Bharti Enterprises and Warburg Pincus will together buy 49% of Chinese consumer electronics maker Haier’s India arm, the culmination of more than a year of negotiations, as the company steps up to challenge the domination of LG and Samsung. Over the past year, large groups such as Reliance Industries, TPG and the Burman family of Dabur; Goldman Sachs and the Amit Jatia family; Singapore’s GIC with BK Goenka of Welspune at about 7,100-7,400 crore. Both Bharti and Warburg will hold similar stakes post deal completion, the executives said.

Haier Group will retain 49% while the remaining 2% stake will be held by Haier India’s management team, Bharti Enterprises said on Wednesday. This is the second instance of Bharti partnering a large foreign consumer company, following its tie-up with Walmart for the US retail giant’s India entry nearly two decades ago, which ended in 2013. ET was the first to break the news on Wednesday morning in its online edition, and also in October 2024 on Haier’s intention to get a local partner. Finalising the deal however got prolonged due to the Chinese government’s delay in giving approval to Haier since it is the first time the company was partnering with a local business globally.

Boosting competitiveness

“This strategic collaboration will accelerate Haier’s growth and expansion in India by bringing together and leveraging the company’s global excellence in innovation, Bharti’s esteemed standing and resultant networks, and Warburg Pincus’ strong track record of scaling brands into industry leaders,” according to a joint statement from companies.

It said the partnership will bolster Haier’s vision of local production and sales by deepening domestic sourcing, expanding manufacturing capacity, driving product innovation, and accelerating market penetration. “The new capital infusion will also enhance Haier India’s competitiveness across the entire value chain,” it said.

Haier wanted to partly divest its stake in the Indian business to a local company, hoping to overcome regulatory hurdles in the country including the need for Press Note 3 approval for any investment. Press Note 3 is a multi-departmental approval necessitated by the Centre for any equity investment from a country sharing land borders with India such as China.

Haier India also needed high capital infusion to set up a planned third plant in India, apart from marketing activities. The company currently operates two plants — in Greater Noida and Pune, which are currently being expanded. The India unit had earlier sought Press Note 3 approval for a fresh infusion of `1,000 crore by its parent, Haier Singapore Investment Holding, but it has been pending for months, showed the company’s latest regulatory filings to the Registrar of Companies (RoC).

The Bharti-Warburg deal will not require any Press Note 3 approval, though statutory approvals will be sought.

For Bharti, the investment would scale up its presence in electronics manufacturing, adjacent to its business of making routers and telephones. It also has a joint venture with contract manufacturer Dixon and is also keen to tap into the broader electronics appliances market.

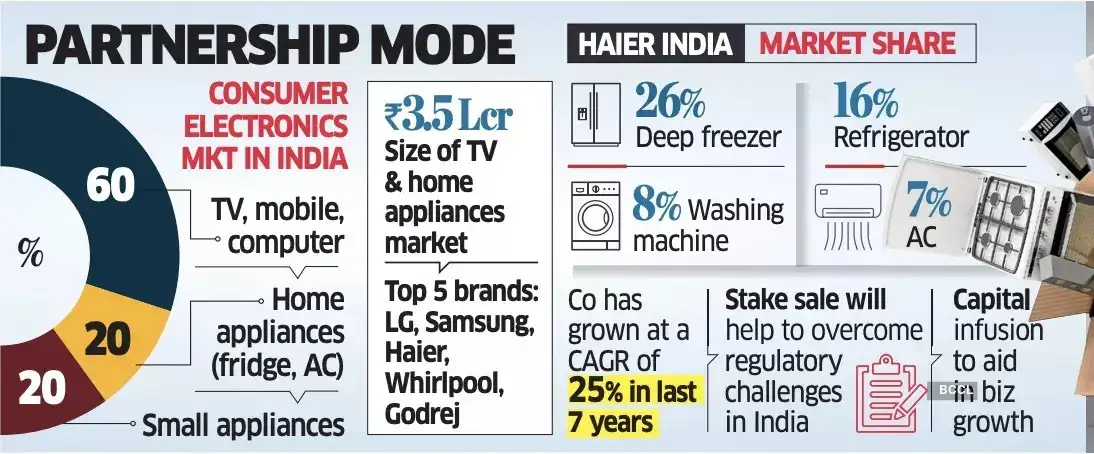

The stake sale will also involve localisation of the management of Haier India, industry executives said. Haier India president Satish NS will be made the managing director and Chinese expat Decheng Huang, who held the post till now, will relocate to Beijing. Haier is the country’s third-largest consumer durables company after market leader LG and Samsung. Apart from the Korean duo, it competes against Whirlpool, Voltas-Beko, Lloyd, and Godrej Appliances. The company is among the top four brands in refrigerator and washing machines, and is also expanding rapidly into televisions and air-conditioners.

As per Haier India’s filings to the RoC, the company recorded sales of 8,234 crore in FY25, a 30% increase from a year ago, while net profit more than doubled to 480 crore. It is targeting `11,500 crore sales this fiscal year.

Bharti said it wants Haier to consolidate its standing as a leading brand in India, while Warburg Pincus said the investment reflects its ability to leverage its pan-Asia franchise, deep local insights, global expertise, and its expansive network to support and accelerate growth for leading companies across the region. The PE firm is also an investor in brands such as Boat, Ola, Apollo Tyres, and Biba Apparels, per Warburg Pincus’ website.

Over the past year, large groups such as Reliance Industries, TPG and the Burman family of Dabur; Goldman Sachs and the Amit Jatia family; Singapore’s GIC with BK Goenka of Welspun, and the family office of Puneet Dalmia of the Dalmia Bharat Group and Bain Capital had evaluated the deal.

Source: Economic Times