A bankruptcy court in Mumbai has rejected an insolvency application filed against Shapoorji Pallonji & Co by an operational creditor.

The Mumbai bench of the National Company Law Tribunal (NCLT) said the Insolvency & Bankruptcy Code (IBC) cannot be used as a recovery mechanism or as a substitute for debt enforcement procedures.

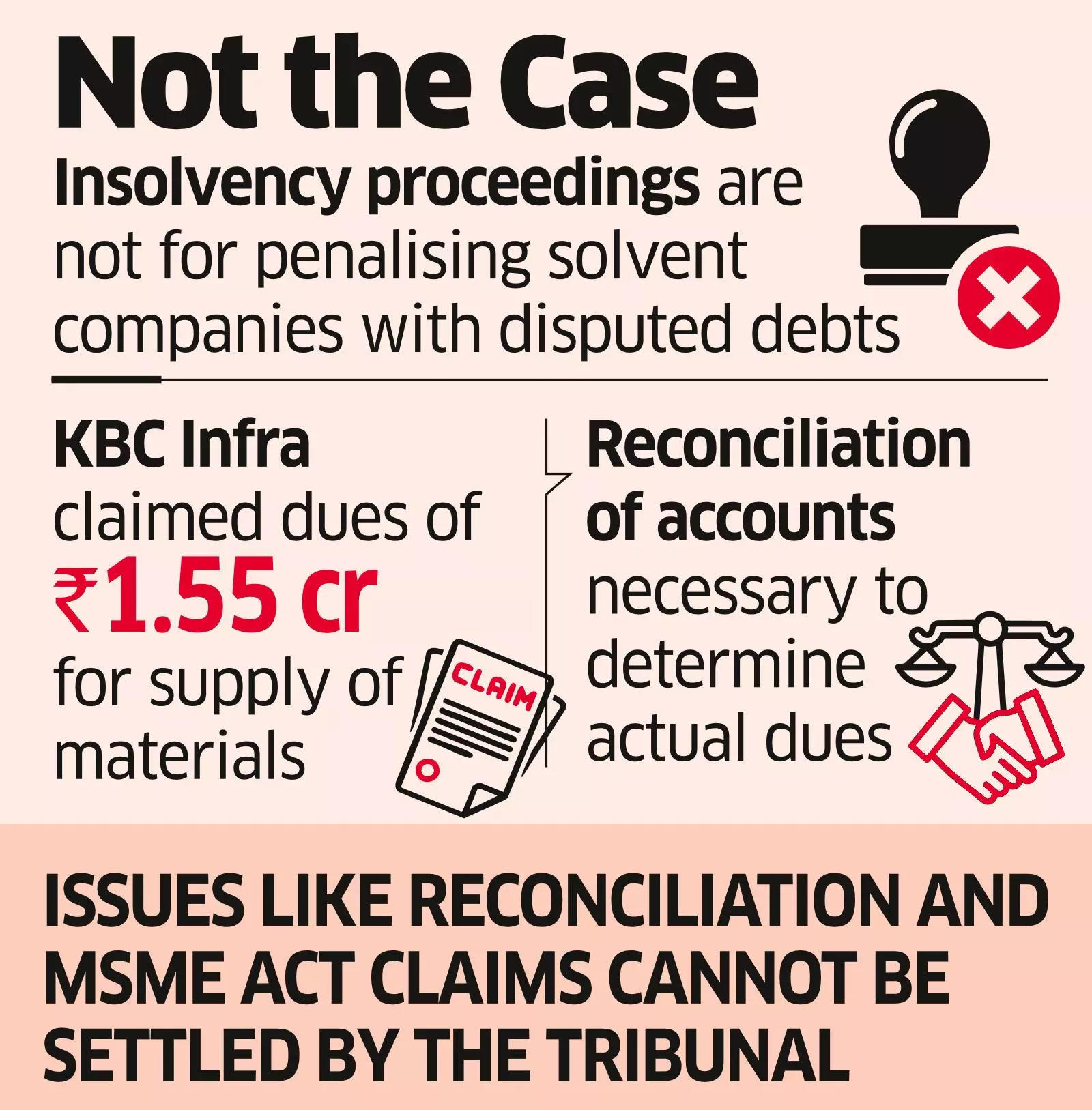

The tribunal said that it is not a debt collection forum and that it is not the objective of the code that bankruptcy proceedings be initiated to penalise solvent companies for non-payment of disputed dues claimed by an operational creditor.

“It clearly emerges that the operational creditor has failed to establish the existence of a crystallised and undisputed operational debt exceeding the prescribed threshold limit under Section 4 of the Code due and payable by the Corporate Debtor (Shapoorji Pallonji & Co),” said a division bench of judicial member KR Saji Kumar and a technical member Sanjiv Dutt in its October 22 order.

In a case dating back five years, Shapoorji Pallonji And Company’s operational creditor KBC Infrastructure had approached the tribunal for alleged failure to pay for supplies of crusher aggregates and ready-mix concrete.

On September 9, the supplier had filed its application in NCLT for the default of about Rs 1.55 crore.

Challenging this application, the engineering conglomerate argued that substantial business transactions had occurred between both parties since FY2017. The case was filed in 2019.

“In view of large and voluminous dealings between the parties since 2016-17, reconciliation of accounts is necessary to accurately ascertain the exact amount owed by the corporate debtor (Shapoorji Pallonji And Company) to the operational creditor (KBC Infrastructure),” argued the engineering-to-realty conglomerate.

Shapoorji Pallonji And Company further argued that no reconciliation of accounts has ever been undertaken between the parties and various payments and adjustments have not been credited to it as admitted by its supplier.

According to Ashish Pyasi, Partner at law firm Aendri Legal, this judgment reconfirms that the NCLT cannot be used as a recovery forum. “Also, issues like reconciliation of accounts and the claims of interest under MSME Act cannot be resolved before the adjudicating authority and these issues amount to a dispute which renders the petition fit for dismissal,” said Pyasi.

On a different context, Dhiraj Mhetre, Partner, Khaitan Legal Associates said the Corporate Debtor is a solvent company with a strong market reputation, indicating that the efficiency of the company is evident from its standing.

“Filing a petition under the IBC against such a company appears to be a mere pressure tactic and an attempt to use the NCLT as a recovery mechanism. Therefore, it is clear that the Operational Creditor has failed to demonstrate the existence of a crystallised and undisputed operational debt to initiate CIRP against the Corporate Debtor,” added Mhetre.

Source: Economic Times