In a move to have 1+1 as more than sum of two, Aster DM Healthcare Limited announced a strategic merger with Blackstone & TPG-backed Quality Care group which will likely to place the merged entity as the 3rd largest hospital chain in India.

Aster DM Healthcare Limited (“Aster” or Transferee Company”) is inter alia engaged in providing healthcare and related services (including diagnostics, telehealth and other allied services) through a network of multi-specialty healthcare establishments across India. The equity shares of Aster are listed on nationwide bourses.

Last year, Aster divested its entire hospital base located in Gulf countries to deleverage itself & build war chest for strengthening India’s position.

Quality Care India Limited (“QCIL” or “Transferor Company) is a part of the originally founded ‘Care Group’ engaged in the business of providing healthcare and related services through a network of multi-specialty healthcare establishments across India and Bangladesh, that it or its subsidiaries own or operate from time to time. QCIL’s healthcare troika includes CARE Hospitals, KIMSHEALTH and Evercare. Last year, QCIL announced the acquisition of ~80% stake in KIMS Healthcare Management Limited, a Kerala based hospital chain.

Over the years, Care Group has seen multiple ownership changes. In 2012, Advent International acquired majority shareholding and investors including Late Mr. Rakesh Jhunjhunwala. In 2016, Abraaj’s growth market health fund acquired entire stake from Advent. In 2019, TPG took over the controlling stake in Care Group. Last year, Blackstone entered QCIL with acquiring ~72% controlling stake from TPG. As on date, QCIL is owned & controlled by private equity players like Blackstone & TPG.

The Proposed Transaction:

