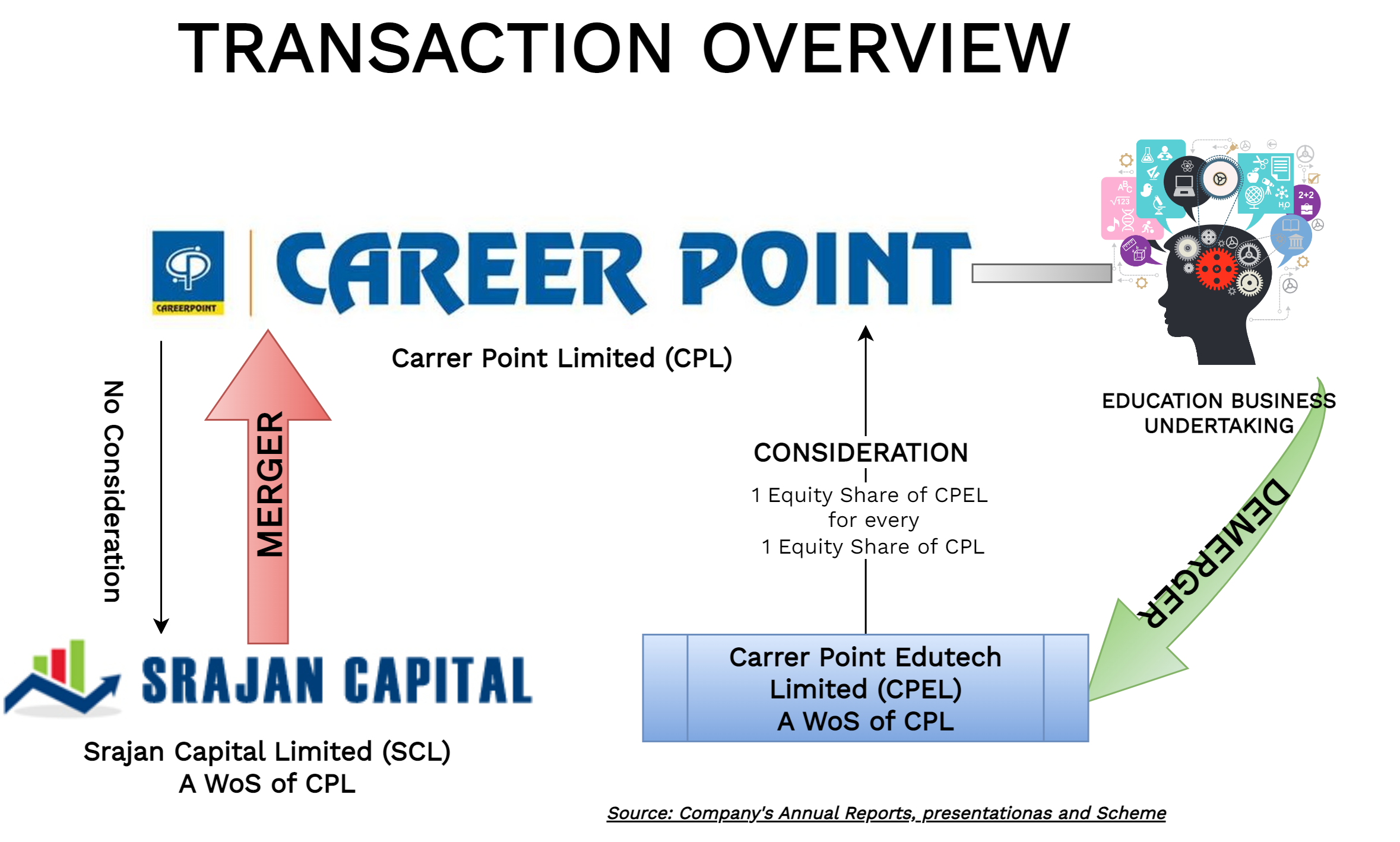

The Board has considered and approved the Scheme of Arrangement between Srajan Capital Limited (“SCL” or “Transferor Company”), Career Point Limited (“Transferee Company” or “Demerged Company” or “CPL””) and Career Point Edutech Limited (“CP Edutech” or “CPEL” or “Resulting Company”) and their respective shareholders (“Scheme”), which inter alia provides for the following:

- Merger of SCL into CPL.

