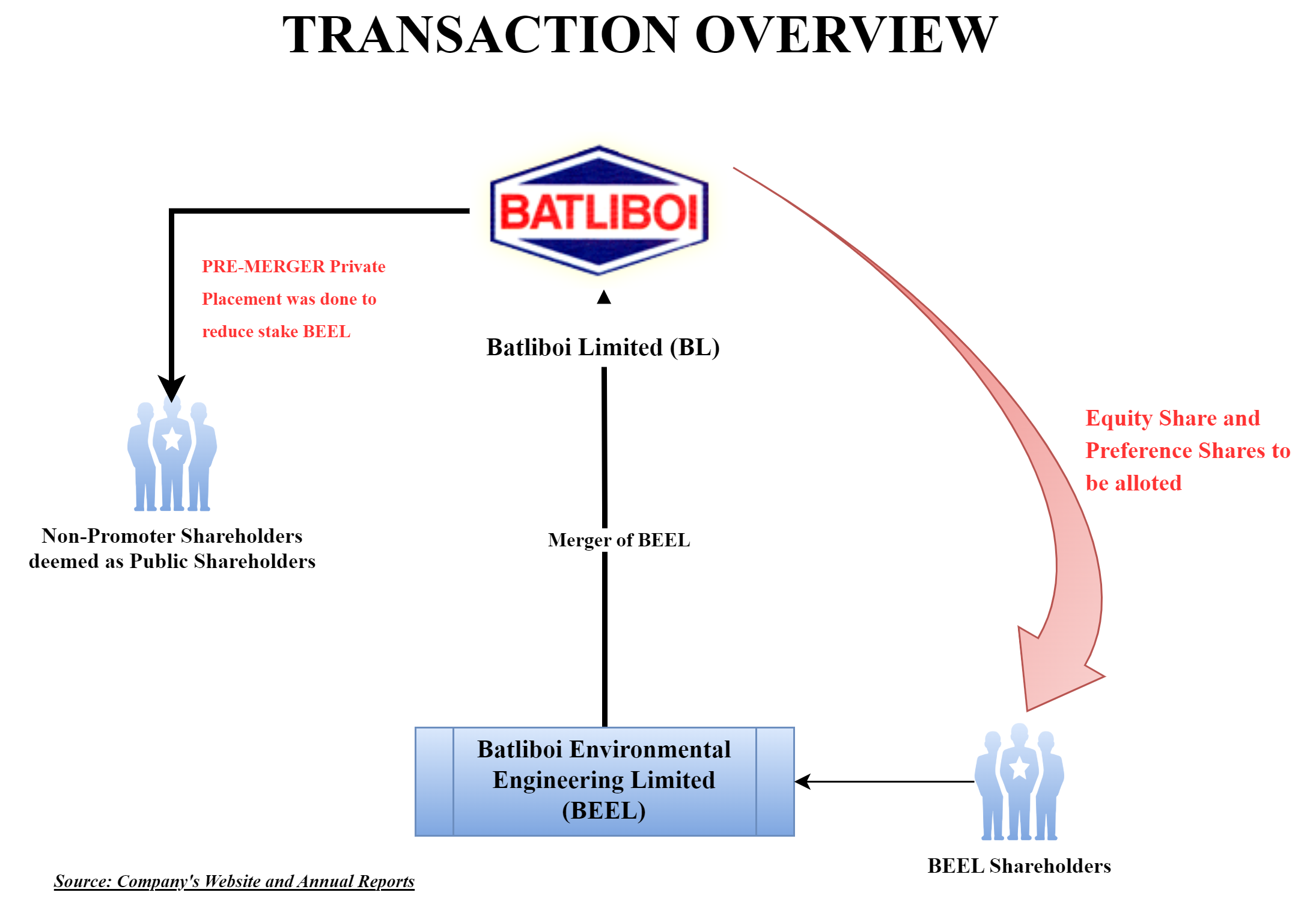

Batliboi Limited has a history of collaborations with various foreign technical partners and has subsidiaries like Hydraulic & General Engineers Ltd. and Batliboi International Ltd. In March 2024, the board of Directors of Batliboi Limited accorded their approval for the merger of promoter owned private company with itself.