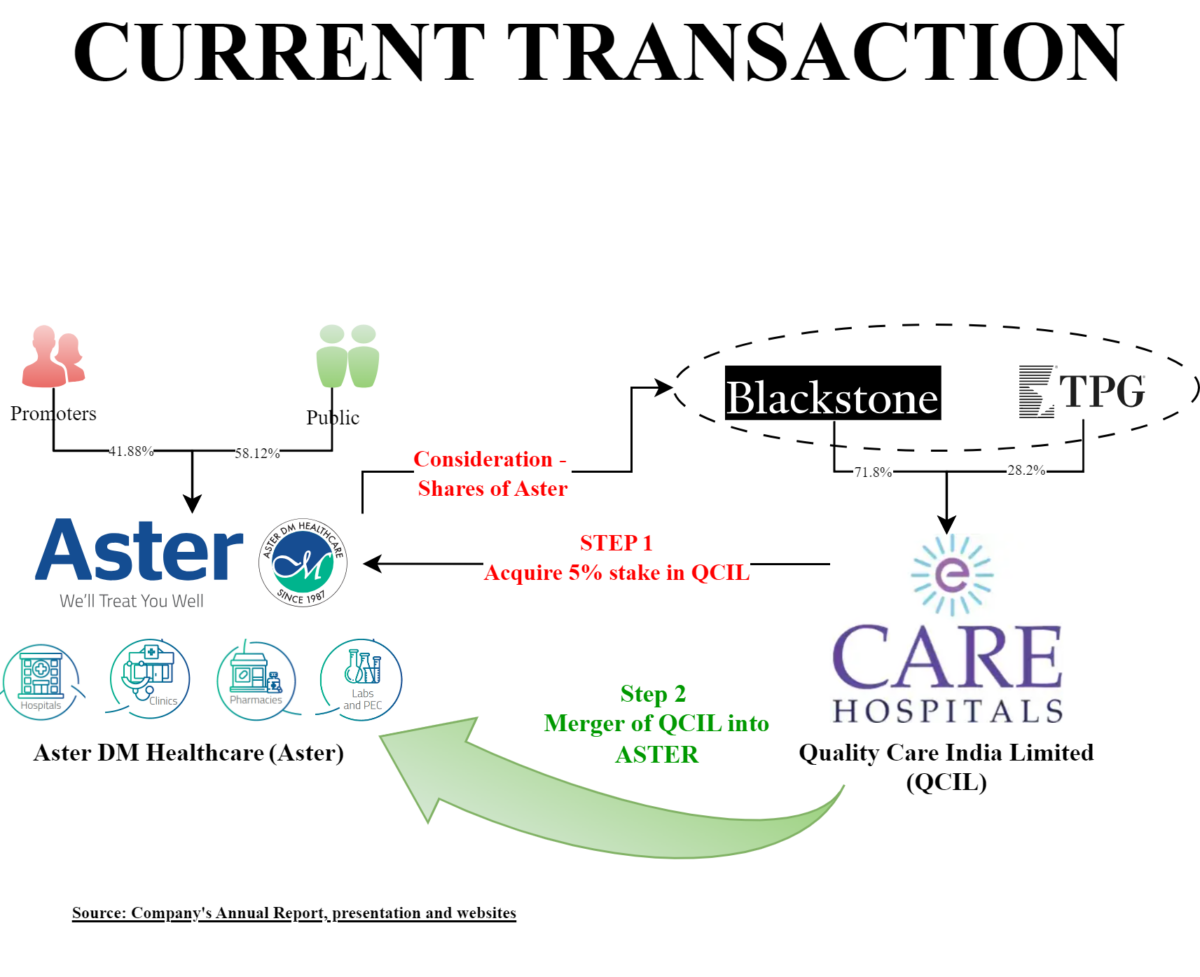

The proposed acquisition of QCIL by Aster has two legs:

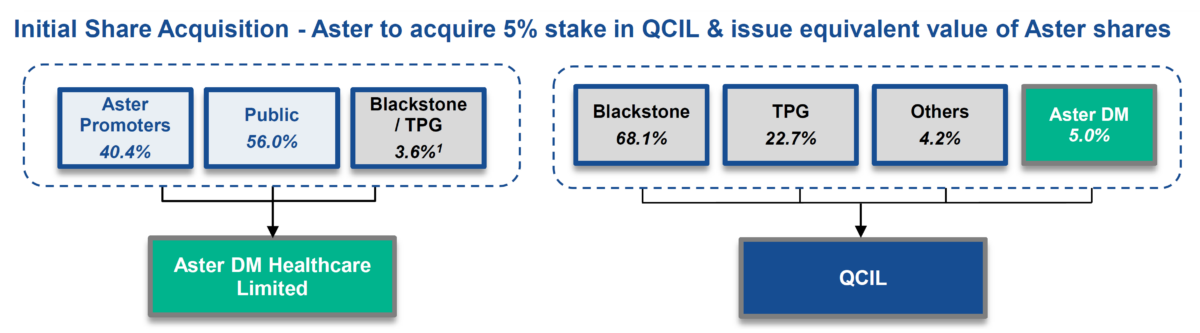

- Aster will purchase circa 5% existing equity shares held by Blackstone & TPG through the issuance of its own shares amounting to 3.60% stake in Aster and

- Merger of QCIL with Aster

The proposed acquisition transaction will be consummated immediately & Aster will be holding a 5% stake in QCIL. The reason for splitting the transaction into two parts can be on account of having access to QCIL much before the effectiveness of the merger so that post-integration can be planned & to have commitment on both parts. There is no mention on what will happen to this acquisition if for any reason the merger cannot be made effective as per plan. Further in meantime, through a scheme of merger, QCIL will get merged with Aster.

