The Ahmedabad bench of the National Company Law Tribunal approved the ICICI Bank’s application for the scheme of arrangement for delisting of broking firm ICICI Securities Ltd from the bourses.

On Wednesday the bench presided by a judicial member Shammi Khan while approving the scheme in an oral order, also dismissed two applications that objected to the delisting scheme. The detailed order was not uploaded till the time of filing the story.

Earlier on August 21, the NCLT Mumbai had also allowed an application filed by ICICI Securities Ltd for a scheme of arrangement.

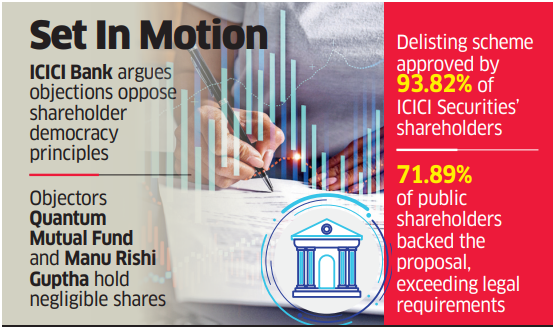

Before that, challenging the objections ICICI Bank argued that the two applications filed against the brokerage house’s proposed delisting are opposed to the established principle of shareholder democracy and has sought to dismiss the same.

The bank also argued that under Section 230 (4) of the Companies Act, only shareholders holding a minimum of 10% of the total shareholding of the company are eligible to object to a scheme of arrangement. The bank further argued that two objectors Quantum Mufutal Fund and an investor Manu Rishi Guptha hold 7,41,488 shares (0.010%) and 200 shares (0.0000% negligible shareholding) respectively in the bank.

In two separate applications, Quantum Mutual Fund and an investor Manu Rishi Guptha have objected to the proposed delisting of ICICI Securities with the arguments that the swap adversely affects minority shareholders. Quantum Mutual Fund and Manu Rishi Guptha hold 0.08% and 0.002% of the paid-up equity share capital of ICICI Securities respectively.

The country’s second-largest private-sector lender in its reply to the objection applications argued that none of the objections raised by the objectors have any relevance vis-a-vis shareholders of the ICICI Bank.

“The contentions raised by the objectors in the applications are similar to the contentions raised by the objectors before Mumbai NCLT,” argued ICICI Bank through its counsels.

In the matter, Sandeep Singhi, senior partner of the law firm Singhi & Co. Advocates is advising ICICI Bank.

Before the tribunal’s approval in August, the delisting proposal was approved by 93.82% in value of the equity shareholders of ICICI Securities. Further, 71.89% in value of the public shareholders also approved it which is well above the requisite threshold under applicable law.