Chennai-based Murugappa Group has signed a deal to acquire German specialty chemicals firm Hubergroup for an enterprise value of $310 million, a move that will help it expand in the global print and packaging sector.

The acquisition was finalised this week and will see Murugappa, along with investment firm Avenue Capital Group, take full ownership of Hubergroup from Cornelius Treuhand Holding, pending regulatory approval.

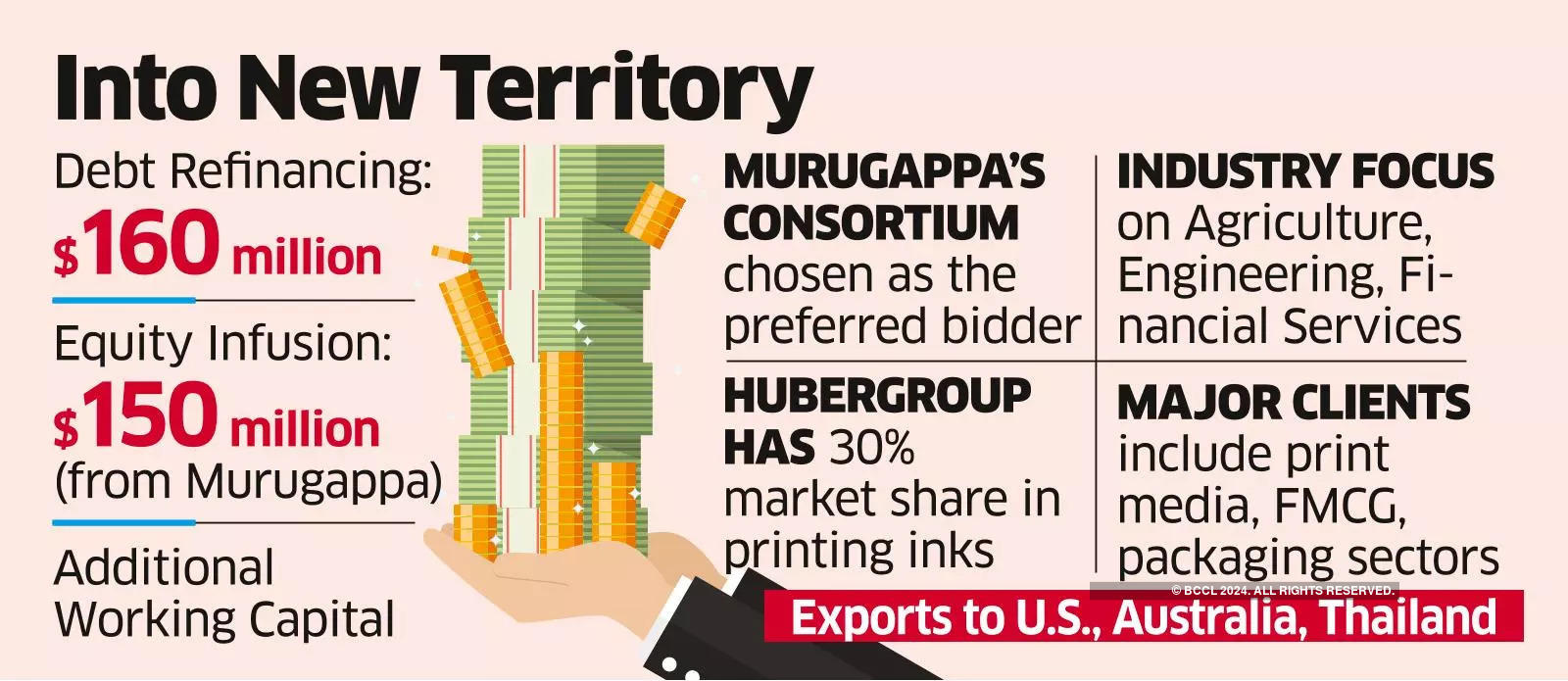

The transaction includes $160 million to refinance Hubergroup’s debt and a $150-million equity infusion from Murugappa besides working capital, according to sources familiar with the matter.

The Murugappa Group did not immediately respond to requests for comment while Hubergroup could not be reached for comment.

The deal follows a competitive bidding process that included Edelweiss and Jindal Poly Films, both of which reportedly sought to acquire Hubergroup with financial backing. Despite the competition, Murugappa’s consortium emerged as the preferred bidder.

Last month, CARE Ratings reported that Hubergroup planned to take on significant debt to buy equity in fellow subsidiaries from its parent company, MHM Holding GmbH, for around ₹1,350 crore. Hubergroup aimed to fund this largely through new debt and internal funds.

The transaction, initially set for early 2024, faced legal issues in Germany and was put on hold while lenders had extended repayment to December 2024 and appointed a trustee and management consultant to manage refinancing efforts, with a potential strategic equity investor to replace MHM’s debt.

Hubergroup India is the market leader in the Indian printing industry with market share of around 30%, with major print media publication houses along with packaging and FMCG companies as its clients.

This company was originally promoted by the Bilakhia Group in 1991. It is now majorly owned by Germany’s Hubergroup, which acquired nearly full ownership by late 2023. The company also manufactures key ink components like adhesives, resins, and pigments at its Vapi, Daman and Silvassa plants. It supplies nearly half its products to India and the rest globally through subsidiaries in countries like the US, Australia and Thailand.

Murugappa is a diversified conglomerate with interests in agriculture, engineering and financial services, and operates listed entities including CG Power & Industrial Solutions, Cholamandalam Financial Holdings, and Tube Investments of India.