loss of ₹247 crore against a net profit of ₹20 crore in FY23. Revenue from the DTH segment dropped 6.1% to ₹3,982.57 crore from ₹4,240.04 crore in FY23.

In comparison, Airtel Digital TV’s net loss narrowed to ₹76 crore in FY24 from ₹349 crore, with revenue rising slightly to ₹3,045 crore from ₹2,949 crore.

“In the DTH business, the company simplified content choices for customers to choose from just three plans, which drove outperformance versus industry with healthy net customer additions,” said Balaji Subramanian of IIFL Securities.

READING THE SIGNALS

Talks of an inevitable consolidation in the pay TV industry intensified after the merger of Disney’s Star and Reliance-owned Viacom18, which will give the new entity significant bargaining power with both operators and advertisers.

A major obstacle to M&As in the DTH industry has been the pending licence fees that DTH operators owe. The matter is in the Supreme Court, but all operators are making provisions for payments. Bharti Telemedia, as per its regulatory filings, potentially faces a liability of Rs 5,580 crore related to disputed licence fees, with provisions of Rs 3,426 crore as of March 31, though the company does not expect having to make an immediate payout. Similarly, Tata Play has received demand notices totalling Rs 3,628 crore, including Rs 1,401.66 crore in interest. This will also potentially influence the final valuation figure.

Another operational roadblock arises out of the different satellites used by operators. For instance, Airtel uses the SES satellite, while Tata Play uses GSAT. Switching between these is expensive and can lead to customer churn, making it harder to realise cost synergies. Dish TV, which merged with Videocon d2h, faced this issue when both services continued using different satellites.