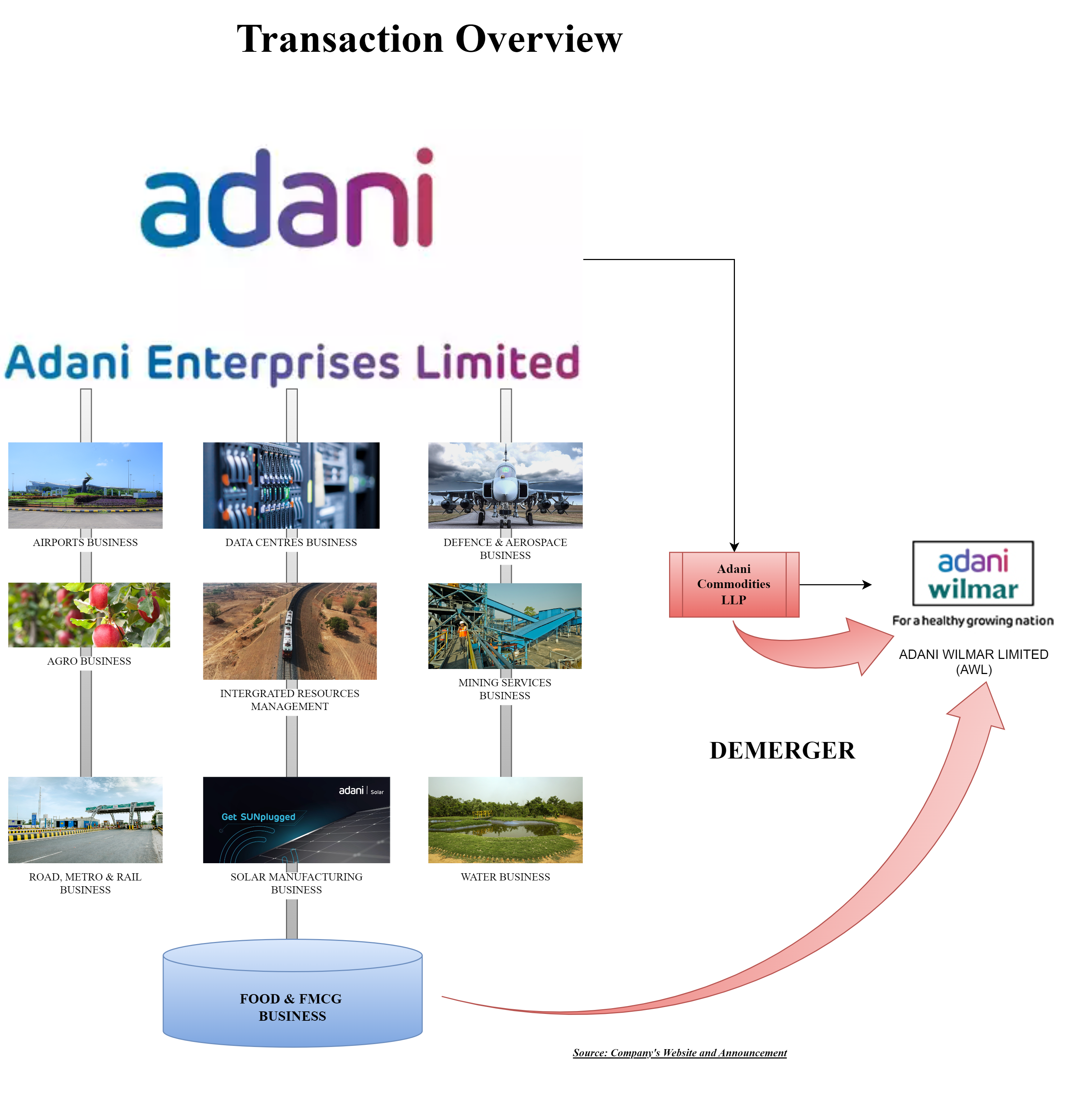

Adani Group, incubator of many businesses, has announced the demerger of one of its mature businesses to unlock value for stakeholders.

