UniCredit SpA is considering tapping shareholders for as much as 5 billion euros ($5.5 billion) and selling its entire stake in Poland’s Bank Pekao SA to raise capital, according to people with knowledge of the matter.

Chief Executive Officer Jean-Pierre Mustier may also dispose of online lender FinecoBank SpA and sell a large share of its Italian bad-loan portfolio, the people said, asking not to be identified because the discussions are private. UniCredit on Wednesday said it ended talks with Banco Santander SA to combine asset-management units and will explore new options for its Pioneer Global Asset Management business.

Mustier, a 55-year-old Frenchman who took over as CEO earlier this month, is working on a business plan that he’ll present in the fourth quarter to lower costs, boost capital buffers and improve profitability. Abandoning the Pioneer deal is a setback to improving capital at UniCredit, which has the smallest buffer compared with European Central Bank targets among Italy’s major lenders.

“The potential capital management options could build a decent capital base for UniCredit,” Carlo Tommaselli, an analyst at Credit Suisse Group AG wrote in a note to clients. Still, selling Pekao and Fineco would also dilute profitability, said Tommaselli, who has a neutral rating on the stock.

The UniCredit CEO aims to use the funds from an asset- and share sales to help cover a possible hit from bad-loan disposals and bolster its buffers, according to the people. A spokesman for UniCredit declined to comment.

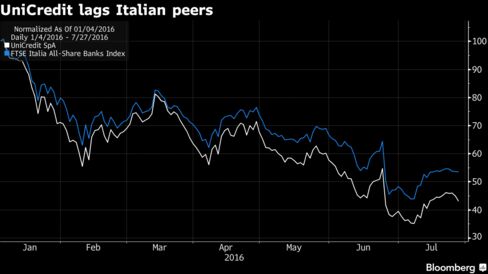

UniCredit declined as much as 5.4 percent and was down 4.5 percent at 2.14 euros at 10:50 a.m. in Milan. The shares have dropped about 58 percent this year, reversing some losses after Mustier took over. Pekao fell as much as 6 percent and Fineco dropped 5.4 percent.

Poland’s deputy Prime Minister Mateusz Morawiecki earlier this month said the July 12 sale of UniCredit’s Pekao stake marked the beginning of the process through which the Polish government could gain control over one of its prized lenders. The ruling Law & Justice party has made a “re-Polonization” of banks a priority as it seeks to boost the state’s role in the economy.

Mustier is reviewing alternatives including an initial public offering for Pioneer after talks with Santander ended, UniCredit said in a statement.

“In the absence of any workable solution within a reasonable time horizon, the parties have concluded that ending the talks was the most appropriate course of action,” UniCredit said. Santander CEO Jose Antonio Alvarez said separately that the banks weren’t able to meet regulatory expectations without “significantly harming the strategy of the deal.”

Management Overhaul

UniCredit has struggled to build up capital and meet regulatory requirements, a task compounded by the bank’s complex structure spread across 17 countries. The bank’s common equity Tier 1 ratio, a measure of financial strength, fell to 10.5 percent at the end of March from 10.7 percent three months previously. The European Central Bank has asked the lender to maintain a 10 percent ratio for 2016.

The new CEO on Tuesday announced an overhaul of the bank’s top management, elevating Gianni Franco Papa, currently one of three deputy general managers and head of the corporate and investment banking division, to general manager. His two colleagues — Paolo Fiorentino and Bernardo Mingrone — will leave the company, while Marina Natale will head strategy and mergers and acquisitions during the restructuring.

UniCredit is scheduled to release second-quarter earnings next week.