Cadila Healthcare Limited (CHL) is a listed company that operates as an integrated pharmaceutical company with business encompassing the entire value chain in the research, development, production, marketing and distribution of pharmaceutical products. The product portfolio of the Company includes Active Pharmaceutical Ingredients [API] and human formulations.

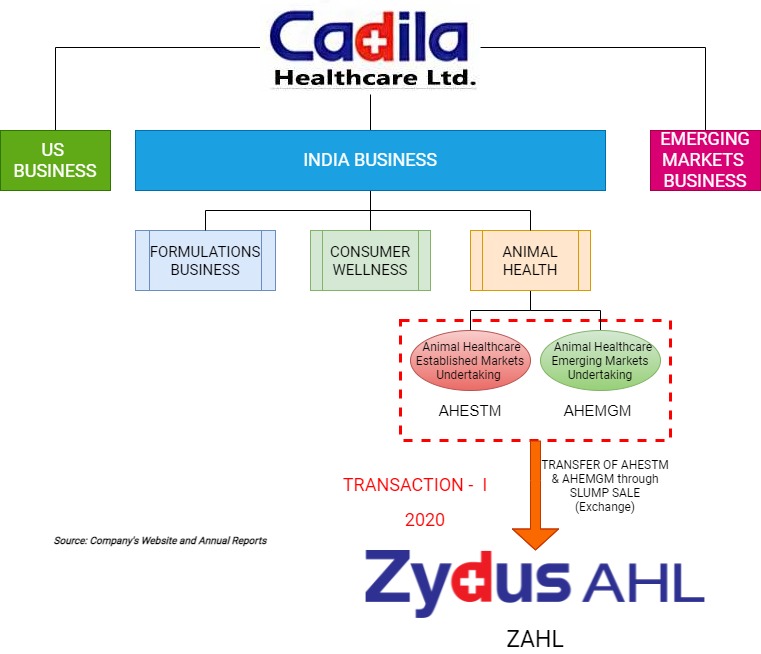

The Animal Healthcare Business (AHB) of the Company is carried through Zydus Animal Health and Investments Limited (“ZAHL”), a wholly-owned subsidiary of the CHL. AHB consists of Animal Healthcare Established Markets Undertaking (AHESTM, comprising of animal healthcare business carried out primarily in India and rest of the world excluding USA and Europe) and Animal Healthcare Emerging Markets Undertaking (AHEMGM, comprising of animal healthcare business carried out outside India, primarily in USA and Europe). AHESTM is one of India’s leading animal healthcare players and a market leader in various therapeutic segments which include anti-bacterial, NSAIDs, anti-mastitis, tonics and poultry vaccines amongst others in India. With a strong presence in the livestock and poultry segments, it has also launched a basket of products specifically for companion animals to cater to the increasing demands of the pet community. For pursuing opportunities in regulated global markets especially the generics animal healthcare market of the USA, AHEMGM is developing several products and has set up a new manufacturing facility in an SEZ near Ahmedabad from which such products would be manufactured and sold in the USA.

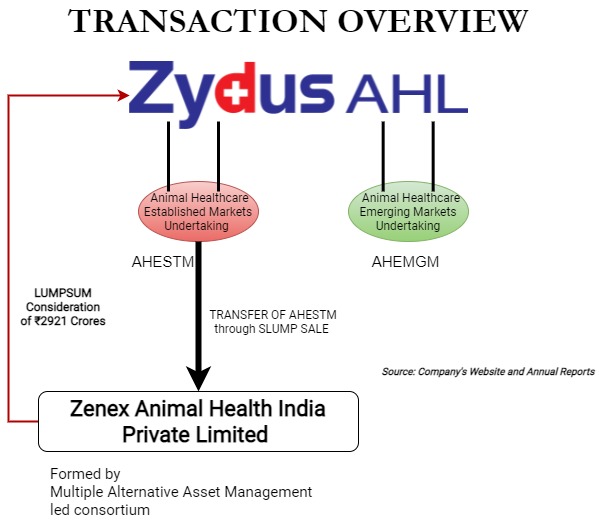

Zenex Animal Health India Private Limited (“ZAHIPL”) is a newly incorporated company formed by Multiple Alternative Asset Management led consortium, including Canada Pension Plan Investment Board (“CPP Investments”) and RARE Enterprises (“RARE”).

