In the past few months, Akzo Nobel India Limited has been in focus as its Dutch promoter is contemplating a sale of its equity shares of Akzo Nobel India Limited. Amidst these rumours, Akzo Nobel India Limited announced an internal restructuring which can facilitate the Dutch promoter’s swift exit if at all it desires.

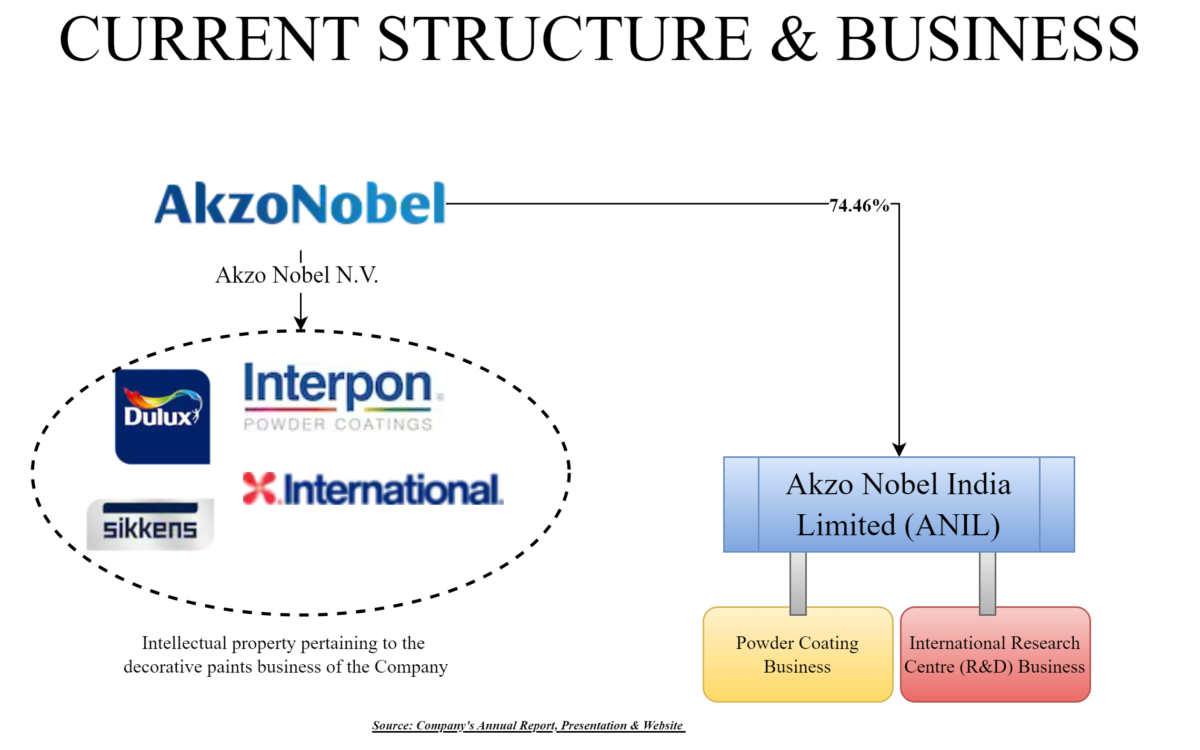

Akzo Nobel India Limited (“the Company” or “ANIL”) is an Indian arm of the multi-national company engaged in the manufacturing of wide range of paint products (Decorative and Coatings) through iconic global brands, including Dulux, International, Sikkens and Interpon. Akzo Nobel N.V. is the main international holding company of the Akzo Nobel group. Currently, promoters control 74.46% equity stake of ANIL. The equity shares of ANIL are listed on nationwide bourses.