- Demerger of the Education Business of the Company (Demerged Undertaking as defined hereinafter) into the Resulting Company

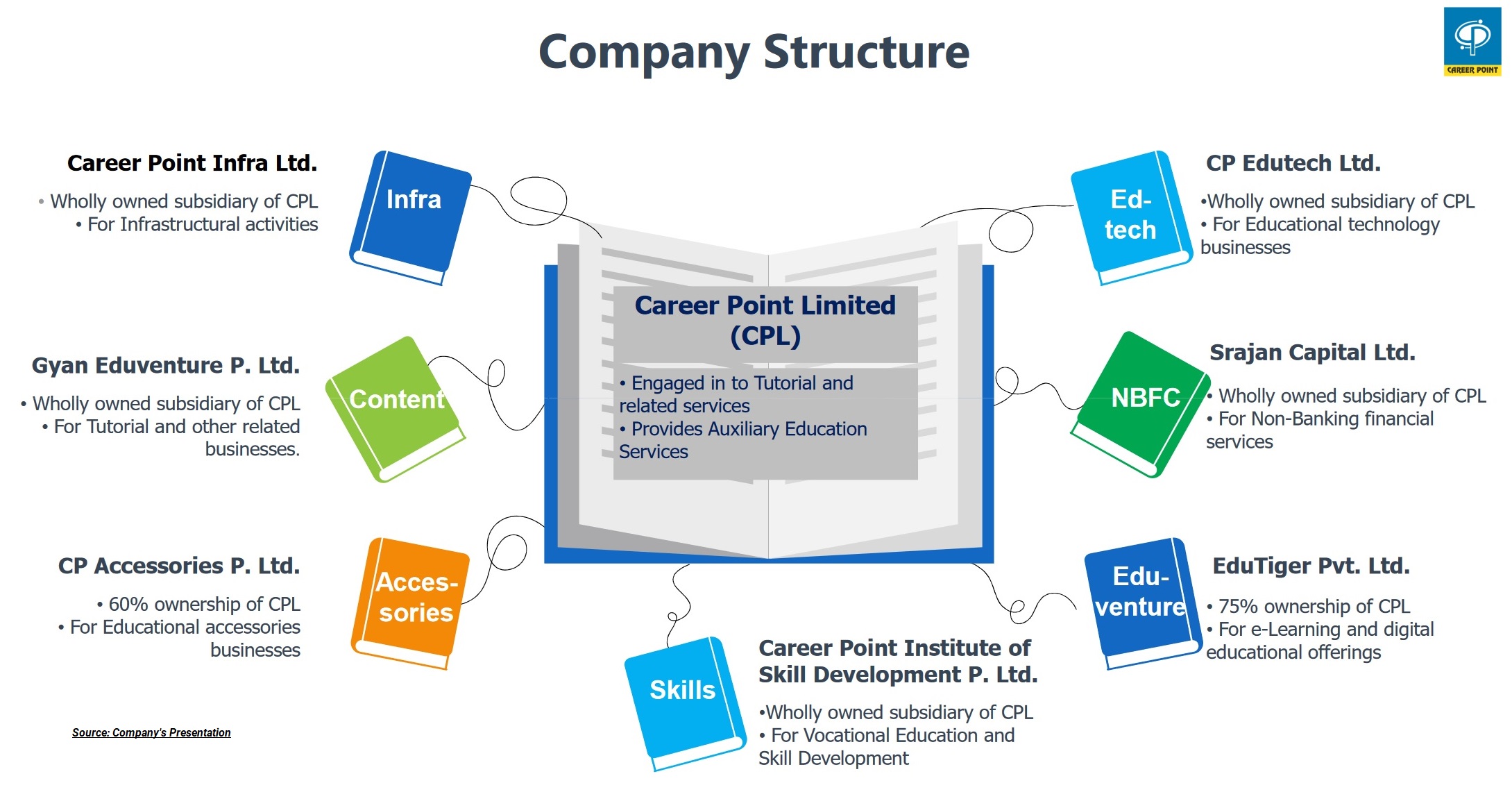

CPL is primarily engaged in the education business includes offering diversified products and integrated services in education segments including pre-school, school education (K-12), test preparation (tutorial services), higher education (universities), e-Learning and vocational education. CPL also carries on education business through its subsidiaries including Career Point Edutech Limited. Further, CPL holds investments in its subsidiaries which are engaged in non-education business. The equity shares of CPL are listed on nationwide bourses. The registered office of the company is in Chandigarh.