The Transaction:

Zydus Animal Health and Investments Limited (ZAHL) a wholly-owned material subsidiary of Cadila Healthcare Limited, has entered into a Business Transfer Agreement (BTA) to sell and transfer its Animal Healthcare Established Markets Undertaking (AHESTM) to Multiples Alternate Asset Management led consortium. The sell is on a slump sale basis as a going concern, for a lump sum consideration of Rs. 2921 crores on a cash-free and debt-free basis. After the transaction, ZAHL will remain with miniscule Animal Healthcare Emerging Market Business which is expected to commence operations in the US and certain European countries. Zydus continues to develop animal health business products for those markets. At present, this business is in the development and investment phase.

Table 1: Financials relating to AHESTM for FY 2021 (All Figs in ₹ Crores)

| Particulars | Amount |

| Revenue | 603 |

| EBITDA | 154 |

| PBT | 138 |

| AHESTM Revenue % of Total CHL Revenue | ~4% |

Transaction in 2016:

To boost its Animal Healthcare Business, CHL acquired select brands and manufacturing operations in India from the Indian subsidiary of Zoetis Inc., a global animal healthcare company. The acquisition was to help CHL to expand its AHB in India and gain access to manufacturing operations located in Haridwar, India. The deal value and other details were not disclosed by CHL.

Table 2: Financials relating to AHB (All Figs in ₹ Crores)

| Particulars | Amount |

| Revenue of AHB in FY 2015 | 308 |

| Revenue of AHB in FY 2016 | 320 |

| Revenue of AHB in FY 2017 | 450 |

Transaction in 2020:

Pursuant to the Definitive Agreement entered into by CHL on March 11th, 2020, with its subsidiary Zydus Animal Health and Investments Limited, the CHL’s AHB comprising of the said two undertakings viz. AHESTM and AHEMGM has been transferred to and vested in ZAHL on a going concern basis in exchange of 8% Non-cumulative Non-convertible Redeemable Preference Shares of Rs. 10/- each issued at face value on a lump sum basis.

As mentioned by CHL, this was done to achieve strategic and commercial objectives of a) having greater focus and accelerated growth of AHB through improved customer focus by catering to changing consumer preferences for value added products and by having greater visibility on and accountability for the performance of AHB b) exploring more strategic choices by leveraging its product pipeline and new manufacturing facility for global regulated markets and having technical and/or marketing alliances including joint ventures and c) improving operational efficiency of AHB by enhancing productivity of the resources employed in the AHB and facilitating faster decision making by providing independence for operations and management of the company.

Accordingly, ZAHL issued 220,00,00,000 Preference Shares, aggregating to Rs. 2200 crore in exchange of the said transfer of AHESTM and 7,33,50,000 Preference Shares, aggregating to Rs. 73.3 crores in exchange of the said transfer of AHEMGM, to CHL.

Table 3: Financials Relating to AHB for FY 2020 (All figs in ₹ Crores)

| Particulars | Amount |

| Revenue | 502 |

| PBT (Profit Before Tax) | 68 |

| Net Assets | 255 |

Table 4: Consideration on transfer of Undertaking (All Figs in ₹ Crores)

| Particulars | Amount |

| Consideration | 2,273 |

| Net Assets Transferred | 255 |

| Access Consideration | 2,018 |

The access consideration was recorded as “Capital Reserve” in the books of CHL.

CHL started planning to divest the Animal Healthcare Business in 2020 itself. CHL carve-out the Animal Healthcare Business from its core business and placed it in a wholly-owned subsidiary through Slump Sale. Interestingly, with respect to the group transaction (Slump Sale of AHESTM and AHEMGM by CHL to Wholly owned subsidiary (WoS)), the consideration was discharged in the form of non-convertible redeemable Preference Shares. The Consideration for the transaction was also designed in such way that future sale will provide efficient upstreaming of consideration to CHL. It seems that the said transaction was considered as tax neutral and no tax was provided.

Table 5: Recording of the transaction In the Books of ZHAL (All Figs in ₹ Crores)

| Particulars | Amount |

| Tangible Assets | 79 |

| Identifiable Intangible Assets | 373 |

| Other assets (Net Assets) | 114 |

| Total Net Assets | 566 |

| Consideration | 2,273 |

| Goodwill (Balancing Figure) | 1,708 |

Taxation

The recent sea changes in Slump Sale brings taxation on the transaction where consideration is discharged by way of other than cash. The said amendment was effective from the transaction executed on or after 1st April 2020. Please also note that rules were just notified in May 2021.