The Proposed Transaction

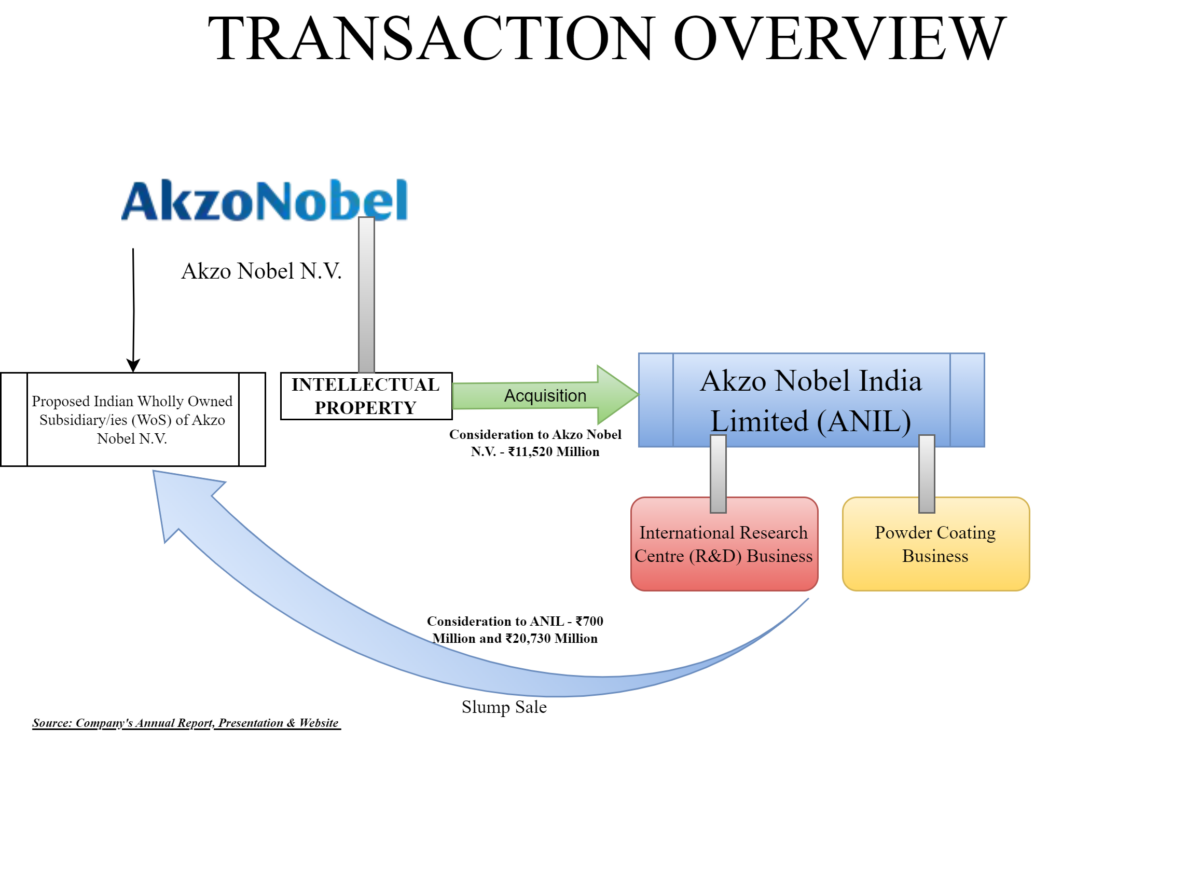

The board of directors of ANIL has approved the following transactions:

- Slump sale of “Powder Coating Business” to a proposed to be incorporated Indian wholly owned subsidiary of Akzo Nobel N.V through a Business Transfer Agreement and

- Slump Sale of the “International Research Centre (R&D) Business” to a proposed to be incorporated Indian wholly owned subsidiary of Akzo Nobel N.V through a Business Transfer Agreement and

- Acquisition of the intellectual property pertaining to the decorative paints business of ANIL from the ultimate holding company.

Powder Coating business undertaking of the Company, comprising the business of manufacturing, marketing, distribution, and sale of powder coating products in India and select geographies abroad.

International Research Centre (R&D) business undertaking of the Company, comprising the business of international research, development and innovation lab, situated in Bangalore, India, and conducted by the Company.

Intellectual property includes trademarks with goodwill, patents, domain names, business know-how and associated proceedings pertaining to decorative paints business of the Company.

Consideration

- ANIL will sale “Powder Coating Business’ for a lumpsum consideration of INR 20,730 million

- ANIL will sale “International Research Centre Business’ for a lumpsum consideration of INR 700 million

- Acquisition of intellectual property by ANIL for a total consideration of INR 11,520 million

| Particulars | Gross Amount in ₹ million |

| Powder Coating Business | 20730 |

| International Research Centre Business | 700 |

| Intellectual Property | (11520) |

| Net Total inflow | 9910 |

ANIL will utilize the proceeds from sale of the Powder Coatings & International Research Centre Business broadly for, inter alia, buying the intellectual property pertaining to the decorative paints from Akzo Nobel Coatings International B.V., paying relevant taxes, normal business operations and distribution to shareholders through a special dividend.