Adani Enterprises Limited (hereinafter referred to as “Demerged Company” or “AEL”) is in the business of integrated resources management, mining services and other trading activities. AEL operates as an incubator, establishing new businesses in various areas like energy ecosystems, data centres, airports, roads, primary industries like copper and Petrochem and others. AEL is also in the business of food FMCG (fast moving consumer goods) through trading and supply of edible oil & other allied commodities and through its strategic investments in Adani Commodities LLP (“Food FMCG Business”). AEL is a designated partner of Adani Commodities LLP with a share of 99.99%. Adani Commodities LLP holds 43.94% of the paid-up equity share capital of Adani Wilmar Limited (hereinafter referred to as the “Resulting Company” or “AWL”).

AEL holds investment in AWL through a special purpose vehicle Adani Commodities LLP. Apart from this, the Food FMCG business includes a factory owned BY AEL at Mehsana which is leased to AWL for refining of edible oils.

The equity shares of AEL are listed on the Stock Exchanges. The listed secured Non-Convertible Debentures issued by AEL are listed on the Wholesale Debt Market segment of BSE Limited (“BSE”).

Adani Wilmar Limited is a joint venture between Adani & Wilmar group which has business portfolio of products spans across edible oil, packaged food FMCG and industry essentials. AWL is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers including edible oil, wheat flour, rice, pulses, and sugar. AWL has the largest distribution network among all the branded edible oil companies in India. The equity shares of AWL are listed on the Stock Exchanges.

The Proposed Transaction

The board of directors of AEL & AWL approved a scheme of arrangement (“Scheme”) which inter alia provided for the transfer and vesting of the Demerged Undertaking (which includes the entire business of AEL pertaining to the Food FMCG Business with all associated activities, assets, liabilities and Demerged Company’s strategic investments in Adani Commodities LLP “ACLLP”) from AEL to AWL on a going concern basis, and issue of equity shares by AWL to the equity shareholders of AEL, in consideration thereof.

In Nutshell,

- AEL holds investment in AWL through a special purpose vehicle ACLLP which shall consist of a large part (Circa 99%) of the undertaking which shall get demerged to AWL.

- Pursuant to the demerger, ACLLP shall be owned by AWL.

- Equity shares held by ACLLP in AWL shall get cancelled & new shares (for shares held by ACLLP + other net undertaking transferred) shall be issued to the shareholders of AEL.

Through the scheme, ACLLP’s investment in AWL is being proposed to be transferred to the shareholders of its (erstwhile) partner i.e., AEL through a tax neutral demerger.

- ACLLP shall continue without any substantial asset/liability with no operations.

The Appointed date for the demerger means the Effective Date. “Effective Date” means the last of the dates on which all the conditions and matters referred to in Clause 18.1 of the Scheme have occurred or have been fulfilled.

Further key rationales as proposed in the scheme are:

- Each of the varied businesses being carried on by AEL either by itself or through its subsidiaries or through associate companies including Food FMCG Business have significant potential for growth and profitability. The nature of risk, competition, challenges, opportunities, and business methods for Food FMCG Business is separate and distinct from other businesses being carried out by AEL

- The Food FMCG Business and the other businesses of AEL can attract a different set of investors, strategic partners, lenders, and other stakeholders.

- There are also differences in the manner in which the Food FMCG Business and other businesses of AEL are required to be handled and managed

- The segregation would enable greater/enhanced focus of the management in the Food FMCG Business and other businesses whereby facilitating the management to efficiently exploit opportunities for each of the said businesses.

- It is believed that the proposed demerger will unlock the direct value of the Demerged Company’s shareholders.

Share Capital & Swap Ratio

The consideration for the demerger of the Demerged Undertaking shall be the issue by AWL of 251 (two hundred fifty-one) fully paid-up equity shares of the AWL having a face value of Re 1/- (Rupee One) each for every 500 (five hundred) fully paid-up equity shares of Re 1/- (Rupee One) each of AEL.

The existing share capital of the companies is as follows:

| Particulars | AEL-Pre & Post | AWL-PRE | AWL-Post |

| Paid-Up no of shares | 114,00,01,121 | 129,96,78,605 | 130,09,39,733 |

| Promoters Stake | 74.72 | 87.87 | 76.75 |

Currently, the promoter stake of AWL is held jointly by the Adani & Wilmar Group. Adani owns 43.94% (through ACLLP) & Wilmar group equal share. Post-restructuring, Adani promoters will own 32.81% of AWL while Wilmar will own 43.94%.

