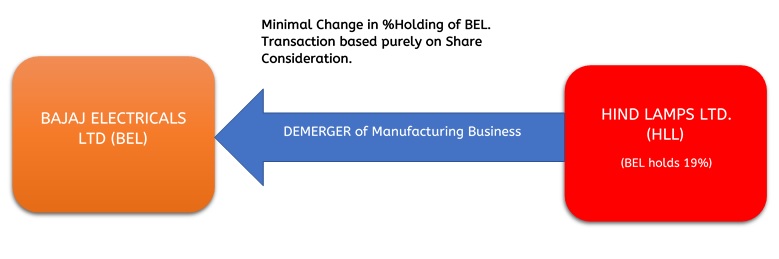

In November 2015, the Board of Directors of Bajaj Electricals Ltd and Hind Lamps Ltd approved the scheme of arrangement for demerger of manufacturing business of Hind Lamps Ltd to Bajaj Electricals Ltd.

Bajaj Electricals Ltd (BEL) incorporated on July 14, 1938, is a part of “Bajaj Group”. Bajaj Electricals business is spread across – Consumer Products (Appliances, Fans, Lighting), Exports, Luminaires and EPC (Illumination, Transmission Towers and Power Distribution). To increase its footprint globally and in India, the company has partnered with reputed brands from across the world such as Greystone of Canada and Magnum Energy of USA for Wired and Wireless Sensors, Disney of USA and Midea of China for Fans, and Morphy Richards of UK for Appliances and many more. Bajaj Electricals Ltd is enjoying a market cap of Rs 4,817 crore.

Hind Lamps Limited (HLL) is an existing public limited company incorporated on April 30, 1951, is engaged in the business of manufacturing of GLS bulbs, HID bulbs and aluminium caps. The equity shares of HLL are not listed on any stock exchange.

Transaction

Demerger of business of manufacturing of GLS bulbs and aluminium caps manufacturing unit of HLL located at Shikohabad, Dist. Firozabad, Uttar Pradesh and HID Lamps manufacturing unit located at Parwanoo, Himachal Pradesh as going concern. The trading business of HLL shall remain with HLL. There is no significant stake increase of BEL post transaction as the demerger is happening mostly on share consideration as mentioned in following paragraphs.

Valuation

Appointed date taken for all tax and other regulatory purposes is March 31, 2014.

In consideration of the above said demerger, BEL shall issue 97 equity shares of face value Rs 2 each fully paid up (called as New Equity Shares) for every 1000 equity shares of face value Rs 25 fully paid up held by the shareholders of HLL.

On November 9, 2017, the board of directors of both the company approved of the revised share allotment ratio in compliance to para 8 of SEBI Circular no: CFD/DIL3/CIR/2017/21 dated 10th March 2017.

Statement of Consideration

| Particulars | Nos of Shares |

| Total shares of HLL | 60,00,000 |

| Less: BEL stake of 19% | 11,40,000 |

| Balance shareholders | 48,60,000 |

| Shares in Consideration to be issued to balance shareholders | 4,71,420 |

Suppose a shareholder holding 25,000 shares in Hind Lamps Ltd will be issued 2425 shares in BEL as consideration for demerger, he will cash in profit due to this merger in the following manner:

| Particulars | Amount |

| Sale price at Rs 464.05 (Market price on December 1, 2017) | 11,25,321 |

| Cost at Rs 25 | 6,25,000 |

| Profit (ignoring tax implications) | 5,00,321 |

Shareholding Pattern

Bajaj Electricals Ltd.

| Pre-Scheme | Post Scheme | ||||

| Details | Nos of Shares | % Share holding | Details | Nos of Shares | % Share holding |

| Promoters | 6,42,18,485 | 63.15% | Promoters | 6,46,89,905 | 63.32% |

| Public | 3,74,78,541 | 36.85% | Public | 3,74,78,541 | 36.68% |

| Total | 10,16,97,026 | 100% | Total | 10,21,68,446 | 100% |

Note: There is no substantial change in the total share capital of Bajaj Electricals post scheme. Only to mention that the promoter’s stake is increasing from 63.15% to 63.32%. There is no change in shareholding pattern of Hind Lamps Ltd.

Accounting Treatment

Acquisition date is the date on which NCLT approves the scheme of arrangement.

| In the books of: | Accounting treatment |

| Bajaj Electricals Ltd (BEL) | The scheme will be accounted from effective date in accordance with the IND AS 103- Business Combinations.

|

| Hind Lamps Ltd (HLL) |

|

Please note: Accounting treatment is different for tax purposes.

Tax Implications

Since this scheme of arrangement satisfies all the conditions of Section 2(19AA) of Income Tax Act, 1961, there will be no capital gains tax in the hands of demerged company by virtue of Sec 47(vib). The resulting company shall carry forward accumulated losses and allowance for unabsorbed depreciation, as per the provisions of Sec 72A (4).

Rationale for Demerger

- The main objective of this demerger is to facilitate revival of the manufacturing business of the HLL upon its consolidation with the BEL.

- Hind Lamps Limited was declared as a sick industrial company within the meaning of Section 3(1)(o) of the Sick Industrial Companies (Special Provision) Act, 1985 (“SICA”) by the Board for Industrial and Financial Reconstruction (“BIFR”) in the year 2002.

- As per the Modified Draft Rehabilitation Scheme (“MDRS”) filed with the BIFR for the revival of the demerged company, the net worth of the demerged company was expected to turn positive by 31st March 2014.

- The demerged company couldn’t achieve the aforesaid objective and accordingly, the management of the demerged company decided to make an attempt to achieve the positive net worth by 31st March 2015.

- However, as on March 31, 2015, the demerged company could not achieve the positive net worth and accordingly, it has been proposed to demerge the manufacturing business of the demerged company with the resulting company with effect from the appointed date of March 31, 2014.

Conclusion

Apart from hiving off loss making manufacturing unit and monetization of assets and settlement of liabilities, this demerger will bail out HLL from falling into Insolvency and Bankruptcy Code, 2016. It seems the transaction is mainly financed by the tax breaks available to resulting company post -demerger. Bajaj may be able to squeeze the assets of the demerge unit to generate profits by infusion of technology and working capital. So, refund of taxes already paid since FY 2015-16 will support the working of the division. As it will ensure continuity of jobs for all its permanent employees. Whether the transaction will create any value for Bajaj’s shareholders or not will depend on how efficient Bajaj is able to run the unit in years to come.