The National Company Law Appellate Tribunal (NCLAT) has overruled BHEL’s objection and has given nod to the liquidation process of Tamil Nadu-based Surana Power, which was admitted into insolvency in January 2019. In fact, during the liquidation proceedings, the state-run company won an ex-parte arbitration award against Surana Power, which gave it lien over all the equipment and goods lying at the latter’s unit, as well as its partially or fully constructed buildings.

Background:

The Chennai Bench of National Company Law Tribunal had ruled the decision in favour of BHEL, as the company won an arbitration award against Surana Power, which was undergoing liquidation. BHEL opposed the liquidation as BHEL was one of the Secured Creditor. National Company Law Appellate Tribunal has set aside the order of Chennai Bench of NCLT and ordered for liquidation of Surana Power Limited.

Facts of the case:

- The Adjudicating Authority admitted Section 9 Application for initiation of CIRP vide order dated 20th January,2019.

- As no resolution plan was approved, as per provisions of I&B Code, the Corporate Debtor (Surana Power Limited) was ordered to be liquidated.

- During liquidation, an exparte Arbitration Award was passed in favour of Secured Creditor (BHEL), based on Secured Creditor granted lien over equipment’s and goods lying at site of Corporate Debtor.

- Corporate debtor has hypothecated the assets to all other Secured Creditors vide Deed of Hypothecation dated 24th September 2010.

- Secured Creditors with a value of 73.76% of secured assets have relinquished their Security Interest and BHEL convey its unwillingness about relinquish.

- Liquidator filed application seeking permission to sell assets of Corporate Debtor which was rejected by Chennai Bench of NCLT.

- Liquidator then moved to NCLAT against Impugned Order and NCLAT passed order setting aside order of NCLT Chennai and allowed liquidation of Corporate Debtor.

Findings in order:

Relinquishment of Security interest by majority Secured Creditors:

NCLT, Chennai failed to take on record that ten out of eleven Secured Creditors having 73.76% of value of total claim have relinquished their security interest to enable Liquidator to proceed under Regulation 32 of IBBI (Liquidation Process) Regulation, 2016.

Regulation 32 of IBBI (Liquidation Process) Regulation, 2016

If Committee of Creditor recommends and Liquidator is of opinion that sale under regulation 32 shall maximize the value of Corporate debtor, he shall endeavor to sell the assets of Corporate Debtor. Further as per regulation 33 (3) of the Regulation , 2016 The liquidator shall not proceed with the sale of an asset if he has reason to believe that there is any collusion between the buyers, or the corporate debtor’s related parties and buyers, or the creditors and the buyer, and shall submit a report to the Adjudicating Authority in this regard, seeking appropriate orders against the colluding parties.

Unless and until there is undisputed matter, Liquidator cannot proceed with sale of assets of Corporate Debtor. In the given case, BHEL one of the Secured Creditor refused to relinquish its Security Interest, created deadlock situation and Liquidator not able to sell the Secured Assets under Regulation 32 of the Liquidation Process Regulation.

Regulation 32 of Liquidation Process Regulation:

The liquidator may sell-

(a) an asset on a standalone basis;

(b) the assets in a slump sale;

(c) a set of assets collectively;

(d) the assets in parcels;

(e) the corporate debtor as a going concern; or

(f) the business(s) of the corporate debtor as a going concern:

Provided that where an asset is subject to security interest, it shall not be sold under any of the clauses (a) to (f) unless the security interest therein has been relinquished to the liquidation estate.”

Despite more than 73% of the Secured Creditors having relinquished their Security Interest Liquidator cannot proceed to sell assets of Corporate debtor, hence Liquidator made an application before Adjudicating Authorities. Here Adjudicating Authority failed to appreciate that majority of Secured Creditors have relinquished their Security Interest.

Views of NCLT are in Violation of Waterfall Mechanism:

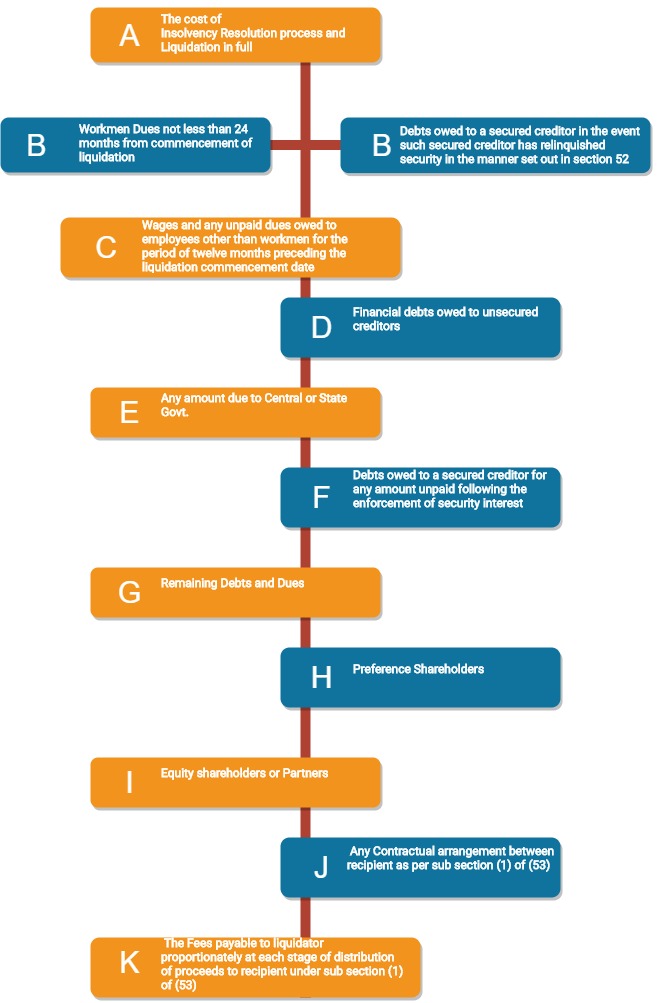

NCLAT contended that the view taken by Adjudicating Authority that lien’s of BHEL has preference over charge created in favour of remaining Secured Financial Creator is violative of waterfall mechanism provided under Section 53 of the Code.

NCLAT pointed out that, Adjudicating Authority has failed to take into account all the Secured Creditors are on the same footing regardless of mode of creation of charge. As per IB&C there are no different kinds of Secured Creditors, neither they are based on nature of charge nor based on ranking of the respective charge, but NCLT, Chennai Bench failed to consider it and held that Respondent’s Lien has preference over the Charge created in favour of remaining Secured Financial Creditors, which is violative of Waterfall Mechanism.

Section 53 of the IBC states a waterfall mechanism, whereby the proceeds from the sale of the liquidation assets in respect of a corporate debtor are required to be distributed in a certain order of priority, which is given below:

As per section 52 Secured Creditor may realise its Security interest on its own, provided he has informed liquidator and liquidator has verified such security interest and permitted Secured Creditors to realise only such security interest. During the pendency of the Appeal, Liquidator received letter from BHEL notifying their intention to realise the Security Interest.

The rights of BHEL under section 52 is unqualified and unbridled said NCLAT.

Going by the waterfall mechanism, though BHEL would have got the money over other unsecured creditors, its share would come down by a lot.

Enforcement as per SARFAESI Act, 2002

BHEL is Secured Creditor at par with remaining other ten Secured Creditors. Enforcement of Security Interest is governed by Section 13 of SARFAESI Act.

Section (9) of 13 states that:

Subject to the provisions of the Insolvency and Bankruptcy Code, 2016, in the case of financing of a financial asset by more than one secured creditors or joint financing of a financial asset by secured creditors, no secured creditor shall be entitled to exercise any or all of the rights conferred on him under or pursuant to sub-section (4) unless exercise of such right is agreed upon by the secured creditors representing not less than [sixty per cent] in value of the amount outstanding as on a record date and such action shall be binding on all the secured creditors:

Considering the above provision NCLAT held that, it will be prejudicial to stop liquidation process at instance of BHEL who is having security interest of 26.24% (in value) only.

Reference of case:

JM Financial Asset Reconstruction Company Ltd. Vs. Finquest Financial Solutions Pvt. Ltd. and Other 2019 SCC OnLine NCLAT 918.

Section 53 r/w Section 52 of the I&B Code. If one or more ‘Secured Creditors’ have not relinquished the ‘security interest’ and opt to realize their ‘security interest’ against the same very asset in terms of Section 52(1)(b) r/w Section 52(2) & (3), the Liquidator will act in terms of Section 52(3) and find out as to who has the 1st charge (‘security interest’) from the records as maintained by an information utility or as may be specified by the Board and pass an appropriate order. If any dispute is pending before court of law, the question as to who has the exclusive first charge, the Liquidator inform the parties and proceed as per Section 52(3) of the I&B Code.

The Arbitration Route:

After accepting Insolvency Plea against Surana Powers by NCLT Chennai, however non approval of any resolution plan, the Company was ordered to be liquidated.

During the liquidation process, the waterfall mechanism applies which would have given very less percentage of share to BHEL along with other Secured Creditors. But BHEL chooses Arbitration Route, wherein an Award passed in favour of BHEL and granted a lien over the equipment and goods lying at site of Surana Power. An Arbitration route was beneficial for BHEL which given complete right over the assets of Corporate Debtor by leaving very less assets to other creditors.

Based on the facts, Honorable NCLAT came to the conclusion that once liquidation process has commenced, rights of all secured creditors are pari passu irrespective of how those rights were created. So liquidator can go ahead with liquidation irrespective of arbitration award in favour of BHEL. It seems NCLAT views are Sec 52 and Sec 53 to be interpreted harmoniously, though it is not clear but post liquidation and transfer of securities, BHEL will get major amount and there will not be any surplus available to pay other secured creditors.

Add comment