Borosil Group has two listed entities i.e. one is Borosil Glass Works Limited (BGWL) & Gujarat Borosil Limited (GBL). BGWL is mainly into Scientific & Consumerware and GBL is into manufacturing solar glass. Both the businesses have different risk & returns and business model. BGWL is primarily into B2C thing which requires huge marketing, continuous changes in products and create brands to have sustainable growth in the revenue while GBL is into B2B and their sales is mainly dependent on macro scenarios, government initiates etc.

The current group structure is quite complex. Borosil Glass Works Ltd (BGWL) hold stake directly and indirectly in Gujarat Borosil Ltd. (GBL). Fennel Investment and Finance Private Limited (FIFPL), group’s investment company, holds stake in BGWL & GBL whilst BGWL holds major stake in FIFPL.

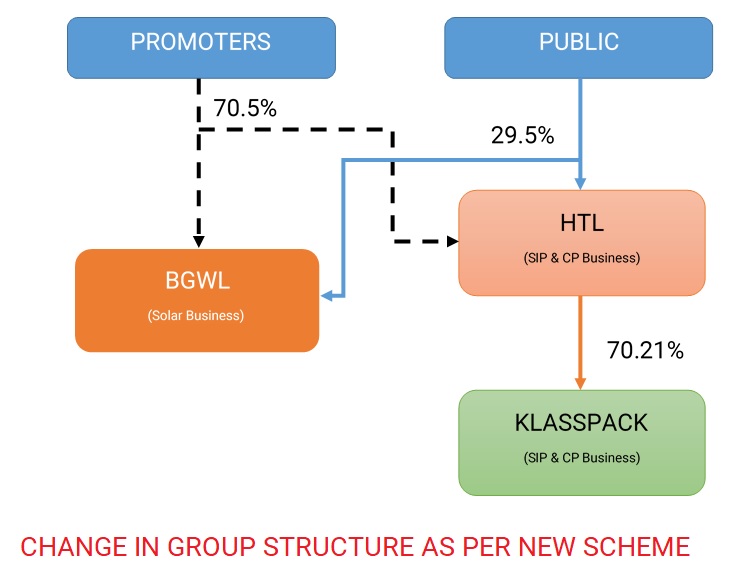

One and half year ago, the group came with a re-structuring exercise to simplify their group structure. We had covered the transaction in our January 2017 issue. However, in June 2018 Borosil Glass Works Limited withdrew their earlier scheme and proposed a new scheme of amalgamation & arrangement. Prime facia, the new scheme looks more complex than the earlier scheme it will result in completely delink two businesses and have simple and direct holding structure. In this article we have tried to analyse the differences between two schemes, their effects on the stakeholders and particularly whether the scheme at a par for both Borosil Glass Works Limited & Gujarat Borosil Limited minority shareholders.

Current group structure

Transaction (As per new scheme)

Step 1: Amalgamation of Vyline Glass Works Limited (VGWL), FIFPL and GBL with BGWL – BGWL will be renamed as Borosil Renewables Limited.

FIFPL is an investment company which holds 5.37 % in BGWL and 33.13% in GBL. BGWL holds 45.85% stake in FIFPL.

VGWL is a promoter group entity engaged in the business of manufacturing of glass and glass products. It is a third-party manufacturer for BGWL.

Step 2: Demerger of the Scientific & industrial product and Consumer product business of BGWL into Hopewell tableware Private Limited (HTPL), a wholly owned subsidiary of BGWL – HTPL will be renamed as Borosil Limited.

HTPL is a 100% subsidiary of Borosil and is engaged in business manufacturing and marketing of opal tableware items.

The Demerged Undertaking shall, inter-alia, comprise of all assets and liabilities of Scientific and Industrial product business and Consumer product business of BGWL and all investments and surplus assets of BGWL (except to the extent of INR 125 crores required for the purpose of expansion of solar business) along with business of VGWL and the assets and liabilities of FIFPL.

The appointed date for the transaction is 1st October 2018.

