Global infrastructure investor Macquarie Asset Management has emerged as the frontrunner for acquiring a significant minority stake in Maple Infrastructure Trust, the India-focused road InvIT sponsored by Canadian pension fund Caisse de depot et placement du Quebec (La Caisse, formerly CDPQ), said people familiar with the matter. Macquarie has signed an exclusivity agreement and is expected to begin due diligence shortly, the people said.

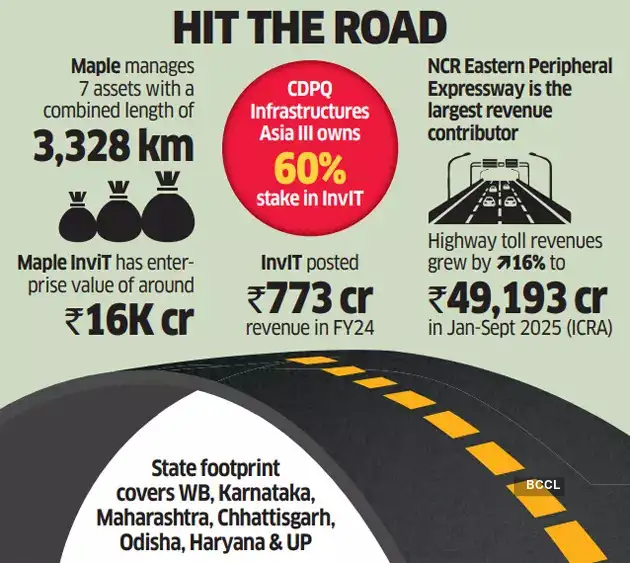

La Caisse aims to raise $350 million (₹3,155 crore) via the stake sale and has appointed Rothschild to manage the process. The InvIT has an enterprise value of around ₹16,000 crore ($2 billion). Maple Infrastructure Trust is sponsored by Maple Highways, La Caisse’s dedicated road platform in India.

Macquarie, French road developer Vinci Highways, and Global Infrastructure Partners (GIP) were also in the race for the stake, as first reported by ET in July. Canada’s PSP Investments, and Aimco also explored acquiring a stake, as earlier reported by ET. The fresh capital raise is expected to support Maple’s recently-completed acquisition of toll road assets from Ashoka Concessions, the people cited above said.

As per the current shareholding of Maple InvIT, CDPQ Infrastructures Asia III has a 60% stake. The other shareholders are Maple Highways Pte with 15%; 360 One Group at 18.3%; Fami Strei-the family office of the Taparia family, founders of contraceptive maker Famy Care-with 3.1%, and other investors including the family office of Uday Kotak owning a combined 3.6%.

A spokesperson for La Caisse declined to comment. Macquarie did not respond to email queries. The InvIT recently completed the acquisition of five operational highway projects from Ashoka Concessions and associated entities, expanding its portfolio to seven assets with a combined length of 3,328 lane kms. These include more than 2,100 lane kms of operational NHAI toll roads across critical economic corridors such as the Golden Quadrilateral and the East-West Corridor, spanning West Bengal, Karnataka, Maharashtra, Chhattisgarh, and Odisha.

The portfolio has strong geographical diversification, with key assets including Shree Jagannath Expressways in Odisha, part of the Golden Quadrilateral and connecting the Chennai-Kolkata corridor; and NCR Eastern Peripheral Expressway, a six-lane expressway across Haryana and Uttar Pradesh.

The EPE accounts for 76% of the cash flow available for debt servicing and 75% of InvIT-level enterprise value, according to a recent report by credit rating agency Icra. India’s highway toll revenues rose 16% from a year earlier to ₹49,193 crore during January-September, according to Icra. India’s infra sector is set for big expansion, with National Infrastructure Pipeline (NIP) projecting investments of $1.4 trillion by 2025.

Source: Economic Times