Europe’s wounded steel industry might be about to get the deals it has been crying out for.

The latest hope for the sector emerged on Friday as the continent’s second-biggest producer Tata Steel Ltd. said it’s in talks with third-ranked ThyssenKrupp AG about a possible joint venture. That closely follows largest producer ArcelorMittal’s move to take control of Ilva, Europe’s top steel plant.

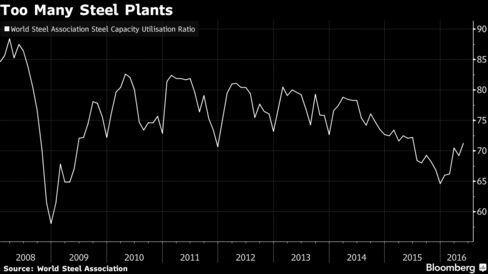

Such deals may help resolve the industry’s most enduring problem: there are too many mills making too much material. The oversupply stops plants from running at full capacity and means their costs rise. At the same time, European companies are churning out steel as China floods the global market with record exports, further hitting profits. The hope is that with more consolidation, the bigger firms can help cut excess supply, supporting prices in the region.

“Failure to progress further with sector consolidation now would be irrational,” Berenberg Bank said in a note to investors on Monday. “An M&A deal will have far more of an effect than a cyclical upturn on the sustainability of the EU steel sector’s earnings.”

Still, a major obstacle to any deal is the future role of Tata’s U.K. business, including its blast furnaces in Port Talbot. The company, which in March said it planned to sell its unprofitable British business, said Friday that it’s looking at “alternative and more sustainable portfolio solutions” for its European assets and will start separate processes to offload some other units in England.

U.K. Issues

Koushik Chatterjee, Tata Steel’s group executive director, said whether the ThyssenKrupp talks produce results and include the U.K. business in the potential joint venture depends on some issues including a suitable outcome for the British Steel Pension Scheme. Other factors are successful discussions with trade unions and the delivery of policy initiatives and other support from the governments of the U.K. and Wales.

Kepler Cheuvreux said a deal with ThyssenKrupp would increase the chances of Port Talbot’s closure, while Deutsche Bank AG said it’s difficult to see how the future of the furnaces can be sustainable. A workers council at the German firm is against the venture, Reuters reported, citing heads of the worker councils.

The latest Tata development follows ArcelorMittal’soffer last month to take over the Ilva plant in Italy in a joint bid with Marcegaglia SpA. The Italian government is seeking bidders after taking over the administration of the plant last year to save jobs and rectify the environmental damage. The plant, which currently competes with steel made by ArcelorMittal, produces about 4.8 million tons a year and is renowned for producing cheap steel. AcciaItalia Spa, a rival consortium including Arvedi, has also bid for Ilva.

Europe’s steel industry has already seen closures, with ArcelorMittal shutting plants in France and Belgium. But eight years after the financial crisis, Europe is still making more steel than it needs. Between 2007 and 2013, when demand plunged by 30 percent, companies cut capacity by just 4 percent, according to Jefferies International Ltd. The continent produced 166 million tons in 2015, well below its capability of 230 million tons.

“A further consolidation of the European steel industry could create new synergies in the sector, which would be helpful in the face of growing international competition,” said Axel Eggert, director general of lobby group Eurofer.

ThyssenKrupp Chief Financial Officer Guido Kerkhoff told investors in May that consolidation in Europe “makes sense,” while Lakshmi Mittal, the billionaire chief executive of ArcelorMittal, has long advocated more deals in the sector.

“A Tata-ThyssenKrupp joint venture may emerge as a strong number two player in the euro market,” Jefferies analysts Seth Rosenfeld said in a report Monday. “The broader Euro flat steel market should benefit greatly from both the potential merger of Tata-ThyssenKrupp and acquisition of Ilva by either ArcelorMittal or Arvedi.”

Source: Bloomberg.com