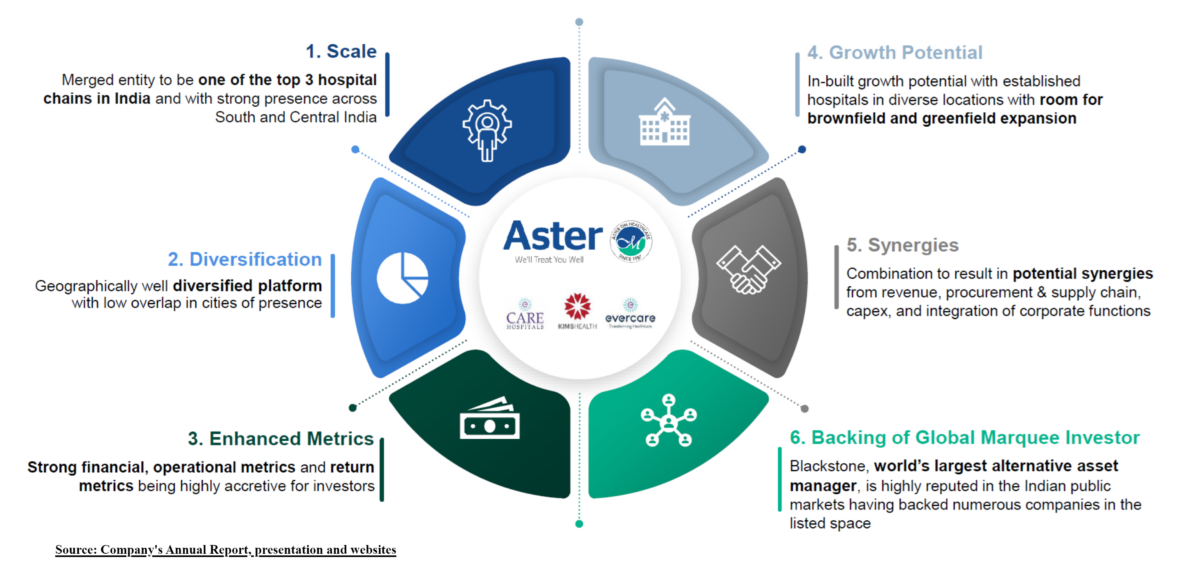

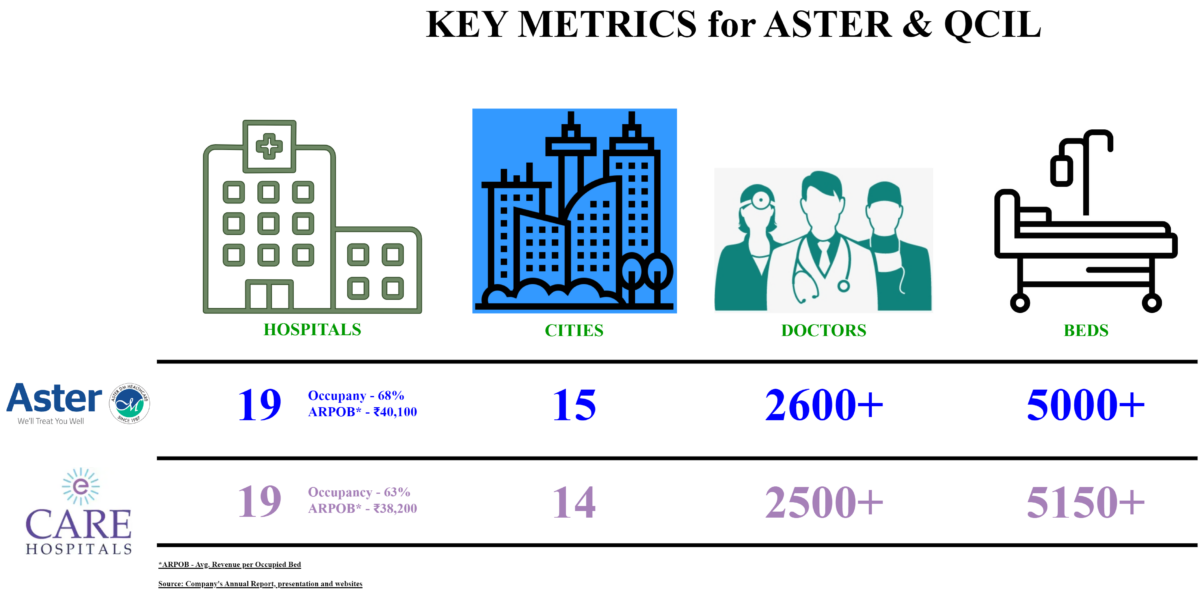

There are several reasons for ringing the merger. Aster DM Quality Care Limited will have a combined portfolio of four leading brands: Aster DM, CARE Hospitals, KIMSHEALTH and Evercare. The combined entity will have a network of 38 hospitals and 10,150+ beds spread across 27 cities making it one of the top 3 hospital chains in India.

