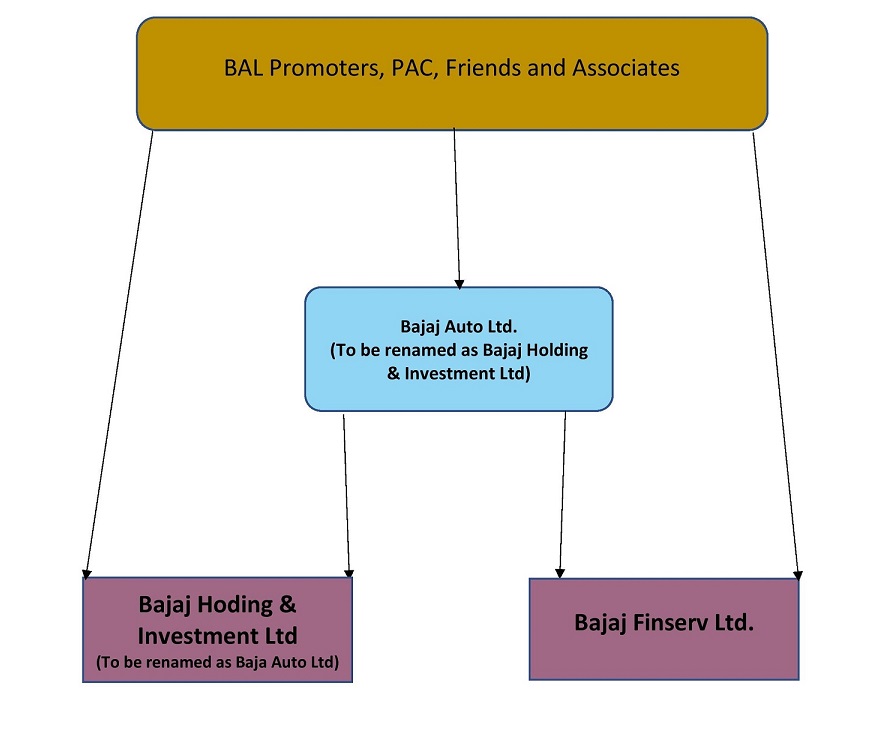

We have studied the demerger scheme of Bajaj Auto Ltd., and in our view, it will create value only for the promoters, while the non-promoter interests have been conveniently ignored. In our opinion, the entire purpose of the scheme is merely to increase promoter holding at substantially lower costs. Currently, the promoters, PAC and friends and associates hold roughly 47% in Bajaj Auto Ltd.

What has the company done?

- Formed two subsidiaries- Bajaj Holding & Investments Ltd. (BHIL) and Bajaj Finserv Ltd. (BFL). Bajaj Auto Ltd. (BAL) has subscribed to 4.35 crore shares of Rs.10 each of BHIL at par and 4.35 crore shares of Rs.5 each of BFL at par.

- A shareholder holding 1 share of BAL would get 1 share each of BHIL and BFL.

- The entire two-wheeler and auto business of BAL would be transferred to BHIL, along with Rs.1500 crores cash and equivalents.

- The entire wind energy, insurance and auto finance business would be transferred to BFL, along with Rs.800 crores cash and equivalents.

- BAL would become the group holding and Investment Company.

- BAL’s name would be changed to BHIL and BHIL’s name would be changed to BAL.

- The shareholding pattern of the three companies is as follows:

| Particulars | Pre-demerger | Post-demerger | ||

| No. of shares | % | No. of shares | % | |

| *Bajaj Auto Ltd. | ||||

| Promoter+PAC+friends etc. | 4.75 | 47 | 4.75 | 47 |

| Individuals | 2.32 | 23 | 2.32 | 23 |

| Institutional | 3.03 | 30 | 3.03 | 30 |

| 10.10 | 10.10 | |||

| #Bajaj Holdings & Invest Ltd. | ||||

| Bajaj Auto Ltd. | 4.35 | 100 | 4.35 | 30 |

| Bajaj Auto Ltd. Promoters etc | 4.75 | 33 | ||

| Individuals | 2.32 | 16 | ||

| Institutional | 3.03 | 21 | ||

| 4.35 | 14.45 | |||

| Bajaj Finserv Ltd. | ||||

| Bajaj Auto Ltd. | 4.35 | 100 | 4.35 | 30 |

| Bajaj Auto Ltd. Promoters etc | 4.75 | 33 | ||

| Individuals | 2.32 | 16 | ||

| Institutional | 3.03 | 21 | ||

| 4.35 | 14.45 | |||

**No. of shares in crores.

#To be renamed as Bajaj Auto Ltd. will contain the auto business.