As on 30th September 2024, ANIL has cash surplus of more than INR 6000 million of which it distributed more than INR 3000 million as dividends. Over the years, ANIL is consistently distributing the free cash flow through dividends.

Further, ANIL has not mentioned how much will be the yearly saving on account of the purchase of intellectual property by ANIL from the holding company. However, in the last two years, ANIL has paid a good amount of royalty to the holding company. However, Royalty paid in FY24 and FY23 was circra3.5% as detailed below.

INR in Million

| Particulars | 2024 | 2023 |

| Royalty | 1411 | 1346 |

| % of revenue from operations | 3.56% | 3.54% |

Rationale for the Proposed Transaction

The rationale underpinning the aforesaid sale of the Powder Coatings Business is to streamline the Company’s business, thereby allowing it to strengthen its position in its liquid paints and coatings business while divesting its existing non-core assets (relating to powder coatings business) which do not provide material synergies. The aforesaid sale creates a more focused, efficient, and strategically aligned company with a clear roadmap for long-term value creation and success.

Powder Coatings represent a fundamentally different technology from liquid coatings, requiring separate R&D, manufacturing and application techniques. The Powder Coatings Business also operates with distinct raw materials and technical service requirements, limiting operational and commercial synergies with the Company’s liquid paints and coatings portfolio which adds complexities without directly contributing to the Company’s core growth strategy.

The divestment of the operations of International Research Centre (R&D) Business would enable the Company to focus entirely on its own business rather than operating on behalf of its global parent.

The acquisition of the intellectual property pertaining to the decorative paints business would establish the Company’s full technological independence in its core business, eliminating ongoing royalty payments with respect to the intellectual property pertaining to the decorative paints business of the Company and immediately enhancing margins and cash flow.

Facilitation Provisions

The slump sale agreement also provides for sharing of some of the services till the time other companies become self-sufficient. The following transitional services shall be provided by ANIL to the Purchaser post-closing on a cost-plus and arm’s length basis for a period ranging between 4 to 12 months from the Closing Date of the Slump Sale:

- Facilities services;

- On-site warehousing & transportation services;

- Tax services;

- Procurement services;

- HR Services;

- Manufacturing & supply chain services; and

- Local IT services.

Non-Compete

The slump sale agreement also provides for non-compete and non-solicit provisions, restricting the ANIL from

(i) conducting any business that competes with or is similar business within the territory (i.e., geographical areas in which the Seller conducts, manages, or operates Business) for a period of 36 months, commencing from the date the Company ceases to be an affiliate of Akzo Nobel N.V.; and

(ii) soliciting or enticing away from the Purchaser, any customer or any employee of the transfer Business for a period of 36 months, commencing from the date the Company ceases to be an affiliate of Akzo Nobel N.V.

Clearly, the above clauses provide the likelihood of selling of promoter holding in the near future.

Direct Tax & Other Consequences:

The proposed slump sale will attract long term capital gains under section 50B of the Income Tax Act, 1961 read with rule 11UAE of the Income Tax Rules, 1962.

Tentative Calculation

Amount in million

| Particulars | Consideration | Net-worth | Taxable Gains |

| Powder Coating Business | 20730 | 1462 | 19268 |

| International Research Centre Business | 700 | 64 | 636 |

ANIL will pay direct tax on the above-mentioned taxable gain at the rate of circa 15%. There will not be any indirect tax if the transfer is of an “Undertaking”. Further, there will be stamp duty implications on the business transfer agreement plus immovable properties getting transferred.

Financials

The Powder Coatings Business contributed ~11% of the total income of the Company in FY 2023-24 and constituted ~11 % of the net worth of the Company as per the audited balance sheet of FY 2023-24.

The International Research Centre (R&D) Business contributed to 1.36 % of the total income of the Company in FY 2023-24 and constituted 0.48 % of the net worth of the Company as per the audited balance sheet of FY 2023-24.

Conclusion

Post all three transactions, ANIL will be left with only the liquid paint business with IPR of its liquid paints and coatings business. So, there is no liability to pay any royalty and exclusive rights to use IPR and brands in agreed territories. Post transactions, Akzo Nobel N.V. will have a 100% stake in acquired businesses “Powder Coating Business and International Research Centre Business through its Indian subsidiaries.