Other key points:

As the proposed merger is a merger of equal (more or less) entities, the broad functioning of the merged entity has essentially been decided before entering into a marriage. This includes:

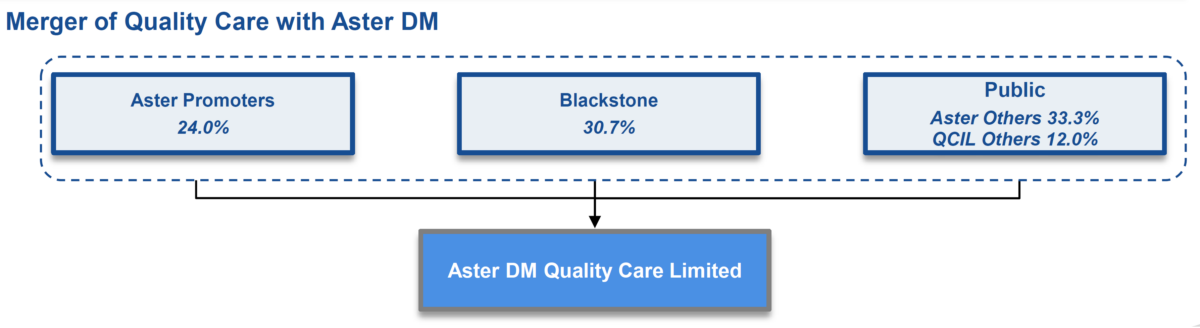

- The resulting merged listed entity will be called Aster DM Quality Care Limited (“Merged Entity”)

- The Merged Entity will be jointly controlled by Aster promoters and Blackstone, holding 24.0% and 30.7% ownership respectively & Blackstone will be classified as a “Co-promoter”)

- Dr. Azad Moopen will continue in his role as the Executive Chairperson and will oversee the Merged Entity. Mr. Varun Khanna, Group MD of QCIL, will be the MD and Group CEO of the Merged Entity

- Based on the agreed swap ratio, Aster shareholders will hold 57.3% and QCIL shareholders will hold 42.7% in the Merged Entity

Shareholding Pattern & Capital Structure

Please note that the above shareholding pattern of the Aster-Post merger is considering the acquisition transaction. Pursuant to the acquisition of 5% stake in QCIL by Aster, Blackstone & TPG will hold circa 3.6% stake in Aster before merger execution. Further, currently TPG owns 23.9% stake in QCIL.

For the merger, Aster will issue 977 equity shares for every 1000 equity shares held by QCIL shareholders in QCIL. Further, the valuation of QCIL for acquisition & merger has kept the same so as it ensure a fair swap for acquisition & merger.

Financials & Valuation

Aster generated significant cash last year from divesting its Gulf Country operations. The same now can be utilised to repay QCIL debt so as to have optimum financial leverage in the merged balance sheet. Most of the QCIL hospitals are matured thus, further improving operational margins are difficult compared to Aster where matured hospital percentage to overall is on the lower side. However, Last year QCIL has formed on account of combination of three different companies giving a chance to further improvise on account of synergies which are likely to realise for the Aster merger. There is replication among key centres like in Bengaluru, Vishakhapatnam, Vijayawada, Kollam etc. which can be merged /realigned to have better efficiencies. Aster will be again loaded with international baggage (Bangladesh hospitals) which it just offloaded to focus on Indian operations.

On valuation side,

| Particulars | Aster | QCIL |

| Assigned Valuation | 22,800 | 17,000 |

| EV/EBITDA | 36.6 | 25.2 |

Last year Blackstone invested giving (Quality + KIMS) a valuation of circa 10,000 crore which resulted in an immediate gain of circa 60% to them.

Conclusion

Through divestment of its Gulf country operations, Aster had recently unlocked a good value for its shareholders. The combined entity, post-merger of equals, will be placed at 3rd spot and will be more flexible for future growth.

What makes the proposed transaction unique is the acquisition of small stake by each other before the merger. This is to ensure the merger facilitates smooth exit in future for minority shareholders of QCIL & TPG followed by Blackstone which eventually they will. The merged entity will be an interesting blend driven jointly by family family-driven mindset along with private equity.

It will be interesting to see how the merged entity adopts and sustain the best practices including human resource. The other challenge for the merged entity will likely be to efficiently manage certain overlapping geographies and overcome its broader concentration in the southern side.

Going ahead we may see some acquisition to expand their geographical reach by the merged entity. Let’s hope that Aster will be able to derive much more than the sum of two from this acquisition.