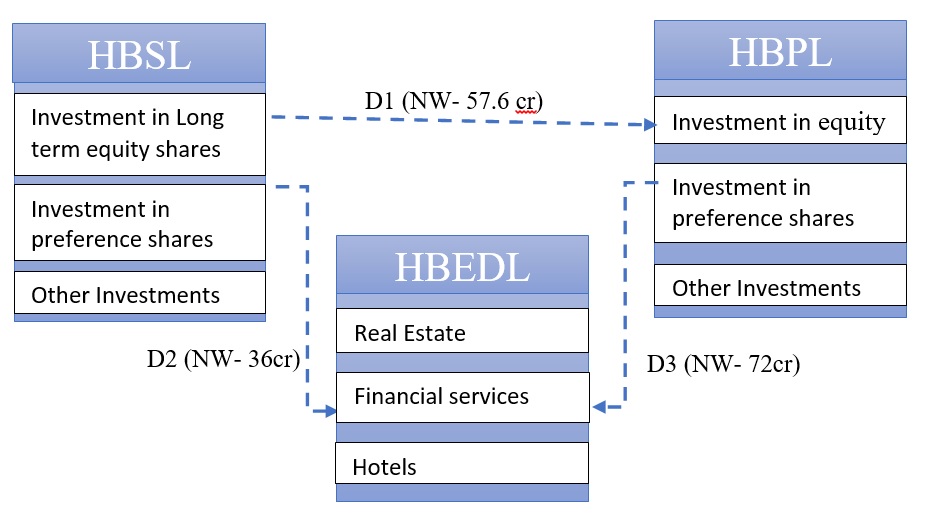

Lalit Bhasin-led HB group recently proposed a restructuring of its three listed companies – HB Stockholdings Ltd. (HBSL), HB Portfolio Ltd. (HBPL) and HB Estate Developers Ltd. (HBEDL). The restructuring was proposed because of financial stress and for a creation of structures where it will be easy to invite investors with different risks profiles. The board of directors, who were in talks regarding various options for business restructuring since a year, approved the scheme of arrangement at its meeting held in February this year.

Brief background

HBSL – It is an NBFC engaged in investment in equity shares, preference shares, mutual funds and debentures of listed as well as unlisted companies for a long term and short term.

HBPL – Its business is to undertake financial services and investing in various kinds of securities. It is also a sponsor of Taurus Mutual Fund.

HBEDL – primarily engaged in the development of commercial complexes. Also engaged in the hotel business and financial services.

Scheme

| Details of Demerger | Appointed date | Swap ratio | Actual swap ratio (considering reduction and consolidation) |

| 1. Demerger of HBSL long term Equity Investment undertaking from HBSL into HBPL | 1.4.2015 | 25 for every 100 equity shares of Rs. 10 each of each HBPL | 15 shares for every 100 shares of Rs. 10 each |

| 2. Demerger of HBSL Preference Shares Investment undertaking from HBSL into HBEDL | 2.4.2015 | 24 for every 100 equity shares of Rs. 10 each | 14.4 shares for every 100 shares of Rs. 10 each |

| 3. Demerger of HBPL Preference Shares Investment and Loans and Advances undertaking from HBPL to HBEDL | 3.4.2015 | 59 for every 100 equity shares of Rs. 10 each | 35.4 shares for every 100 shares of Rs. 10 each |

Transaction Structure

Rationale

- It will enable investors to choose an option based on different investment characteristics matching their investment strategies and risk profiles.

- To cater to the organic as well as inorganic growth plans, there is a need to raise funds and diversify.

- To increase efficiency in cash management and excess cash flow generated to maximize shareholders’ value.

- Creation of more focused investment companies and management attention and leadership.

Inter-company transactions

On the scheme becoming effective, the following will get cancelled-

- Preference shares of HBEDL of Rs. 750 lakh issued to HBPL and HBSL each

- Short-term borrowings of Rs. 900 lakh by HBEDL from HBPL

Reduction and consolidation-

Equity shares

(Figures in Lacs)

| Company | Equity share capital (Pre reorganisation) Rs. 10 each | Reduction in % | Equity share capital (Post reorganisation) Rs. 10 each |

| HBSL | 2,379 | 70% | 714 |

| HBPL | 1,794 | 40% | 1,076 |

| HBEDL | 3,243 | 40% | 1946 |

Preference shares

(Figures in Lacs)

| Company | Preference share capital (Pre) | Cancellation | Preference share capital (Post) |

| HBEDL | 8,000 | 750 | 7,250 |

Contingent liabilities

The following are considered for valuation of the companies-

- HBPL’s contingent liabilities of 16.25 crore out of which –

- Guarantees are given on behalf of subsidiaries – 15 crore

- Remaining is uncalled capital – 1.25 crore

- HBEDL’s contingent liabilities of Rs. 12.63 crore out of which –

- Show cause notice for demand of from Delhi Development Authority – 2.6 crore

- Claims not acknowledged as debt – Rs. 2.78 crore

- LC/BG – Rs. 6.39 crore

- Other – 0.86 crore

Observations

Details in terms of net worth

(Figures in Lacs)

| Company | NW as on 31.3.2015 | (Demerged)/ Resulting NW (Net) | % of NW | Post reorg NW |

| HBSL | 13,516 | (9,360) | 69% | 4,157 |

| HBPL | 12,065 | (1,439) | 12% | 10,626 |

| HBEDL | 9,738 | 10,799 | 111% | 20,537 |

Details in terms of investment portfolio

- HBSL is demerging 96% of its total investments to HBPL and HBEDL, so it will be left with mainly loans and advances in its portfolio.

- HBPL is demerging 45% of its total investments to HBEDL.

Changes in promotor’s shareholding due to reorganisation

| Company | Shareholding Pattern | |

| Pre % | Post % | |

| HBSL | 53.23 | 53.23 |

| HBPL | 65.53 | 61.45 |

| HBEDL | 74.57 | 66.53 |

Financials

- Financials of HBPL and HBSL have taken a dive in FY 2014-15. Market value (as on 25th May 2016) is 1/10th of book value (as on 31st March 2016) in the case of HBPL and less than 1/5th in the case of HBSL and HBEDL.

- Out of total accumulated losses of HBEDL Rs. 138.35 crore as on 31.3.2016, 13 crores adjusted because of reduction of capital as part of the scheme.

- The net worth of most of the companies in which unquoted investments of preference shares were made by HBSL is negative.

- Even the market price of HBSL and HBEDL as on 25th May 2016 was below the face value.

Conclusion

The group has multiple listed companies (4) having huge capital as compared to its operations. The exercise seems to be done to increase the net worth of HBEDL and reduce its liabilities. Realigning the capital to match the post-demerger assets and present level of operations seems like a sensible move from the point of view of long-term growth and fundraising. But even after implementation of this scheme, paid-up capital is too large.

The group has shifted a majority of its operations in HBPL (long-term equity investments) and HBEDL (Hospitality, hotels, and preference investments). HBEDL, it seems, will dispose of off the investments to fund its present business activities and reduce debt. Post scheme, if the group does not make efforts to hive off or sell off some assets and raise funds, there will be no perceptible change in the business and income of the group.