As on date, ACLLP holds 571,019,435 equity shares in AWL. Pursuant to the demerger, ACLLP will become wholly owned by AWL & AWL will issue shares to the shareholders of AEL. As per clause 9 of the Scheme, Simultaneous with the issuance of consideration by AWL, the existing issued and paid-up equity share capital of AWL, as held by Adani Commodities LLP, shall without any further application, act, instrument or deed, stand automatically cancelled and reduced, which shall be regarded as reduction of share capital of AWL, pursuant to Sections 230 to 232 of the Companies Act.

Direct Tax implications

Transfer of Undertaking or Asset?

As provided in the scheme, AEL will transfer Food FMCG Business to AWL. Further, Clause 7 of the Scheme provides that the transfer is in compliance with the definition of “demerger” as per section 2(19AA) of the Income Tax Act, 1961 which includes transfer shall be of running business.

As per the press release given by AEL, the turnover of Food FMCG business for FY 2024 was nil. Further, the valuation report provides that the undertaking includes land, building, plant & machinery of AEL for refining of edible oils at Mehsana which is leased to AWL only.

Considering the consideration discharged, it is clear that almost the entire part of undertaking shall be attributable to AEL’s investment in AWL.

| Particulars | No. of Shares issued by AWL | Tentative Value (INR in Crore) |

| Investment of AEL in AWL | 571,019,435 | 19,643 |

| Net Asset value of Undertaking (excluding equity shares of AWL held by ACLLP) which is carried on by AEL | 12,61,128 | 43.4 |

Please note that the above valuation is as per valuation report which states that the appointed date is 1st April 2024. As most of the part of undertaking is shares of AWL, it has no major impact on valuation.

Essentially, almost entire part of the undertaking will consist of AEL investment in ACLLP which owns equity shares of AWL. Considering various courts/tribunal’s decisions in past, it will be interesting to see whether the same qualifies the litmus test of “Undertaking”?

Tax implications of cancellation of shares of AWL held by ACLLP?

As an integral part of the Scheme, the shares held by ACLLP in AWL shall be cancelled and reduced without any further application, act, instrument, or deed, which shall be regarded as reduction of the share capital of AWL, pursuant to Sections 230 to 232 of the Companies Act. Further, as mentioned in the scheme, the aforesaid reduction of capital does not involve any diminution of liability in respect of any unpaid share capital or payment to any shareholder of any paid-up share capital or payment in any other form.

- Pursuant to the demerger, ACLLP will be owned by AWL

- Shares owned by ACLLP of AWL will get cancelled

- AWL shall issue its shares to shareholders of AEL for shares transferred through ACLLP which got cancelled.

It is pertinent to note that ACLLP is not a company to which the prohibition of holding shares of its holding company shall be applied (Section 19 of the Companies Act 2013).

As ACLLP will cancel its investment in AWL without any consideration being received by ACLLP, one really needs to ponder whether there will be any tax implications for ACLLP on the cancellation of equity shares of AWL?

One may consider conversion of ACLLP into a company however, there could have been challenges in fulfilling the conditions for tax neutral conversions.

Accounting Treatment

AEL shall derecognise the carrying value of assets (including its investment in ACLLP) and liabilities pertaining to the demerged undertaking. The excess/deficit of net assets transferred shall be adjusted against retained earnings.

AWL shall record all the assets and liabilities of the Demerged Undertaking (other than investment in equity shares of AWL forming part of the Demerged Undertaking and held through Adani Commodities LLP) at the amount arrived at in a manner that fair value of shares recorded gets allocated on a proportionate basis.

AWL shall divide the shares issued pursuant to the demerger in the following order:

- equity shares issued, to the extent of shares received back as part of the Demerged Undertaking, i.e., held through Adani Commodities LLP, at their face value.

- Additional shares issued, if any, at their fair value such that the face value of shares issued is credited to the Share Capital account and any differential amount is credited to the Capital Reserve/Securities Premium account.

There are certain other accounting clauses including accounting treatment in the books of ACLLP upon cancellation which we are not very clear at this moment. However, the entire accounting treatment for AWL & ACLLP will be complex and needs to be carefully executed.

Conclusion

The scheme of demerger proposed by Adani Group is in a way unique scheme. The scheme will enable the shareholders of AEL to receive sale consideration directly in its hands instead of going to AEL. This will lead to better exit valuation and opportunity for the acquirer to continue to have listed companies and minimising its investments.

Post scheme public shareholders of AEL will also become shareholders of AWL and hence will leads to reduction of shareholding of promotors from 87.87% to 76.75%.