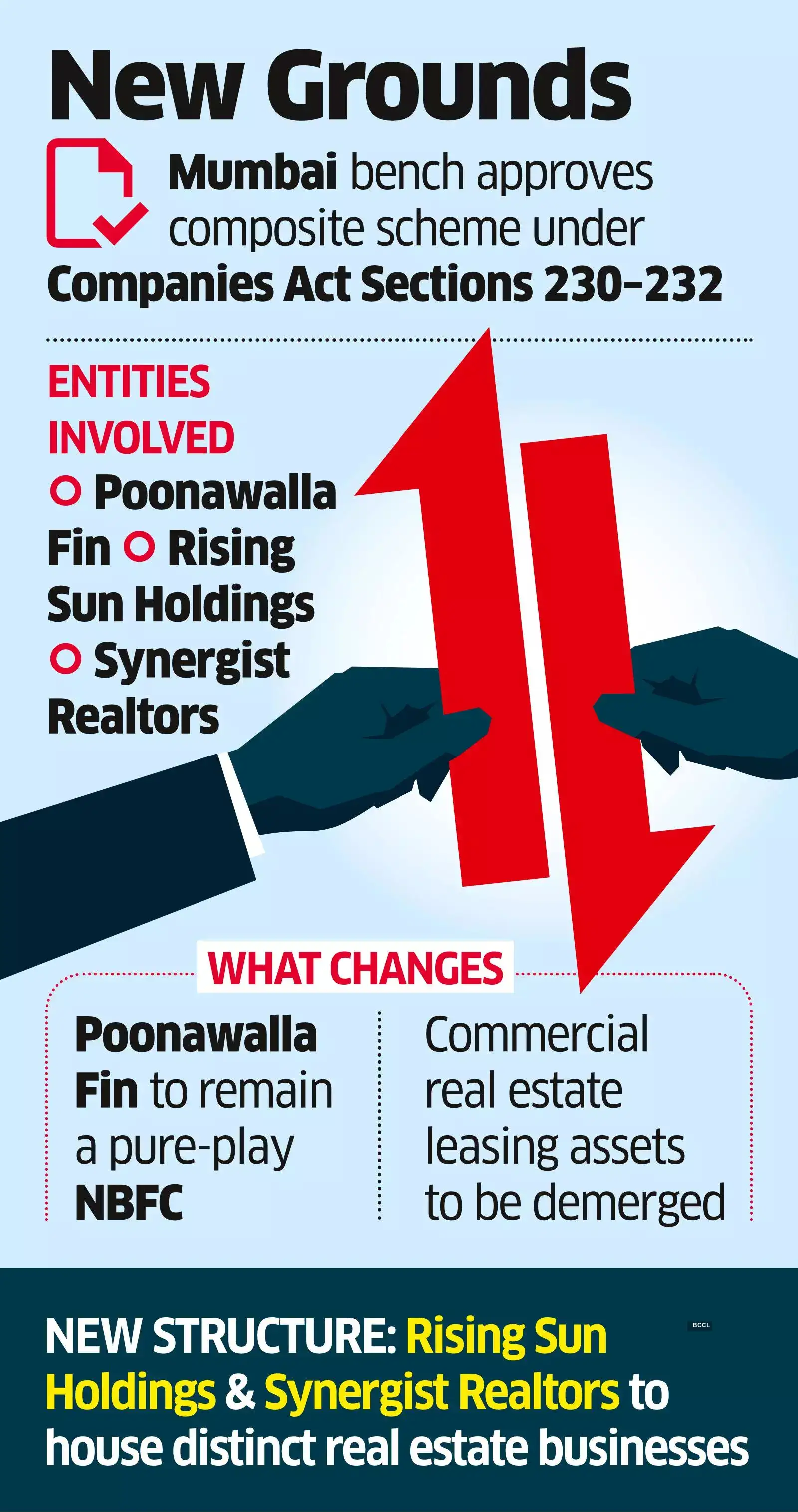

The National Company Law Tribunal (NCLT) has approved a composite scheme of arrangement involving Poonawalla Finance and its real estate entities, clearing the way for a multi-step demerger aimed at splitting the lending and real estate businesses.

In its order, the tribunal’s Mumbai bench has approved the restructuring under Sections 230 to 232 of the Companies Act, allowing Poonawalla Finance to hive off specific business undertakings into two resulting entities, Rising Sun Holdings and Synergist Realtors.vThe NCLT found the scheme to be fair, reasonable, and compliant with applicable laws. It also noted that shareholders, creditors, and regulators didn’t object to the plan.

Under the approved structure, Poonawalla Finance will continue as a non-banking financial company focused on the lending business, while its commercial real estate leasing assets will be transferred as part of the demerger.

Rising Sun Holdings and Synergist Realtors will house distinct real estate and related businesses, enabling sharper strategic focus, separate management, and the ability to attract different sets of investors and lenders.

The tribunal observed that the scheme had received unanimous board approvals and requisite shareholder and creditor consents. It also recorded that the Income Tax Department and the Ministry of Corporate Affairs didn’t raise any objection after receiving undertakings that ongoing tax proceedings and statutory liabilities would continue to remain enforceable.

Poonawalla Fin to hive off its real estate business into two separate entities

The NCLT clarified that the sanction doesn’t grant any exemption from payment of stamp duty or taxes and that tax authorities would retain the right to examine liabilities arising from the restructuring. The appointed dates for the demergers were fixed on October 1, 2024, and January 1, 2025, respectively.

Poonawalla Group didn’t respond to ET’s email query.

Top corporate groups and conglomerates have increasingly been restructuring their operations by segregating disparate businesses into separate entities to sharpen strategic focus and improve execution.

Experts say such demergers allow companies to ring-fence capital-intensive or cyclical businesses, adopt clearer governance structures, and pursue sector-specific growth strategies without cross-subsidisation.

The trend has gathered momentum over the past few years as groups seek to unlock value, simplify balance sheets, and make individual businesses more attractive to investors and lenders.

Separate listings or standalone entities also provide management teams with greater operational autonomy and accountability, while enabling investors to assess risks and performance more transparently.

Regulatory clarity around court-approved schemes and a more active capital market environment have further supported this shift, with sectors such as financial services, real estate, infrastructure, and manufacturing seeing a growing number of such restructurings.

Source: Economic Times