Changes in Structure under both the Scheme:

Under the earlier scheme, after merger of FIFPL into BGWL, GBL would have become the subsidiary of the BGWL with 58.38% stake in it. if somebody invests in BGWL, they indirectly invest in GBL.

To overcome this, the management proposed a new scheme to separate both the businesses. Under current proposed structure, both BGWL & GBL will have no inter holdings and investors will have an option to invest in either of the business or both.

Shareholding Pattern

Currently, promoters hold 72.85% stake in BGWL and 74.95% stake in GBL. However, after adjusting FIFPL stake, the promoters economic stake in both the entities is different. Under earlier scheme, promoters stake in BGWL would have increased to 74.58%. Under current scheme, promoters economic stake in BGWL is decreasing but in GBL it is increasing significantly.

Table 1: Change in Shareholding Pattern

| Particular | BGWL | GBL | FIFPL |

| BGWL | NA | 25.25% | 45.85% |

| Promoter (Individual) | 67.48% | 16.57% | 54.15% |

| FIFPL | 5.37% | 33.13% | NA |

| Total Promoter’s Stake | 72.85% | 74.95% | 87.55% |

| Public | 27.15% | 25.05% | 12.45% |

| Promoter’s Economic Stake | |||

| Current | 72.18% | 63.80% | NA |

| Under Earlier Scheme | 74.58% | 60.12% | NA |

| Under Current Scheme | 70.52% | 70.52% | NA |

*: Above working is approximate. The actual stake could differ.

Points to consider:

GBL’s business is still nascent. It requires huge capital expenditure for growth. Till date, GBL grew with the help of cash flows of BGWL. BGWL has subscribed to INR 90 crore preference shares of GBL on which GBL has not paid any dividend till date. In 2015, the terms of the preference shares were hanged from cumulative to non-cumulative. Additionally, BGWL will give INR 125 crores to GBL for its expansion project. During the merger, this will get cancelled and become the assets of GBL. Under earlier scheme, this would have continued to be a liability on GBL’s part.

Table 2: Financials Standalone and Consolidated

| Particulars | 2018 | 2017 | 2016 | 2015 | 2014 |

| GBL | |||||

| Free Cashflow | 33 | -29 | 11 | 16 | 4 |

| ROCE(%) | 11.55 | 20.71 | 14.75 | 2.84 | 9.21 |

| Capital Employed | 184 | 176 | 152 | 162 | 176 |

| BGWL (Standalone) | |||||

| Free Cashflow | 44 | 114 | 9 | 37 | -37 |

| ROCE(%) | 8.85 | 19.31 | 2.37 | 9.39 | 6.55 |

| Capital Employed | 822 | 772 | 669 | 700 | 658 |

| BGWL (Consolidated) | |||||

| Free Cashflow | 24 | 61 | 15 | 46 | -37 |

| ROCE(%) | 9.57 | 20.83 | 5.19 | 9.69 | 6.36 |

| Capital Employed | 866 | 833 | 718 | 732 | 660 |

Source: ACE Equity

Currently, GBL is doing capacity expansion of its solar glass. Post-expansion, capital employed by GBL will get substantially increased. BGWL capital employed will be reduced by the extent of amount it will provide to GBL. This can result in significant short-term impact on ROCE’s of both the businesses.

Post restructuring, GBL’s share capital will be increased by 67%. One must evaluate the need for such a huge share capital for GBL.

Further, all the expenses relating to the implementing this scheme will be borne by the BGWL alone.

End Note:

The proposed new structure, though looks complex, will lead to more simplified group structure. In future, GBL will have to manage on its own and BGWL can use its surplus funds to further strengthen its business. However, instead of such a complex way of restructuring, direct demerger of investment of GBL would have achieved the same purpose with lesser complexity and cost. Recently, Thomas Cook Limited announced the similar re-structuring. However, in that case, the promoters stake in BGWL would have remained unchanged but in GBL it would have become much lower compared to the proposed scheme.