SCL is primarily engaged in the business of providing loans, including educational loans, institutional loans, personal loans, and business loans (trade finance and term loans to regional SMEs). SCL is a wholly-owned subsidiary of CPL. SCL is registered as a Non-Banking Financial Company with the Reserve Bank of India. The registered office of the company is located in the state of Punjab.

[rml_read_more]

CP Edutech is engaged in operation of selling Video Lecture of Physics, Chemistry. Math and Biology in pen drive and memory card, books of IITJEE. The Company has also developed a software for online test series and provides the software on fixed price to institutions. CP Eductech is a wholly owned subsidiary of CPL. The registered office is in Jaipur, Rajasthan.

Demerged Undertaking

Demerged undertaking means Education Business of Career Point Limited including all assets, properties, liabilities, permits, licenses, registrations, approvals, contracts, and employees, in relation to and pertaining to such Demerged Undertaking.

The turnover of the Demerged Undertaking of the Demerged Company as on March 31, 2022, was INR 16.03 cr. The turnover of Demerged Undertaking is ~42% to the total turnover of the Demerged Company as on March 31, 2022.

Bifurcation between Demerged & remaining undertaking for FY 2022:

INR in Crore

| Particulars | Demerged Undertaking | Remaining Undertaking |

| Networth | 6 | 422 |

| Turnover | 16 | 22 |

| PAT | -1 | 12 |

The appointed date for the purpose of giving scheme effect is 1 April 2023. It is also pertinent to note that a separate application to grant NBFC license in Career Point Ltd is filed at RBI Mumbai and approval in being awaited.

Consideration:

For Demerger: 1 equity share (face value of INR 10/- per share) of CP Edutech to be issued for every 1 equity share (face value of INR 10/- per share) of CPL. The share so issued by the Resulting Company to the shareholders of the Demerged Company shall be listed on BSE Limited and the National Stock Exchange of India Limited.

Share Capital of the Companies:

| Particulars | CPL | CPEL (Post-Demerger) |

| No. of Shares of INR 10 each | 1,81,92,939 | 1,81,92,393 |

| Paid-up share capital | 18,19,29,390 | 18,19,29,390 |

Post-demerger, the share capital of CPEL may not commensurate with the size of operations it will be holding.

Please note that no shares shall be issued by CPL pursuant to the merger of SCL since it is a wholly-owned subsidiary.

Rationale

Consolidation of education business — Management intends to consolidate education business in CP Edutech. Accordingly, demerger of education business of CPL into CP Edutech is being envisaged which will help in consolidation of education business in one single entity i.e., CP Edutech.

Consolidation of financial services business — SCL is providing financial services. Merger of SCL into CPL will achieve consolidation of financial services business into CPL. In view of above, the Scheme provides the flexibility to future investors to invest in core education business and/or non-education business.

Streamlining group structure and operations — The Scheme ensures simplified and streamlined group structure by reducing the number of entities in the group. The Scheme ensures better synergy of operations by way of focused operational efforts, standardization & simplification of processes and productivity improvements which will entails the following advantages:

- Improve the overall operational efficiency and effectiveness of the respective businesses;

- Reduction in the overall operational and compliance cost.

Improve management control — Ensures better management control on the respective businesses. Independent management of each of the education and non-education division will ensure adoption of strategies necessary for growth of respective businesses.

Conclusion

Over a period, CPL has started some of the ancillary businesses catering to its core education businesses like providing educational loans. Now these businesses have matured in fact became bigger than its primary business. Education business does not seem to grow as expected and promotors is interested in growing NBFC business. which need distinct strategies.

Further, it also appears that due to coming under realm of compulsory registration as Non-Banking Financial Company, CPL has also in the process of obtaining approvals. This appears to be one of the key reasons of demerger of its education business and housing it in non-NBFC company.