There’s little that companies on the hunt for mergers and acquisitions hate more than uncertainty, and the second quarter of 2016 had plenty of that.

Deal volumes suffered as potential acquirers — and their targets — navigated markets roiled by volatility, looked for clarity on the Federal Reserve’s next move, and awaited British voters’ decision last week on whether to leave the European Union.

While they were waiting, overall deal values for the quarter to date fell 18 percent from the same period last year, according to data compiled by Bloomberg. Almost half as many deals were terminated, the data show, while others were stuck in limbo as antitrust regulators met to decide their fate.

But there were bright spots: Chemicals and utility companies rushed to consolidate, and targets — well aware of their attractiveness to buyers on a desperate hunt for growth — demanded multiples not seen since 2007.

Here are the big deals and trends that marked the second quarter and first half of the year, and what to look out for in the rest of 2016.

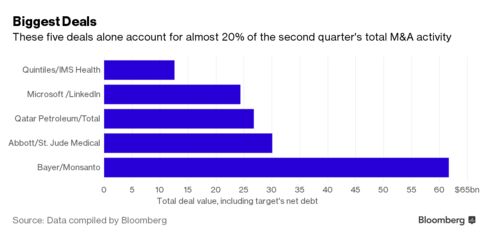

Top Deals

St. Louis-based Monsanto, which reports earnings for its fiscal third quarter on Wednesday, has so far rejected Bayer’s offer as too low.

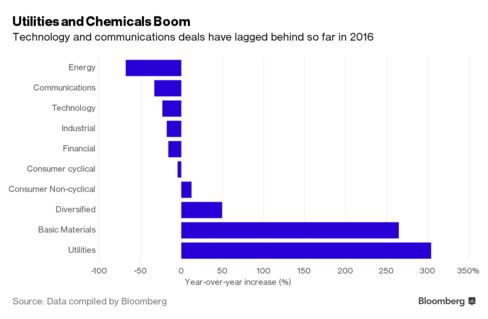

Chemicals & Utilities

Bayer’s potential mega deal is part of a key trend this quarter: A jump in chemicals transactions. Consolidation in the industry makes up about 88 percent of all deals across the basic-materials sector — and that momentum could continue into the second half.

Germany’s BASF SE is assembling an M&A team to help it evaluate potential targets, according to people with knowledge of the situation, after it lost out to Evonik Industries AG in its $3.8 billion offer for Air Products & Chemicals Inc.’s chemical coatings division.

Utilities also dominated the past three months, with some $32.9 billion of deals announced — more than four times the total in the same period last year, the data show. Electricity deals, like Great Plains Energy Inc.’s $12.1 billion takeovers of Westar Energy Inc., accounted for about 90 percent of deals in the sector, according to data compiled by Bloomberg.

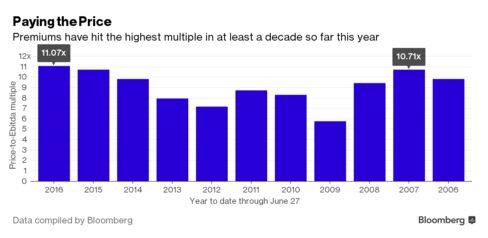

Record Premiums

Despite fewer overall deals, premiums have reached the highest multiple in at least a decade this year, as companies seek consolidation to drive revenue and profit amid scarce opportunities for organic growth. Companies paid a median of 11.07 times their target’s earnings before interest, taxes, depreciation and amortization through June 27 to make acquisitions, the data show.

High premiums are likely to continue, particularly in the health-care and technology industries, Peter Tague, co-head of global M&A at Citigroup Inc., said Monday on Bloomberg TV’s Deals Report segment.

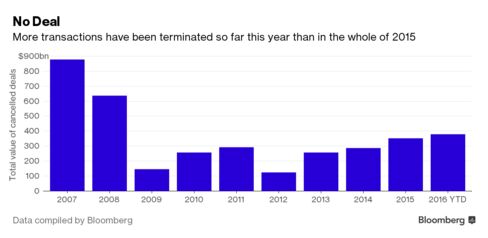

Dead Deals

This year could end up being remembered as that of the un-merger. Some 119 deals worth almost $312 billion were terminated in the second quarter alone, including Pfizer Inc.’s blockbuster $183.8 billion acquisition of Allergan Inc. and Canadian Pacific Railway Ltd.’s $38 billion attempts to merge with rival Norfolk Southern Corp.

Going into the second half, the outlook is shaky for several other big deals. Britain’s decision to leave the European Union may threaten the planned merger between Deutsche Boerse AG and London Stock Exchange Group Plc, with a German shareholder protection group saying the proposed transaction no longer makes sense.

Dealmakers have said a Brexit — which Richard Cranfield, a corporate partner at Allen & Overy LLP called the “biggest de-merger in history,” — could mean a prolonged drought in M&A activity.

Meanwhile, health insurers Anthem Inc. and Cigna Corp. are waiting to find out whether the U.S. Justice Department will approve or block their $48.4 billion deal, which was proposed almost a year ago. A decision could come as soon as July.

Source: Bloomberg.com