Batliboi Limited (“BL” or “Transferee Company”) was incorporated in 1941 and is engaged in the business of Machine Tools, Air Engineering, and Textile Machinery. The equity shares of BL are listed on BSE Limited.

Batliboi Environmental Engineering Limited (“BEEL” or “Transferor Company”) is incorporated in 1959 is engaged in the business of design, selection, engineering, fabrication, supply, installation and commissioning of air pollution control equipment and system for variety of industrial and municipal applications. BEEL is owned by the promoters of BL & BL. As on date, BL holds 11.93% equity shares of BEEL.

Earlier Scheme:

In March 2023, BL announced similar scheme for merger of BEEL with itself. The Consideration for the merger was 9 fully paid 7% optionally convertible preference shares of INR 10 each for every 10 equity shares of BEEL.

However, the same scheme was rejected by exchanges on account of exceeding promoters shareholding in BL post-merger than the maximum prescribed promoter holding i.e. 75%. Exchange observed that if optionally convertible shares are converted into equity shares, promoters holding post-merger will become 83.44%. The Appointed Date for the scheme was 1st April 2023.

The Proposed Scheme:

The proposed Scheme of Amalgamation (“Scheme”) inter-alia provides for the amalgamation of BEEL with BL.

However, to avoid rejection from exchanges this time, BL has recently done preferential issue of equity shares on private placement basis to non-promoter’s shareholders. Pursuant to the private placement, BL has issued 57,14,000 equity shares at a consideration of INR 113.5 per equity share aggregating to circa INR 64.85 crore.

The appointed date for the merger will be 1st April 2023 or such other date as may be approved by the Hon’ble National Company Law Tribunal. Considering the significant delay, the NCLT (National Company Law Tribunal) might direct the company to have an appointed date closer to the present date.

Key Rationale’s envisaged in the scheme:

- Economies of scale will play a big role as the consolidated entity’s operational efficiency will increase, which will in turn allow the merged entity to compete on a larger scale in the industry, thus benefiting the merged entity and the shareholders;

- The combined net worth of both entities will enable the merged entity to tap into new business opportunities thereby unlocking growth opportunities for the merged entity;

- Being a part of the same management, this merger would facilitate the simplification of group structures and reducing administrative redundancies.

Consideration & Capital Structure

As a consideration to the proposed merger, BL will issue 9 equity shares to the shareholders of BEEL for every 10 equity shares held by them in BEEL.

Further, BL will issue one 8% non-cumulative non-convertible preference share of INR 100 each for every one 8% non-cumulative non-convertible preference share of INR 100 each.

| Particulars | Pre-preferential issue | Post-preferential issue but pre-merger | Post- merger |

| No. of paid-up equity share capital of Face value 5 each | 2,90,45,884 | 3,47,59,884 | 4,74,74,847 |

| Promoter Stake % | 74.06 | 61.88% | 72.07 |

| 5% non-cumulative redeemable preference shares of INR 100 each issued to promoters | 6,92,480 | 6,92,480 | 6,92,480 |

| 8% non-cumulative redeemable preference shares of INR 100 each issued to promoters | – | – | 2,70,000 |

Please note that the entire paid-up preference shares of transferee company & transferor company are held by promoters. Pursuant to the merger, the new investors’ stake (shares issued in recent preferential allotment) will decrease from 16.44% to 12.04%.

Accounting treatment

The merger will be accounted in the books of transferee company in accordance with the provisions of the “Pooling of interest method” under Appendix C of IND-AS 103 (Accounting for Business Combinations) and any other relevant Indian Accounting Standard prescribed under Section 133 of the Act.

Financials

For quarter ended on September 2023, BEEL revenue was INR 78 crore with profit after taxes of 3 crore. Clearly, BEEL is increasing its revenues and trying to generate good cash profits. BEEL does not require fixed assets as such but working capital is being required.

BL’s asset based is significantly high mainly due to the revaluation of land which, in our opinion, is surplus asset. Going ahead, there can be a significant jump in revenue for the merged entity. It will be interesting to see whether the merged entity will be able to command more margin & better terms for improving its working capital.

Conclusion

The step seems to be in the right direction for more than 100-year-old company. It is likely to unlock value due to consolidation and fundraise at the same time. In the process, it is also strengthening its board of directors by taking professionals on board. 50-year-old listed company is attempting to create value for all its stakeholders.