Mizuho Financial Group is buying a controlling stake in home grown investment bank Avendus, giving KKR an exit from its nine-year old investment, as Japanese mega banks continue to pick India to deploy significant growth capital.

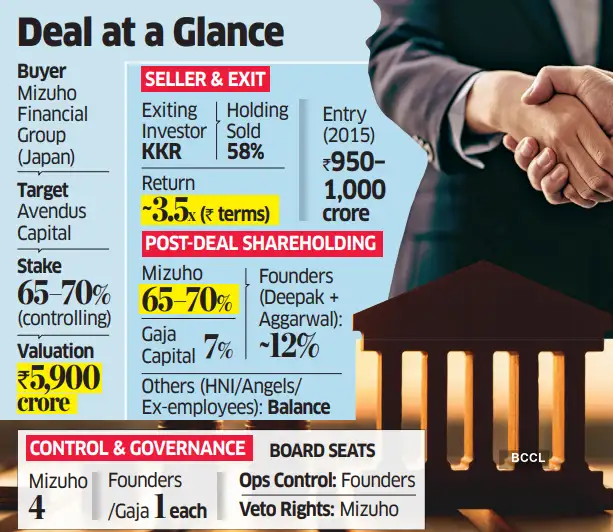

A formal announcement was made on Wednesday following Avendus board meeting a day earlier to approve the transaction. Details of the transaction were not made public, but people in the know said Avendus has been valued at Rs 5,900 crore. The valuation got finalised almost six months back but the announcement got postponed after serious differences cropped up between the existing shareholders and founders of the bank. This would translate into a blended 3.5x return for KKR in rupee terms.

ET in its June 9th edition was the first to report that Mizuho had sealed a deal with KKR to take control of Avendus. But at the very final stages, the exit valuations and rights became a bone of contention among some of the key minority shareholders and members of the founding team. Some even wanted an IPO hoping public market valuations will fetch an even higher premium. This snowballed into a major challenge, even pushing the transaction on the brink of collapse rekindling the hope of competing PE bidders. The final negotiations dragged for over 6 months.

KKR that held its 58% stake via Redpoint Investments Pte Ltd will be selling its stake in the firm to Mizuho Securities Co. Ltd., a subsidiary of Mizuho Financial Group, Inc. Avendus’ Co-founder and Executive Vice Chairman, Ranu Vohra, will also be divesting his 6% shareholding along with some of the earlier HNI and angel investors and ex-employees. Local PE firm Gaja Capital will continue with their 7% shareholding in the 26-year old firm. The other two co-founders Gaurav Deepak, also the CEO, and Kaushal Aggarwal will continue to stay invested with a combined 12% shareholding. They will retain full operational control, though Mizuho will have veto rights. Once completed, the transaction is likely to see the Japanese mega bank owning up to 65-70% of the investment bank.

The firm was founded in 1999 by three friends — Vohra, Aggarwal and Deepak. One of the hottest domestic deal shops in the country, Avendus operates in the financial services space through subsidiaries in financial advisory, capital markets, wholesale financing through Avendus Finance, wealth management and alternative asset management. The acquisition of Spark in 2022 led to the addition of institutional equities to the offerings. Still a lion’s share of revenues come from the investment banking division. But from its technology focus, over time they have diversified into several other areas like industrials, financial service, consumer and healthcare.

“Mizuho mirrors our values, vision, and ambition to shape the future of financial services with purpose and impact,” said Deepak. “This partnership is about more than capital — it’s about a shared belief in what the future of financial services from India can represent. Together, Avendus and Mizuho will deliver broader capabilities, sharper execution, and a stronger value proposition for our clients,” added Aggarwal, the firm’s co-founder.

The transaction will mark the biggest investment by Mizuho in India, underscoring the increased strategic interest of Japanese financial groups in the country. With $2 trillion in assets, Mizuho Financial Group is Japan’s third-largest megabank.

“Avendus has been walking side- by-side with the entrepreneurs supporting India’s rise, and it makes us very happy to be able to welcome them as one of our key partners,” said Masahiro Kihara, President and Group CEO, Mizuho Financial Group. “Their journey parallels our own journey of innovating together with clients for social and economic development. With them, we aim to evolve into a truly global financial institution that creates new value by bridging diverse cultures beyond national and regional boundaries.”

Mizuho, according to people in the know, will have 4 board seats while Gaja, Deepak and Kaushal will have 1 representation each. Independent board members will also get appointed over a period.

In 2015, KKR paid Rs 950-1,000 crore to pick up a controlling stake in Avendus Capital Pvt Ltd (ACPL) from Eastgate Capital Group Ltd and Americorp Ventures, early investors in Avendus via Singapore-based Red Point Investments Pte Ltd.

“Together, we helped accelerate its transformation into a diversified, market-leading franchise with strong capabilities across its advisory and investment businesses,” said Akshay Tanna, Head of India Private Equity, KKR.

ACPL, on a consolidated basis, reported a net profit of Rs 170 crore in the nine months ended fiscal 2025, as per a Crisil report from March. In FY26, the firm is expected to clock profits of Rs 250-300 crore with revenues of Rs 1700 crore.

India has become an investment hotspot for Japan Inc, especially in the financial sector. Earlier this year, SMBC picked up a strategic stake in private sector lender Yes Bank. Daiwa has deepened its relationship with Ambit, another homegrown investment bank, with equity investments in its lending and wealth management business over and above its equity in Ambit’s holding company. MUFG is also in advance negotiations to make a near $3 billion investment in Shriram Finance for a 20% stake, ET had reported in October.

Rothschild was the advisor in the transaction.