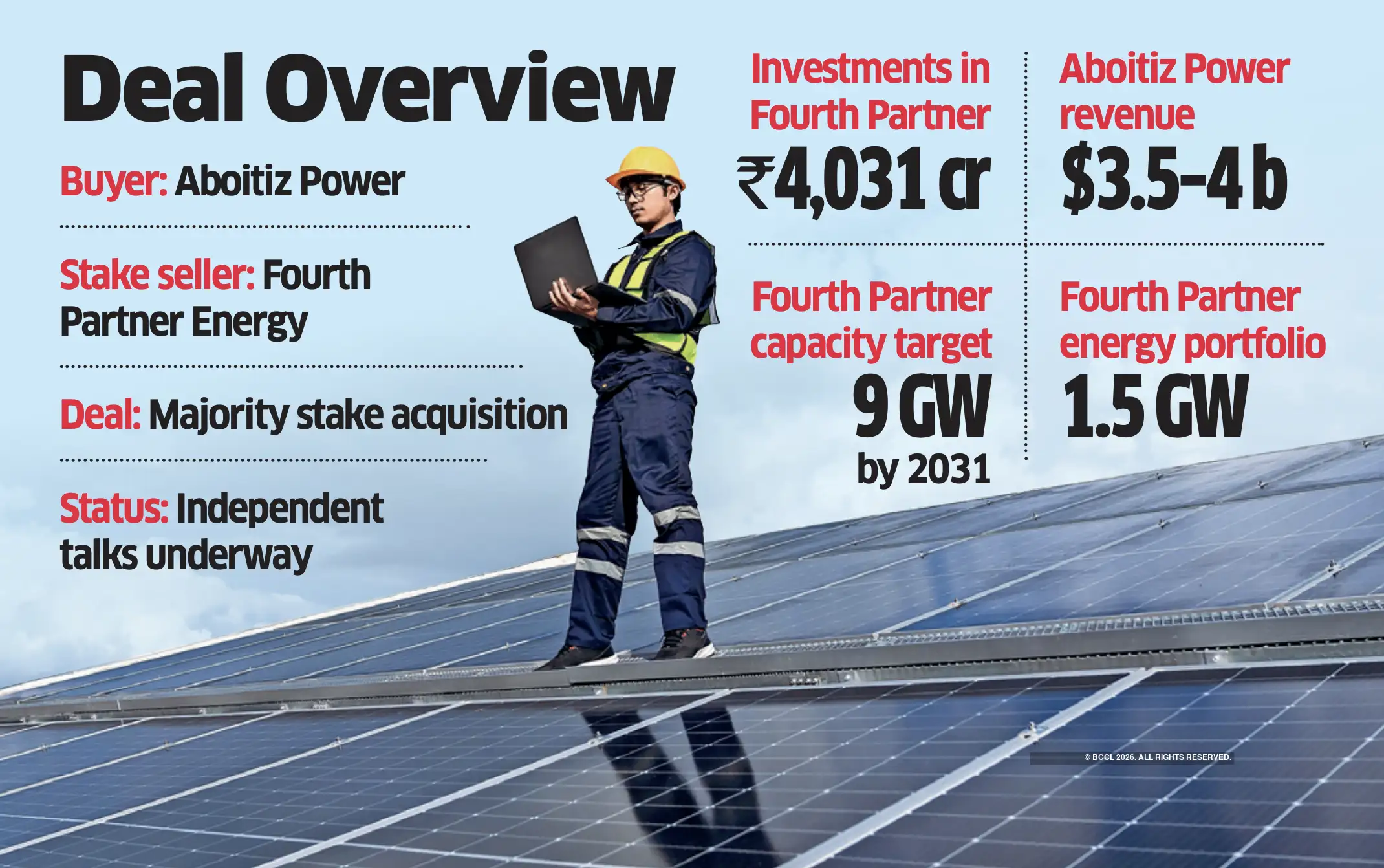

Manila-headquartered Aboitiz Power is in talks to buy a majority stake in Hyderabad-based Fourth Partner Energy which specialises in selling power generated from green energy sources to commercial and industrial (C&I) establishments, said people in the know.

Some of the early investors in Fourth Partner are looking to pare their holdings, the people told ET. They didn’t disclose the size of stake that Aboitiz Power is looking to buy and Fourth Partner’s value.

Fourth Partner’s investors TPG Rise, Norfund, Asian Development Bank (ADB), World Bank arm IFC, and DEG have cumulatively infused ‘4,031 crore in the company at various stages since its inception in 2019.

The people cited above said Aboitiz Power is in independent negotiations for a majority stake in Fourth Partner but is also open to owning the stake in partnership with another new investor. Aboitiz Power is Philippines’ second largest power generation and distribution company with annual revenues of $3.5-4 billion.

Fourth Partner had reportedly held stake sale talks with Indian Oil Corporation, but it eventually didn’t materialise, the people said.

Aboitiz Power said it regularly evaluates strategic opportunities.

“The Company regularly evaluates strategic opportunities in the ordinary course of business. As a matter of policy, we do not comment on market speculation,” Aboitiz Power said in a statement, responding to a query.

Fourth Partner said fundraising is an ongoing process in the company. It declined to comment on ET’s specific queries.

TPG, DEG, Norfund, ADB and IFC declined to comment.

Fourth Partner was cofounded by Saif Dhorajiwala and Vivek Subramanian, colleagues at SME-focused investment fund Avigo Capital before they ventured out as renewable energy entrepreneurs.

The company has a 1.5 gigawatt portfolio of renewable energy generation projects, serving customers such as Akzonobel, Dr Reddy’s, Hyundai, ITC, Nestle, and D’Mart, per its website.

Fourth Partner also has a presence overseas, with projects in Vietnam, Indonesia, Bangladesh, and Sri Lanka. It has a target to set up 9 gigawatts of renewable energy generation capacity by 2031.

Commercial and industrial establishments are increasingly switching to green energy to meet power requirements while addressing internal decarbonisation targets and lessen fuel bills.

India has set stiff targets for raising installed renewable energy generation capacity that could see it add 50 GW capacity per year through 2030. This could be crucial in line with the planned setting up of data centres which is projected to raise power demand.

India’s renewable energy sector continues to attract investments besides being witness to several mergers and acquisitions. Recently, Inox Clean Energy acquired Vibrant Energy from Macquarie for about $200 million. Vibrant Energy is into generating power from green sources for commercial and industrial customers and supplies to Amazon among others.

ArcelorMittal announced doubling investments in setting up green power projects in India by infusing an additional $900 million. These projects will provide electricity to the company’s steel making operations, making them more climate friendly. Singapore’s Sembcorp recently bought a portfolio of renewable energy projects from ReNew Power.

Source: Economic Times