*To be renamed as Bajaj Holding and Investments Ltd. will act as the group holding and investment company.

Post-demerger shareholding:

Why has the company done this?

- Post demerger, the promoter group will hold 63% (promoter group+BAL) in the newly named Bajaj Auto Ltd. (Currently called BHIL) Currently, they hold only 47% in Bajaj Auto Ltd., as a single entity. The incremental 16% holding has been bought at merely Rs.43.5 crores. (4.35 crore shares at Rs.10 each)

- Post demerger, the promoter group will hold 63% (promoter group+BAL) in Bajaj Finserv Ltd. Currently, they hold only 47% in Bajaj Auto Ltd. as a single entity. The incremental 16% holding has been bought at merely Rs.21.75 crores. (4.35 crore shares at Rs.5 each)

What are the implications?

For the Bajaj Auto Ltd. promoter group:

- Have acquired substantial controlling interest in both BHIL (to be renamed BAL) and BFL, i.e. 63%, without having to make an open offer or pay controlling premium. This total stake has been acquired at an extremely nominal cost. (Rs.65.25 crores).

- Promoter group will hold 47% in BAL (to be renamed BHIL). This company will be the group holding and Investment Company. Since such companies get extremely low valuations in the market, and no interest from investors, the promoters can increase their stake to 51% easily.

- In essence, the promoter group would get controlling interest in all three-group companies at a much lower cost than it would otherwise have to incur.

For non-promoter shareholders of Bajaj Auto Ltd.:

- The non-promoter group will suffer substantially since the core auto business has suffered dilution, to the extent of around 40%. Since this dilution has taken place at par, the company will not benefit significantly from the funds so raised.

How does the management justify the demerger scheme?

- Separation of businesses would enable focus on core businesses and strengthen competencies.

- Separation of businesses would clearly establish management focus on respective businesses.

- The two new companies will be able to tap (at arms length basis) into the cash pool of the investment company to support new business initiatives.

- It will enable investors to hold separate focused stocks.

- It will enable transparent benchmarking with peers.

(Source: management presentation)

While we agree with the above, it still does not explain why BAL picked up shares in BHIL and BFL at par. These actions raise serious issues about corporate governance and management/promoter quality.

Special issues: The insurance business:

The issues relating to the insurance business are not directly related to the demerger.

- Currently, in its JV with Allianz, Bajaj has a 74% stake, both in life as well as the general insurance business.

- As per given information, Allianz has the option to raise the stake in the life insurance JV to 74% and non-life insurance JV to 50%. This can be done at a price of Rs.5.42 per share plus an interest rate of 16% per annum. We do not clearly understand the implication of this additional interest rate, as details are not clear.

To conclude

- The basic purpose of the demerger-to separate unrelated businesses, so that there can be better focus on each business, is justified.

- The two newly created companies, which contain the core businesses, can tap into the cash reserves of the holding/investment company for their expansion.

- However, the dilution in BHIL (to be renamed BAL), which will contain the core auto business, has hurt investors’ interest.

- Promoters have increased their stake and acquired controlling interest in the two new companies without having to make an open offer or pay controlling premium.

It may be worthwhile for non-promoters investors to contest the scheme on the ground that the same is not in public interest. From the management side it would be fair if the scheme provides for the exit to them at a price just before the announcement and/ or to keep a window to allow them to exit from Bajaj Holdings based on the market value of investments in the new companies and not based on the quotation on the stock exchange at least for a period of six months post listing of all three companies.