In transaction-related con-call hosted by the management of CHL before the notification of the rule for working out the cost and sale consideration in case of slump sale, the management mentioned that the tax liability for the transaction will be around INR 200 cr. So, it can be assumed that the management considered 2200 crores as cost to be adjusted against sale consideration of Rs 2951 crores. However, earlier transfer from CHL to the subsidiary was at fair value but it seems it was without any tax liability. Under the circumstances, if difference between the book value and fair value is considered as revaluation of the assets by the tax department, that tax can be much higher.

On recent transaction of selling AHESTM, there will be tax liability in the hands of ZAHL. However, it will be much lessor than if CHL would have sold it directly instead of first transferring to WoS. Additionally, the consideration will be used to redeem the preference shares issued by ZAHL to CHL which will likely usher in efficient upstreaming of cash to CHL.

Financials:

Table 6: Financial Snapshot of CHL & ZHAL for FY 2019 – 2020

| Particulars | ZHAL | CHL Consolidated | ZHAL % of CHL | CHL without ZHAL |

| Revenue (₹ Crores) | 603 | 14,821 | 4.07% | 14,218 |

| PBT (₹ Crores) | 138 | 2,490 | 5.56% | 2,352 |

Valuation

Table 7: Valuation of AHESTM undertaking (All Figs in ₹ Crores)

| Particulars | ZAHL-AHESTM* | Sequent Scientific Limited |

| Consideration/Market Capitalisation | 2921 | 6800 |

| Net Debt | – | 130 |

| Enterprise Value | 2921 | 6930 |

| Revenue | 603 | 1179 |

| EBITDA | 154 | 175 |

| Revenue Multiple | 4.84 | 5.87 |

| EBITDA Multiple | 19 | 39 |

*ZAHL figure are for FY 2021.

**Sequent figure except loan is for FY 2020 & loan is as on 31 Dec 2020.# Sequent MCap is as on 7th June 2021.

In 2020, the earlier promoters of industry leader company, Sequent Scientific Limited announced the selling off their entire stake to the Private Equity firm ‘The Carlyle Group’. The proposed deal was at equity value of circa INR 2136 crore. Post-Deal, the valuation of Sequent Scientific Limited has increased threefold.

Overall basis, ZAHL AHESTM has much better margins than Sequent, however, in recent time, ZAHL has not being able to scale the operations significantly. In the last 4 years, its revenue grown from INR 450 Cr to INR 600 Cr only.

Strategy for CHL

The decision of selling AHB for CHL seems to be the move pursuant to their decadal 2021-2030 plan. In 2020, CHL moved AHB from itself and place it in a WoS. The aim was also to expand the animal business, health business by exploring strategic choices such as leveraging a strong product pipeline as well as its new manufacturing facility and forging technical and marketing alliances including joint ventures a global regulated market. CHL also initiated to look for strategic and/or financial partners for AHB who share the same values and growth ambitions for the business with an intention to invite them to take equity stakes in ZAHL.

Acquirer i.e., Consortium led by Multiples must be interested in taking over only Indian operations in AHB, thus, CHL has to keep the AHB operations in the USA & Europe. Going ahead, CHL will try to nurture the AHEMGM and likely to look for buyer for that business. CHL plan to utilize the cash which will be generated from this transaction for pursuing the strategic objectives in India and US geographies and advance its innovation-led programs in the NCs, Biologics, vaccines, biosimilars and specialty areas. In the short term the cash will help CHL to deleverage balance sheet by reducing debts.

Table 8: CHL Debt-Equity Ratio FY 2021

| Particulars | CHL Before Transaction | CHL after Transaction |

| Net Worth | 14,930 | 14,930 |

| Borrowings | 3,680* | 1180 |

| Debt-equity ratio | 0.25 | 0.09 |

*Excluding current maturities of long-term loan.

# Assuming INR 2500 crore used for debt reduction.

Strategy for Multiples

Animal healthcare Business in India is currently at an inflection point. With a rising healthcare-related expenditure, AHB is also poised for stronger growth in the coming period. Last year, private Equity Firm, The Carlyle Group acquired Sequent Scientific Limited. Joining the race, Indian grown Multiples decided to acquire AHESTM of CHL. The Acquirer intention to create value both by increasing operation and financial reengineering by handing over the management to professionals and then take a partial or complete exit. Multiples either may list the business or may sell it to strategic/financial partner.

Add comment